Crypto Analyst Says One Altcoin Is ‘Potential Steal’ As Bitcoin Tries To Break Out

A widely followed crypto trader says he’s keeping his eye on one of the market’s “best opportunities” while looking ahead to what’s next for Bitcoin ( BTC ) and Arbitrum ( ARB ).

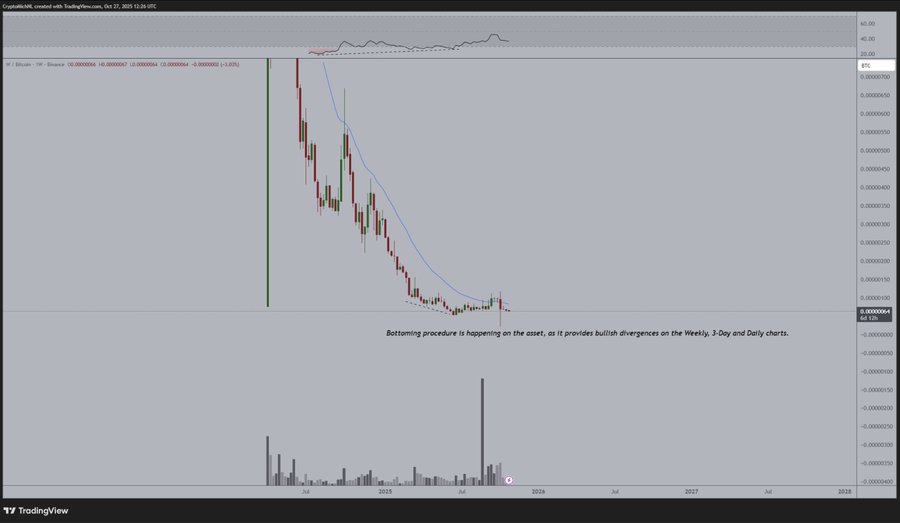

In a new post on X, crypto analyst Michaël van de Poppe tells his 812,700 followers that Wormhole ( W ), an interoperability project that allows communication between blockchains, is potentially a “steal” at its current price.

“In my opinion, one of the best opportunities in the markets.

Very glad that I’ve got W allocated in the Altcoin portfolio in the size that I’ve got it allocated.

The Altcoins were about to break to the upside, although the market crash wiped everything out again.

That’s why the next leg up should be higher than the previous one, and that brings W as a potential steal at these prices.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Looking at crypto king Bitcoin, Van de Poppe says the upcoming U.S. Federal Open Markets Committee (FOMC) meeting results will have major sway on BTC.

“Good start of the week.

As FOMC is approaching for Bitcoin, there’s likely a correction pre-FOMC taking place.

Retest of the $112,000 area wouldn’t be bad.

After that –> onwards to a new all-time high.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Finally, moving on to ARB, the analyst says that the Ethereum ( ETH ) layer-2 altcoin could potentially be up by 200% against BTC soon.

“ARB consolidating nicely on a strong support level.

One of the most active ecosystems within Ethereum, as they have just reached 2 billion transactions on-chain.

It’s hilarious that token prices aren’t moving upwards, but anyways, that’s still a window of opportunity for anyone interested into buying those assets.

Given that all liquidity has been taking surrounding the resistances in the previous run, I would assume that the next run will bring arbitrum higher up on the list.

That, technically, is a potential 200% run against Bitcoin in the coming period.

And that would bring ARB to $1.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Moonbirds to launch BIRB token in early Q1 2026

Aligning Universities with Emerging Industries: The Critical Need for STEM Investment

- Global industries demand AI, renewable energy, and biotech skills faster than traditional education systems can supply, creating a critical skills gap. - Universities like MIT and Stanford are embedding AI across STEM curricula while industry partnerships accelerate hands-on training in automation and biomanufacturing. - Renewable energy programs with apprenticeships and public-private funding are addressing talent shortages as $386B global investments outpace workforce readiness. - Biotech's fragmented

PENGU Token Value Soars: Blockchain Data and Institutional Interest Indicate Optimal Timing for Investment

- PENGU ranks #81 with $706.5M market cap, showing rising institutional interest and whale accumulation. - The pending Canary PENGU ETF, if approved, could unlock institutional capital by including NFTs in a U.S. ETF. - Mixed on-chain signals (RSI 38.7, OBV growth) and 2B tokens moved from team wallets highlight uncertainty. - Partnerships with Care Bears and Lufthansa, plus Bitso collaboration, expand utility but face regulatory risks. - Recent 8.55% price rebound and 2.6% gain post-BNB listing suggest ca

Evaluating How the COAI Token Scandal Influences Cryptocurrency Regulatory Policies

- COAI Token's 88% price crash and $116.8M loss exposed systemic risks in centralized AI-DeFi projects with opaque governance. - Global regulators responded with stricter frameworks, including EU's MiCA and Singapore's asset freezes, to address jurisdictional gaps. - Institutional investors now prioritize compliance, with 55% of hedge funds allocating to digital assets via tokenized structures in 2025. - Emerging solutions include AI-driven risk platforms and anthropological governance models to enhance tr