ZEC ‘Bubble’ Bigger Than 2021, CryptoQuant Data Shows

Zcash (ZEC) is signaling a bubble phase, with current trade volume exceeding 2021 highs, CryptoQuant reports. The analyst warns new retail buyers may face a sharp correction.

Zcash (ZEC) is exhibiting signs of entering an extreme bubble phase, according to a recent on-chain analysis. Current trading metrics exceed those recorded during its 2021 bull run peak.

On Tuesday, Ki Young Ju, CEO of on-chain data platform CryptoQuant, posted the sobering analysis on his X account. In doing so, he warned retail investors about the risks. He bluntly stated, “Sorry, but you’re retail if you’re buying Zcash now.”

CryptoQuant CEO Issues Stark Warning

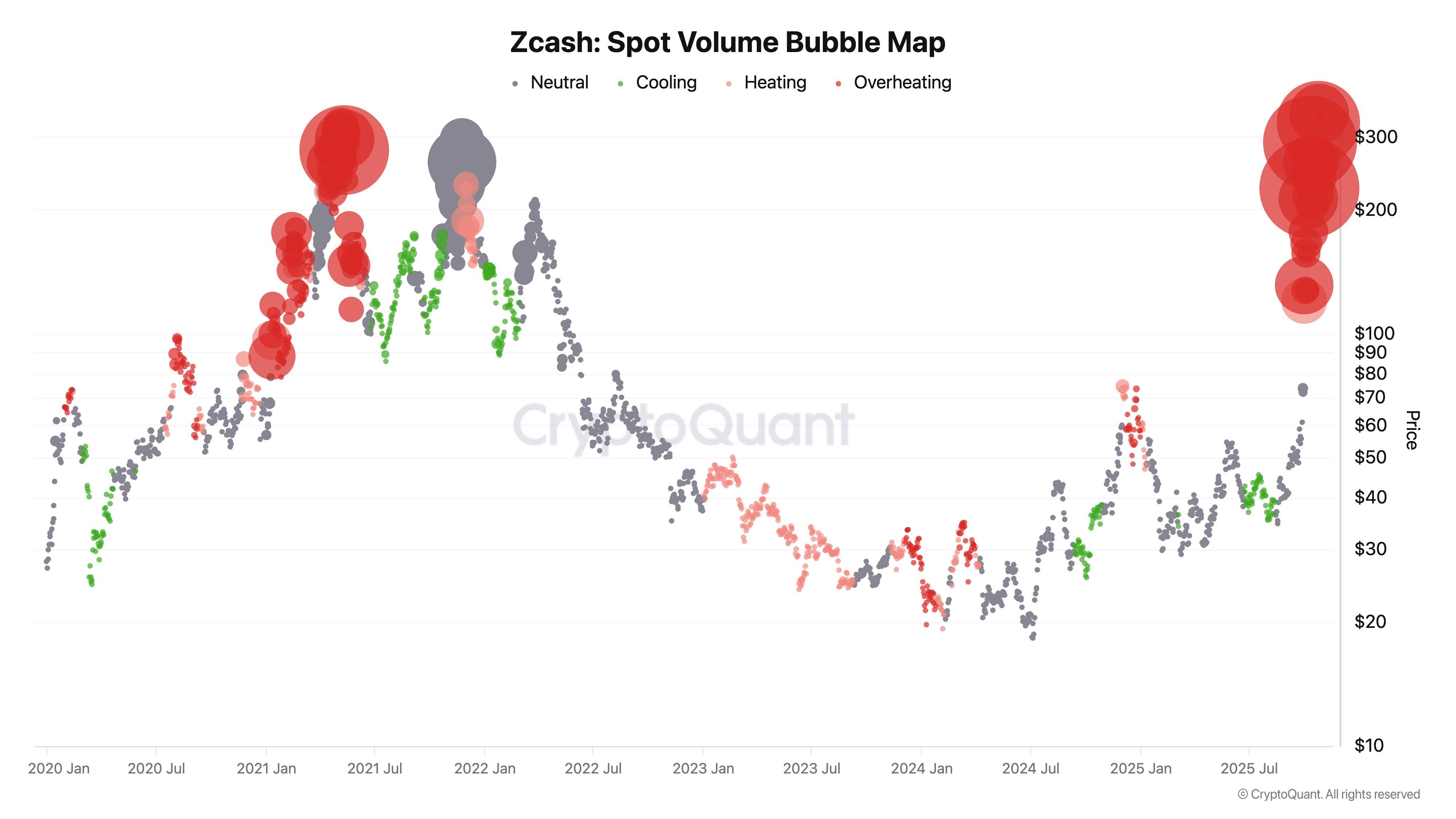

The CEO shared a chart titled ‘Zcash: Spot Volume Bubble Map’ which tracks ZEC’s trading volume against its price since January 2020. In this visualization, the size of the circles indicates trading volume, while the color reflects the volume change rate (cooling, neutral, heating, or hyper-heating).

Zcash: Spot Volume Bubble Map. Source: CryptoQuant

Zcash: Spot Volume Bubble Map. Source: CryptoQuant

The chart’s core interpretation relies on spotting a Distribution Phase. This phase is late in a bull cycle when trading volume is exceptionally high, but price appreciation is slow. This signifies that new investors are entering the market, leading to a massive turnover, or “handover,” of tokens from seasoned holders.

The chart shows a sharp period of high turnover that lasted about six months during the first half of 2021, when ZEC surged toward $300 per coin. This phase ultimately preceded a market-wide downcycle, which led to a price collapse and major losses for investors who bought ZEC at the end of the rally.

Current Metrics Surpass 2021 Peak

The most alarming finding is that the latest ZEC trading volume and price action register a larger bubble size than the one seen in the first half of 2021. If the broader cryptocurrency market is indeed in the final stage of its cycle, the analyst warns that a repeat of the 2021 collapse is highly possible.

ZEC has attracted massive attention recently, soaring by over 750% in the last three months. The cryptocurrency’s seemingly inexplicable rally has spurred price increases across the entire privacy coin sector.

High-profile figures have amplified the speculative frenzy surrounding ZEC. Former BitMEX CEO Arthur Hayes posted on X on October 26 that he expects the ZEC price to climb to as high as $10,000 per coin. At the time of this report on Tuesday, ZEC is trading around $328, up from $308 when Hayes made his prediction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea's KRW1 Stablecoin Strives to Strengthen Its Position as a Global Leader in Digital Finance

- South Korea's BDACS launched KRW1, a won-backed stablecoin on Circle's Arc blockchain, marking its first cross-border digital finance gateway. - The stablecoin, fully collateralized and audited by Woori Bank, leverages Arc's interoperability to expand beyond Avalanche, aligning with Korea's digital finance strategy. - Circle's Arc, now hosting 100+ institutions including BlackRock, positions KRW1 as part of a growing Asian trend in blockchain-based stablecoins. - Regulatory challenges persist as Korea dr

Ethereum News Today: "Dormant Ethereum Whale Stirs After 8 Years, Moves $80M and Boosts Institutional Optimism"

- Ethereum whale transfers $80.48M in ETH to Kraken after 8-year dormancy, signaling potential institutional interest. - Another whale accumulates $362M in BTC and ETH with 100% profitability, boosting bullish sentiment. - Analysts highlight Ethereum's institutional appeal due to upgrades and DeFi dominance, with key resistance near $4,250. - Combined whale activity underscores Ethereum's growing role in institutional portfolios amid Bitcoin's dominance.

Solana News Update: Litecoin ETF Debut Gauges Investor Interest in Altcoins

- Litecoin's first Nasdaq spot ETF launch could drive LTC to $135, supported by 7% weekly gains and rising on-chain activity. - ETF approval boosts institutional credibility, with $157M in LTC network transactions and growing social media engagement. - Technical analysis shows LTC testing $104 resistance after breaking $96.30, with bullish RSI and MACD indicators. - Mixed altcoin ETF reactions highlight market selectivity, as Solana's BSOL ETF saw $56M volume but 3.6% price decline. - Broader crypto volati