Another Plunge! Gold Falls Below the $4,000 Mark, Drops Over $100 in a Single Day

Bulls face another “bloodbath”! After losing the key psychological level of $4,000, gold faces more tests this week...

On Monday, spot gold continued to decline, extending the momentum of its first weekly loss since mid-August.

As of the US session on Monday, gold prices plunged nearly 3% and fell below the $4,000/oz mark, dropping more than $100 intraday. Traders optimistically believe that some of the economic risks and geopolitical tensions that had previously supported precious metal prices have now eased.

Last Monday, a strong rally had pushed gold prices to a historic high above $4,380 per ounce, but the rally began to reverse due to signs of overbuying. However, supported by central bank purchases and the so-called "currency debasement trade"—where investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits—gold prices have still risen by more than 50% so far this year.

Kyle Rodda, Senior Financial Market Analyst at Capital.com, said: "We are now returning to a more fundamental basis, a more rational market. Due to trade progress, the market has shown some reflexive reactions, which is better than anyone expected."

This week will see a flurry of interest rate decisions from central banks around the world. The Federal Reserve, European Central Bank, and Bank of Japan will all make rate decisions. The market predicts that the Federal Reserve will cut rates by 25 basis points, while the European Central Bank and Bank of Japan are expected to keep rates unchanged. Soojin Kim, an analyst at Mitsubishi UFJ, said that further monetary easing by these central banks could provide new support for non-yielding assets like gold.

Meanwhile, nearly 1,000 professional gold traders, brokers, and refiners have gathered in Japan to attend a conference hosted by the London Bullion Market Association. The event, which began last Sunday, has set a record for attendance, and the increasingly fierce talent war among gold traders is likely to be a hot topic.

John Reade, Market Strategist at the World Gold Council, stated at the event that central bank demand is not as strong as it used to be, and professional traders may welcome a deeper correction.

Citing conversations at the conference, he said some believe that a price of $3,500 per ounce "is healthy for the gold market, as it is still an absurdly high price."

UBS analyst Giovanni Staunovo said: "A possible trade agreement is supporting risk assets and weighing on gold, but we should also remember that potential tariff reductions would allow the Federal Reserve to cut rates further."

Since a 25 basis point rate cut has already been priced in by the market, attention is now on any forward-looking comments from Federal Reserve Chair Jerome Powell. Staunovo added: "Lower real interest rates should still support gold demand. The market consensus is that the Federal Reserve will cut rates by 25 basis points, so I do not expect much volatility around the Federal Open Market Committee (FOMC) meeting."

In addition, comments from officials at the Central Bank of the Philippines may have also influenced market sentiment to some extent. A policymaker from the Central Bank of the Philippines stated that as safe-haven demand weakens and gold prices are expected to further retreat from historic highs, the Central Bank of the Philippines should sell some of its "excess" gold reserves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can you receive a Polymarket airdrop by using AI agents to execute end-of-day strategies?

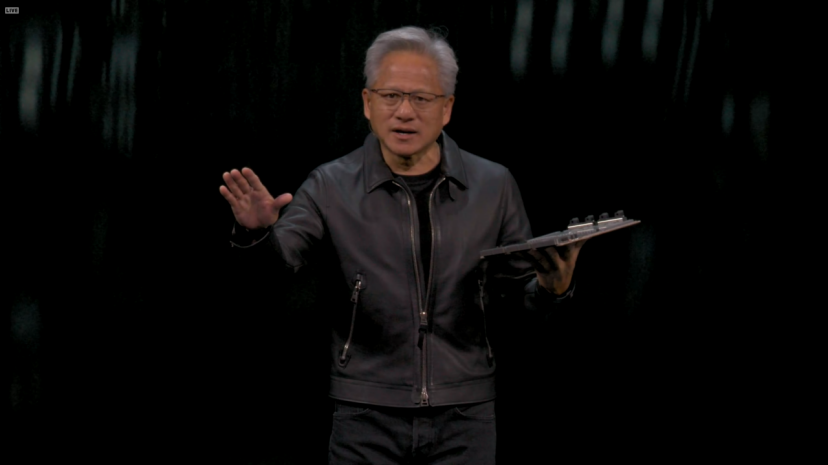

Give Nokia 1 billion, Jensen Huang wants to earn 200 billions

Jensen Huang unveiled some major announcements at the 2025 GTC.

When AI Agents Learn to Make Autonomous Payments: PolyFlow and x402 Are Redefining the Flow of Value on the Internet

x402 has opened the channel, while PolyFlow extends this channel to the real business and AI Agent world.

PolyFlow integrates x402 protocol to drive the next-generation AI Agent payment revolution

PolyFlow's mission is to seamlessly connect traditional systems with the intelligent world through blockchain technology, gradually reshaping everyday payments and financial activities to make every transaction more efficient and trustworthy—making every payment more meaningful.