Top 3 Highest Gaining Small-Cap Tokens in the x402 Ecosystem This Week

The x402 ecosystem’s explosive growth pushes its market cap above $800 million, driven by massive rallies in AIN, PAYAI, and AURA—three AI-focused small caps capturing traders’ attention with triple- and quadruple-digit gains.

x402, an internet-native payment standard designed for artificial (AI) agents, has gained major traction across the crypto ecosystem and emerged as one of the most talked-about innovations in the space.

It’s not just attention. The ecosystem’s market capitalization has also surged past $800 million. As momentum continues to build, three small-cap tokens have benefited the most, standing out as the top weekly gainers within the x402 ecosystem.

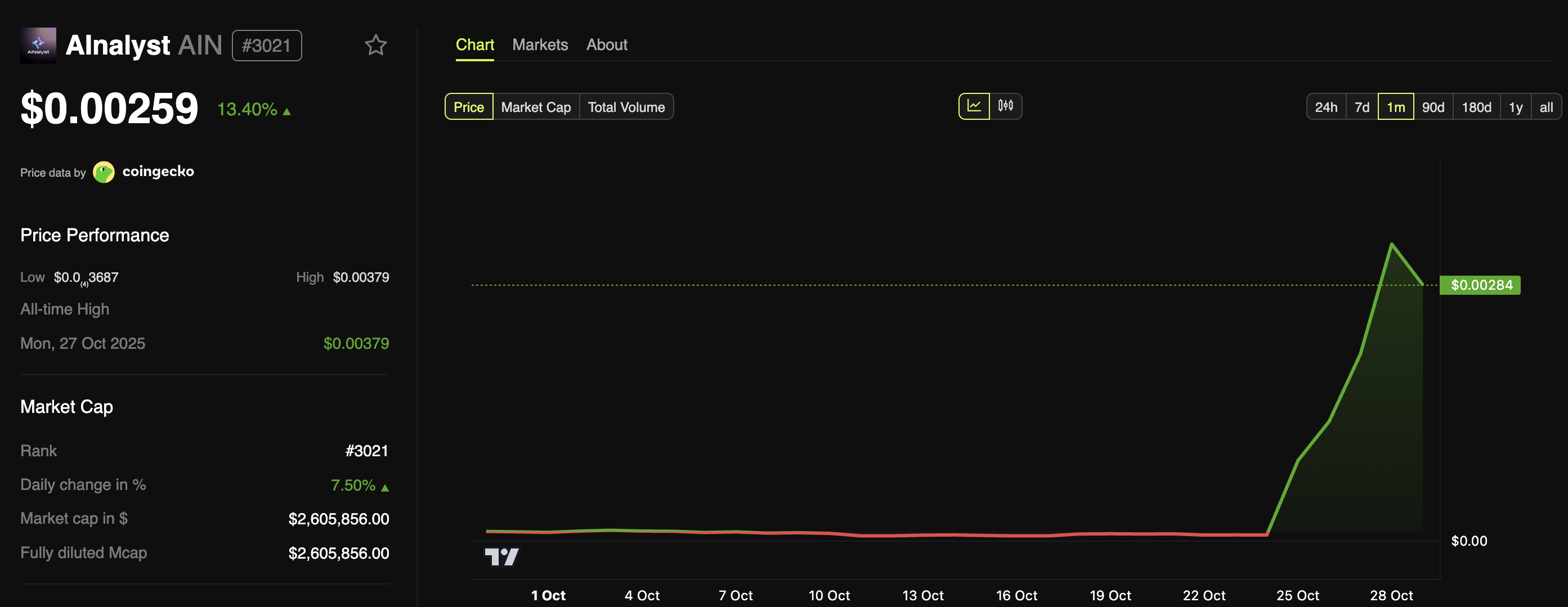

1. AInalyst (AIN)

AInalyst is an AI-driven Web3 analytics platform. It fuses on-chain metrics, social sentiment, and behavioral data to deliver real-time insights for traders and agents.

The project is currently the top agent on x402 and the highest weekly gainer among the ecosystem’s tokens. The altcoin has soared by more than 3,800% this week, reaching a new all-time high yesterday.

AInalyst (AIN) Price Performance. Source:

BeInCrypto Markets

AInalyst (AIN) Price Performance. Source:

BeInCrypto Markets

At the time of writing, AIN traded at $0.00259, up 13.4% in the last 24 hours. Its market cap stands at $2.6 million. Notably, the token recently gained a listing on Binance Wallet, broadening access for new users.

“You can now trade AIN directly on Binance Wallet and find it listed under the x402 category. Real data. Real utility,” the team posted.

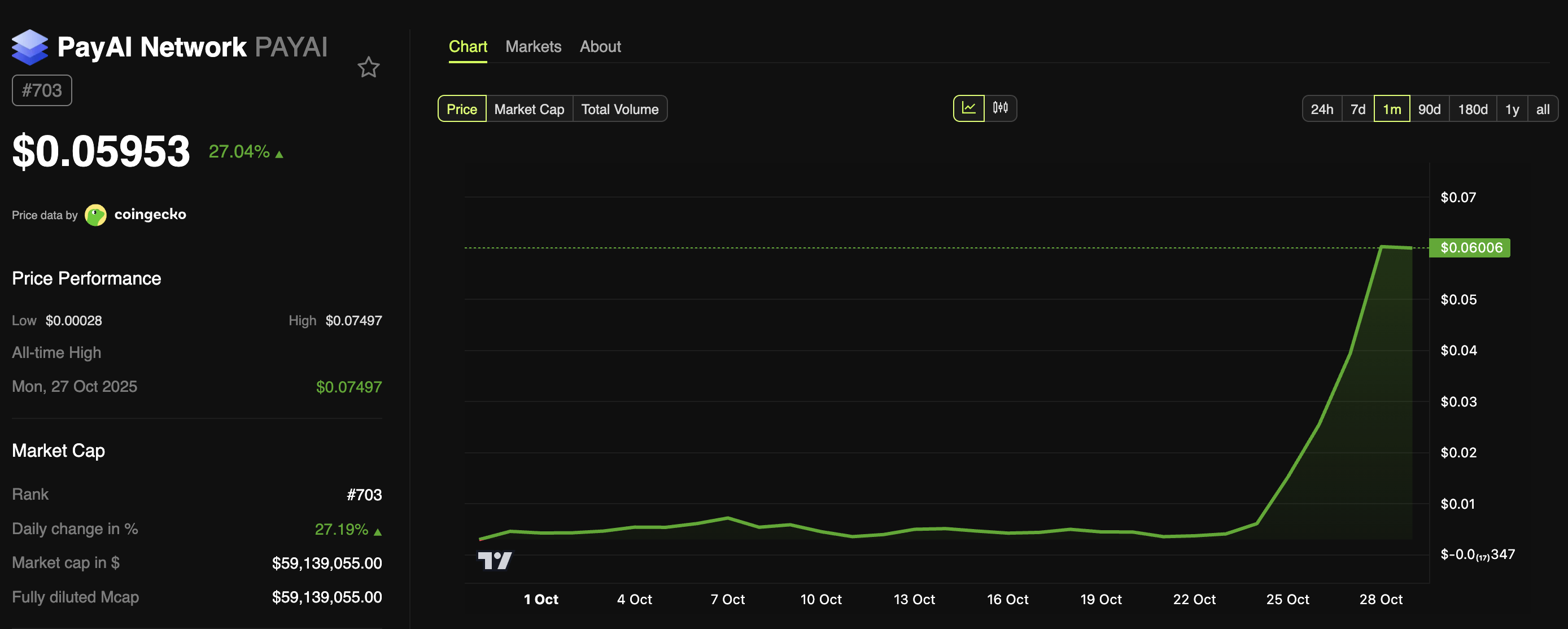

2. PayAI Network (PAYAI)

PayAI Network is an open-source marketplace where AI agents hire, contract, and operate 24/7 autonomously. The network accounts for about 14% of x402’s volume.

With a market capitalization of $59.1 million, PayAI is the third-largest token in the x402 ecosystem. Over the past week, the token jumped over 1,500%, hitting a record high before settling at $0.059. This represented a 27% daily gain.

PayAI Network (PAYAI) Price Performance. Source:

BeInCrypto Markets

PayAI Network (PAYAI) Price Performance. Source:

BeInCrypto Markets

Market analysts suggest the project could soon achieve a $100 million valuation if the current momentum continues.

“PAYAI is dominating on Solana. 100 million is not so far, we will easily break it before the end of this week,” analyst Alex forecasted.

Meanwhile, PayAI’s growth has been accompanied by several notable developments. Crypto exchanges Poloniex and Ju.com announced that they will add trading support for PAYAI today, boosting liquidity and exposure.

At the same time, the network launched an airdrop campaign to reward early supporters and active users, allocating 1 million PAYAI tokens for distribution. This development has further fueled community engagement.

Nonetheless, Talentre DEX’s tool has flagged abnormal capital inflows into PAYAI, raising concerns.

“Our tool detected an unusual inflow into PAYAI and it’s flagged not by wash trading but by real wallets with positive ROI. Once those wallets start selling, it’s time to exit the trade. We warned you!” Talentre posted.

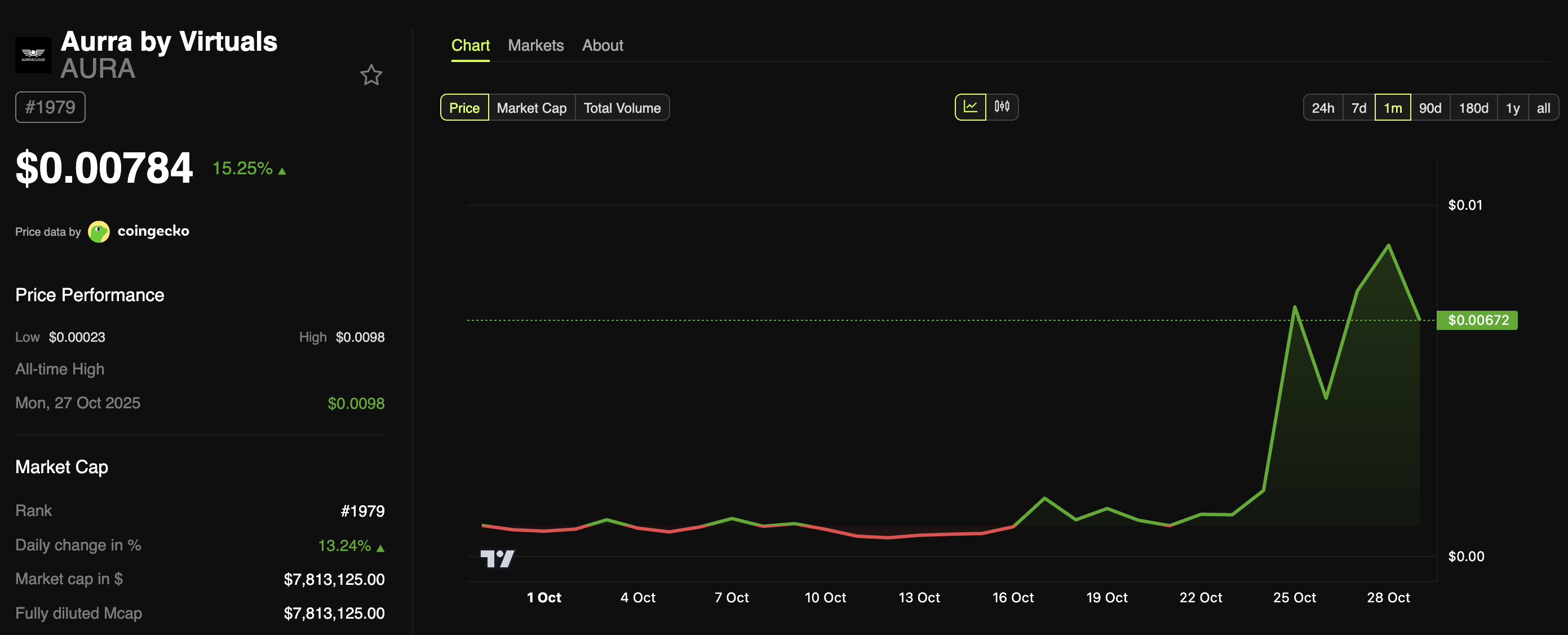

3. Aurra by Virtuals (AURA)

Aurra by Virtuals rounds out this week’s top three. The platform provides AI agent tooling and hosting designed for crypto applications. It enables seamless deployment and monetization of AI agents with zero coding required.

Aurra’s token, AURA, has gained 988.2% over the past week, reaching $0.0078 at press time.

According to data from BeInCrypto Markets, its market capitalization is $7.8 million. The token is also listed on LBank and WEEX, expanding accessibility for traders.

Aurra by Virtuals (AURA) Price Performance. Source:

BeInCrypto Markets

Aurra by Virtuals (AURA) Price Performance. Source:

BeInCrypto Markets

The fast-paced gains of AIN, PAYAI, and AURA reflect both opportunities and risks tied to new technology trends. While exchange listings, airdrops, and broader market participation support the sector’s expansion, volatility could increase if profit-taking accelerates or protocol weaknesses appear.

Future results for x402 small caps hinge on continued development, deeper integrations, and the capacity of AI-powered payments to achieve real-world efficiency. The coming weeks will reveal whether today’s rally signals the start of a long-term trend or another fading meta in the crypto space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prediction Market Platforms Explode: Daily Volume Hits $500M Milestone

British giant CF Benchmarks presents three bullish scenarios for Bitcoin (BTC)! Here are the latest predictions

Revolutionary Shift: South Korea Poised to Lift Ban on Domestic ICOs After 7 Years