Key Market Insights for October 28th, How Much Did You Miss?

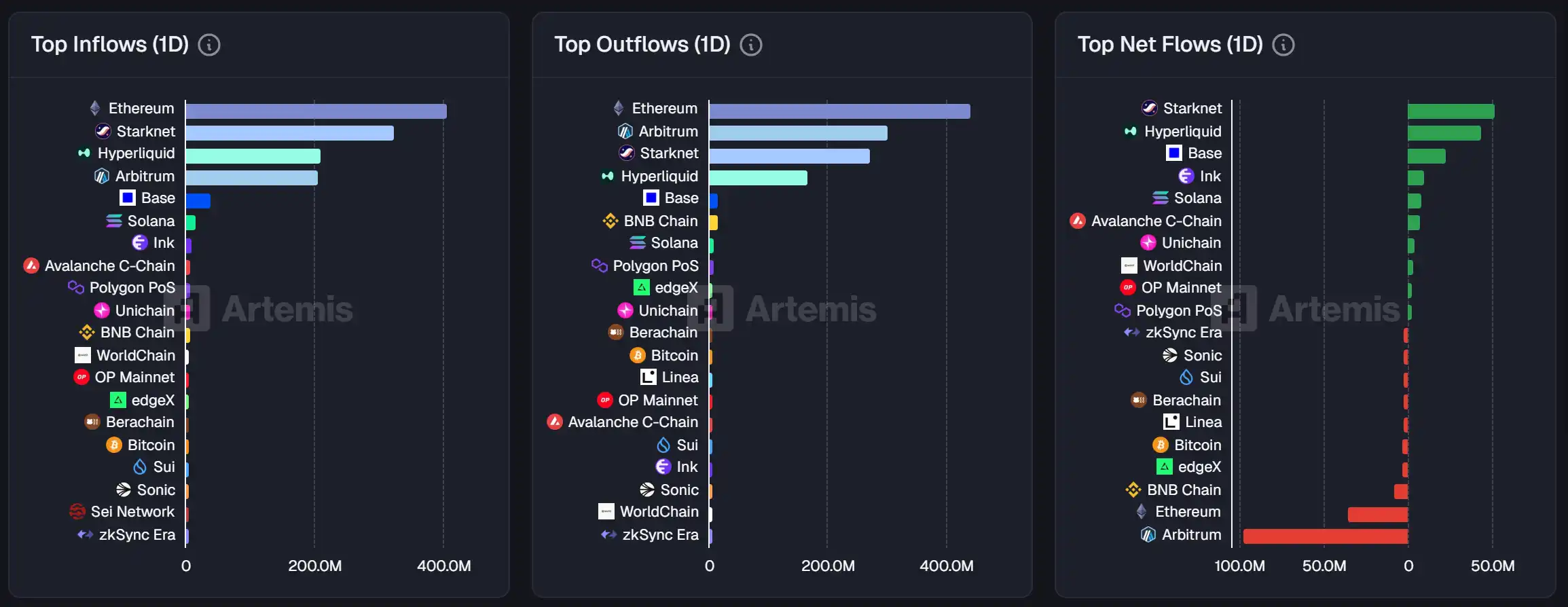

1. On-chain Funds: $146.2M USD inflow to Starknet today; $132.7M USD outflow from Arbitrum 2. Largest Price Swings: $ANYONE, $COMMON 3. Top News: The MegaETH public sale has raised $530M USD to date, with 18,590 participating addresses

精选要闻

1、MegaETH 公售目前已募集 5.3 亿美元,参与地址数达 18,590

2、比特币今年 10 月回报率暂报 0.39%,此前历史平均回报率为 21.89%

3、部分 Solana 生态 meme 币今日涨幅明显,CHILLHOUSE 单日涨超 130%

4、受上线 Upbit 影响,KERNEL 短时拉升超 50%

5、Binance Alpha 将于 10 月 29 日上线 BitcoinOS(BOS)

精选文章

1.《为什么 x402 协议没有昙花一现?》

自 x402 协议因 meme 币 $PING 的爆火点燃市场热情,已经快要过去了一周的时间。目前为止,绝大部分的市场观点是正向的,既有对 x402 协议未来发展的乐观展望,也有对各类项目的细分讨论。但也会有一些声音认为,x402 的爆火太快,有可能无法在短期内承载过热的市场期望,出现后继乏力的情况。那么,在这将近一周的时间里,x402 协议生态发生了哪些变化呢?在一起回顾并分析完接近一周时间内 x402 生态的变化后,我们可以对文章标题的内容给出一个回答。

2.《MSTR 被评 B 级,DAT 公司还值得了解和投资吗?》

DAT 模式连接的是风险,也可能是未来。它代表了一种介于加密与资本市场之间的中间地带——既不完全属于「币圈」,也不完全属于「股市」。Strategy 被评为「垃圾」,但某种意义上,这是数字资产财库第一次获得被评级的资格。未来,传统评级机构如何量化比特币风险、投资者如何看待「加密版伯克希尔·哈撒韦」,将决定 DAT 能否从投机叙事走向金融结构的一部分。

链上数据

10 月 28 日上周链上资金流动情况

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Analysts Predict Institutional Buying to Drive Bitcoin to $200K by 2025

- Bitcoin analysts predict $150,000–$200,000 prices by late 2025, citing institutional accumulation and market fundamentals. - Geopolitical optimism from Trump-Xi talks and Fed rate cut expectations temporarily boosted Bitcoin to $111,390 in October. - Lunar cycle theories and on-chain data suggest November could see renewed volatility, with potential for mid-cycle recovery. - Institutional buying persists despite short-term risks, while macroeconomic factors maintain cautious optimism in crypto markets.

Bitcoin Updates: Trump and Xi Discuss Crypto Market Fluctuations Through Rare Earth Policies and Tariff Changes

- Trump-Xi summit in South Korea aims to ease trade tensions, stabilizing crypto markets amid Bitcoin's 10%+ volatility since September. - Agreed measures include delaying 100% US tariffs on China and relaxing rare earth export controls, critical for crypto mining hardware supply chains. - Bitcoin rose 1.6% post-summit as Kalshi prediction markets priced 93% deal probability, signaling investor optimism over trade resolution. - Ongoing challenges remain in semiconductor supply diversification, with China c

Regulatory Transparency Fuels Taurus’ Growth in New York’s Institutional Crypto Sector

- Taurus opens New York office for U.S. expansion, second North American location. - Regulatory changes like GENIUS/Clarity Acts and SAB 121 repeal create favorable environment for crypto engagement. - Provides custody, tokenization, and trading tech to major institutions, supporting 35+ blockchain networks. - Appoints Zack Bender to lead U.S. operations, aligns with Circle's Arc testnet for infrastructure projects. - Raised $65M in 2023 for expansion, targets underserved U.S. market with compliant solutio

ZKP Disrupts Crypto Speculation by Introducing a Trust Model Based on Verification

- ZKP blockchain project challenges crypto speculation by rewarding verifiable contributions over speculation, using cryptographic proof-based governance. - Its tokenomics allocates 48.5% of 1 billion tokens to community through phased unlocks, emphasizing long-term ecosystem development. - Whitelist participants shape trust mechanisms via data validation, contrasting traditional presales that prioritize capital or timing. - Integrating AI computation and privacy protocols, ZKP combines Proof of Intelligen