US Lawmaker Seeks to Ban Trump and His Family From Trading Crypto or Stocks

A Democratic legislator launches heavy artillery against the American president’s crypto activities. Ro Khanna proposes to purely and simply ban Donald Trump, his family and all elected officials from trading cryptos and stocks. An initiative that rekindles the debate on conflicts of interest at the top of the American state.

In brief

- Democratic Representative Ro Khanna is drafting a bill to ban U.S. lawmakers from trading stocks and cryptocurrencies.

- Trump is targeted for his alleged ties to World Liberty Financial, his son’s crypto project that reportedly generated millions of dollars.

- The pardon granted to Binance founder Changpeng Zhao has fueled accusations of “blatant corruption.”

- This proposal aligns with Senator Adam Schiff’s COIN Act, which specifically seeks to prevent the Trump family from “financially exploiting” cryptocurrencies.

Congress wants to cut Trump off from his activities in the crypto sector

Ro Khanna, Democratic representative from California and vice president of the Congressional Progressive Caucus, launched a frontal attack against Donald Trump during an appearance on MSNBC. The legislator denounces what he considers “blatant corruption”: the presidential pardon granted to Changpeng Zhao, co-founder of Binance.

“You’ve got a foreign billionaire who was basically engaged in money-laundering“, hammered the California representative.

For him, the timing is no coincidence. CZ had pleaded guilty in 2023 to violating US banking law, having failed to implement an effective anti-money laundering program at Binance. Then Binance financially supported WLFI. And finally, Trump pardoned him .

The causal link seems clear to Khanna. He claims that CZ now finances the stablecoin of the president’s son’s company, which generates “millions of dollars under Donald Trump’s presidency.” This accusation echoes concerns expressed by Representative Maxine Waters.

However, Eric Trump has always categorically denied any involvement of his father in the project, recalling last September that the president “runs a nation” and has “no connection” with their business activities.

For his part, Ro Khanna concluded his intervention with an unequivocal call : banning any elected official from holding cryptos or accepting foreign money. A position that is part of a broader offensive led by Democrats to regulate the financial influence of political leaders.

Along the same lines, Senator Adam Schiff has gone further with the COIN Act, a much stricter bill that would ban presidents, vice presidents, and their close relatives from issuing, owning, or supporting cryptos during their entire term—and up to two years after leaving office.

When the guardian of the temple has his hands in the cookie jar himself

The irony of this anti-trading crusade is not without spice. Because while Khanna denounces Trump’s alleged conflicts of interest, his own stock market activities raise embarrassing questions. The Quiver Quant data reveals that the representative made $80.3 million worth of stock trades in 2025 alone.

Since his election in 2017, Khanna has conducted over 35,000 transactions for a volume exceeding $580 million. His preferred sectors? Finance, information technology, and health.

Areas over which, as a legislator, he could potentially exert influence. This potential hypocrisy significantly weakens the impact of his message.

The bipartisan stock trading bill, currently under discussion in Congress, illustrates the complexity of the debate. Should government representatives be allowed to invest in financial markets? The question has long divided opinions, but cryptos add an explosive dimension to this old ethical dilemma.

According to government documents, Khanna’s proposal has not yet been officially filed. And chances of its adoption remain slim given the Republican majority in both chambers. However, this Democratic offensive marks a turning point in the political war surrounding the Trump presidency’s crypto activities .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

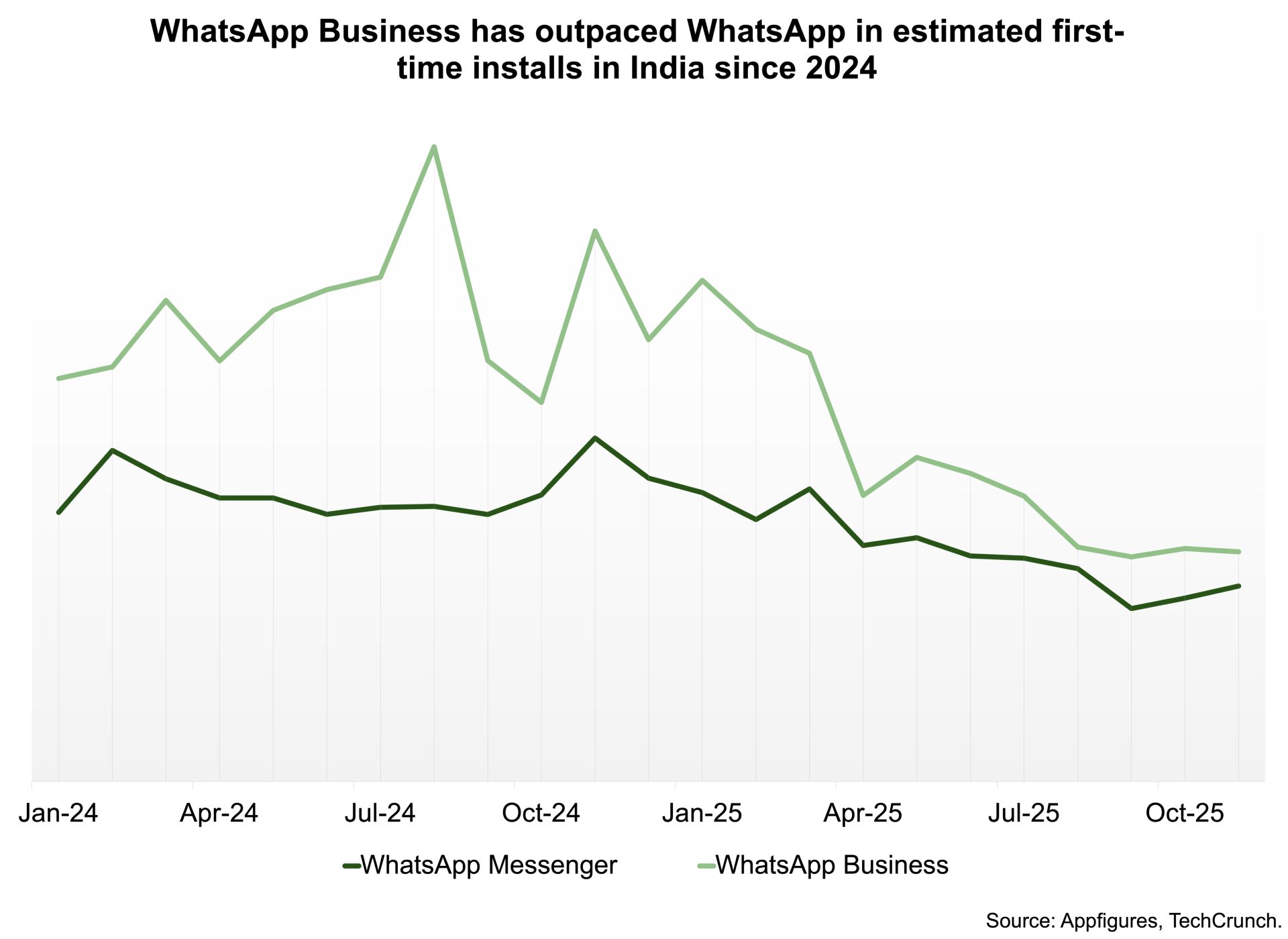

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026