VIRTUAL Price Could Rally Beyond $3 If This Pullback Level Holds — Here’s Why

Virtuals Protocol (VIRTUAL) has cooled after a strong rally, but the broader trend remains healthy. On-chain data shows whales accumulating and exchange balances falling, while chart signals hint at fresh momentum. If the price holds key support, the setup could fuel a move toward $3.34 — keeping the bullish breakout alive.

Virtuals Protocol (VIRTUAL) price has cooled off after a strong run, slipping 8% in the last 24 hours. Still, the broader setup looks constructive.

The token remains up nearly 79% over the past seven days, and the current pullback may simply be a pause before another push higher, if it stays above a key support level.

Mega Whales Accumulate as Retail Interest Returns

Even as smaller holders booked profits, mega whale wallets, the top 100 VIRTUAL addresses, quietly increased their holdings during the latest dip. Their combined balance rose 0.06% over the past 24 hours to 966.01 million tokens, meaning they added about 0.58 million VIRTUAL.

VIRTUAL Mega Whales Are Buying:

Nansen

VIRTUAL Mega Whales Are Buying:

Nansen

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

That kind of steady accumulation often signals that big holders view the correction as temporary.

Meanwhile, exchange balances have dropped 0.46%, with about 0.18 million tokens moving off trading platforms. This shows that while the mega whales have been loading up, retail and smaller whales might be booking profits. Yet, net buying pressure remains.

This quiet accumulation also lines up with improving chart signals.

On the 4-hour chart, the 100-period Exponential Moving Average (EMA) has just crossed above the 200-period EMA, a bullish crossover that often signals growing strength in the short-term trend. The EMA is a moving average that gives more importance to recent prices, helping traders spot early momentum shifts.

At the same time, the Money Flow Index (MFI), which tracks how much money is entering or exiting the market based on both price and volume, has started curling upward from near 40 toward 60.

Improving Virtuals Protocol Chart Metrics:

TradingView

Improving Virtuals Protocol Chart Metrics:

TradingView

That shows buying power returning gradually, especially from retail traders who often react to whale-led moves. The recent VIRTUAL/USDT listing on OKX could be a sentimental driver of this renewed retail pickup.

Together, these on-chain and chart signals suggest that both large and smaller investors are positioning for a continuation of the broader uptrend. The VIRTUAL price pullback, for now, appears to be a pause and not the end of the rally.

Flag Breakout And Bullish Divergence Keep the VIRTUAL Price Rally Alive

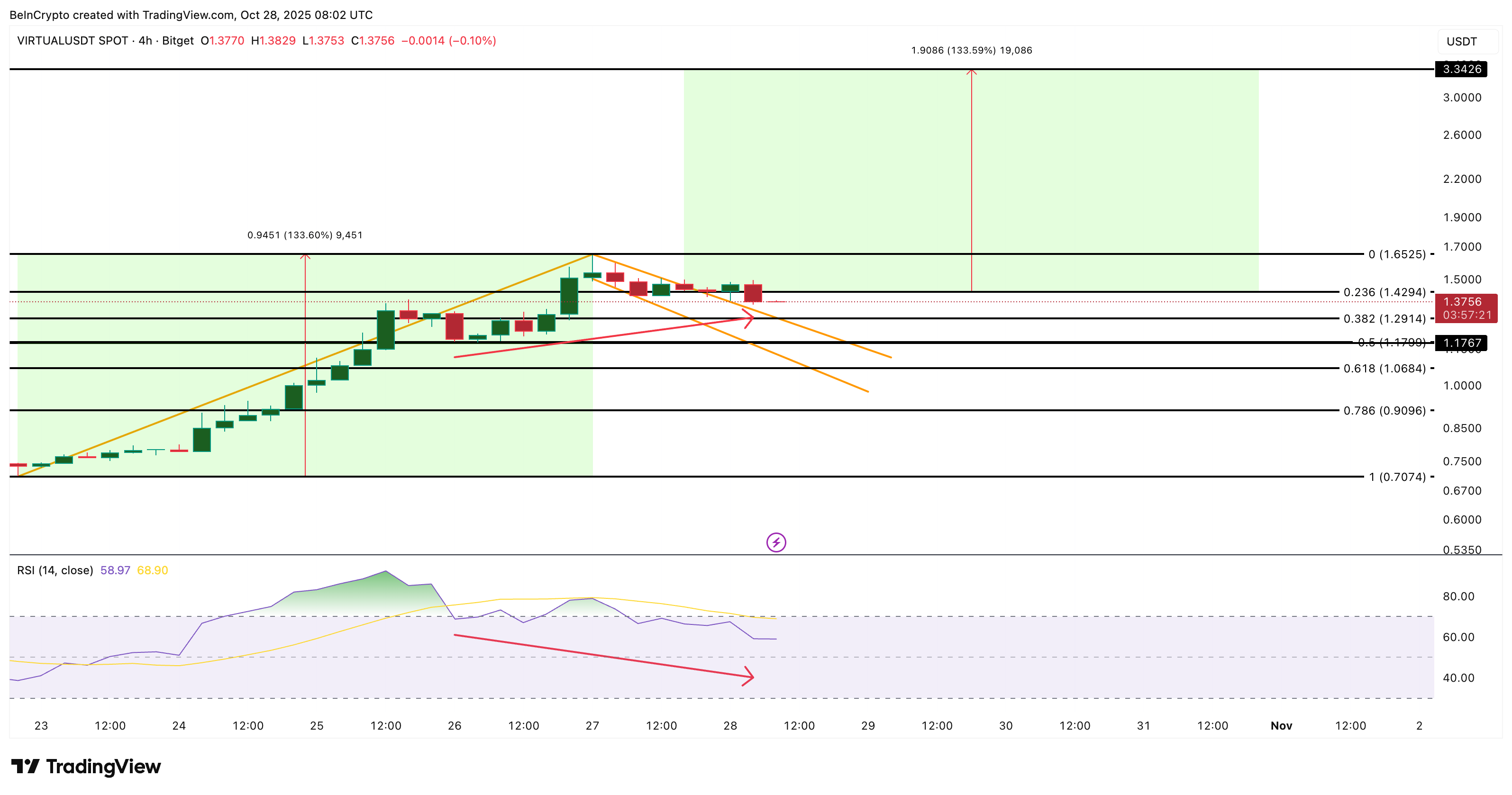

VIRTUAL recently broke out of a flag-and-pole pattern near $1.42. It is a setup that often precedes continued upside after a sharp rally. From that breakout, the projected move points toward $3.34, representing a potential 133% gain from current levels.

However, the token must first close a full 4-hour candle above $1.65 to confirm renewed strength and attempt a push towards $3.34. Adding conviction to this view, between October 26 and 28, the price made a higher low while the Relative Strength Index (RSI) made a lower low.

This pattern, a hidden bullish divergence, typically shows that an uptrend remains intact even as prices cool.

VIRTUAL Price Analysis:

TradingView

VIRTUAL Price Analysis:

TradingView

It also hints that the ongoing pullback could end soon if buyers continue to defend the lower levels.

For downside validation, the bullish setup remains valid as long as VIRTUAL holds above $1.17. A 4-hour close below that would open the way toward $1.06. That would invalidate most of the bullish pole-and-flag breakout momentum.

Even if the rally reaches $3.34, VIRTUAL would still be about 35% below its all-time high of $5.07, leaving ample room for recovery. If the broader trend continues, this pullback could drive the next major rebound phase rather than its end.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Kite AI (KITE)

XRP ETF Launch Could Happen Soon, Says Analyst Nate Geraci

Quick Take Summary is AI generated, newsroom reviewed. ETF expert Nate Geraci predicts the first XRP ETF could launch within the next two weeks. The launch would be a major win for Ripple Labs after years of SEC battles. Analysts expect billions in institutional inflows and strong market interest. Approval would move crypto investing closer to full mainstream acceptance.References FIRST SPOT $XRP ETF COULD LAUNCH IN 2 WEEKS! ETF analyst Nate Geraci says it would be the "final nail in the coffin" for anti-c

Ripple Moves 800M XRP Worth $1.9B from Escrow to Unknown Wallet

Quick Take Summary is AI generated, newsroom reviewed. Ripple moved 800M XRP from escrow to an unknown address, which is typically a routine liquidity management step. This transfer comes ahead of the Ripple Swell conference (Nov 12-14) in Dubai, where major announcements are expected. The move is magnified by a cryptic "XRP coded" message from the Gemini exchange, sparking partnership rumors. Despite the large transaction, the XRP price remained relatively stable, as traders anticipate most of the tokens

Swiss crypto bank AMINA secures MiCA license in Austria