SharpLink Invests $200M in Ethereum Through Linea, EtherFi, and EigenCloud Platforms

Enhancing Institutional Yields through Combined Staking and Restaking Services in Linea's zkEVM Layer 2

Key Points

- SharpLink Gaming plans to deploy $200 million in Ethereum (ETH) to Linea, ConsenSys’ zkEVM Layer 2 network.

- The company’s strategy aims to generate enhanced DeFi yields through institutional-grade staking and restaking services.

SharpLink Gaming, Inc. (Nasdaq: SBET), the world’s second-largest corporate holder of Ethereum (ETH), recently announced an ambitious strategic move. The company plans to deploy $200 million in ETH from its treasury to Linea, a Layer 2 network by ConsenSys.

The company’s strategy leverages staking and restaking services from ether.fi and EigenCloud to generate enhanced DeFi yields. The ETH assets are safeguarded and deployed through Anchorage Digital Bank, which ensures compliance and sets a new standard for digital asset treasury practices.

Institutional Yield Strategy and Layer 2 Infrastructure

SharpLink’s deployment is optimized for institutional DeFi yields, combining native Ethereum staking rewards, restaking incentives from EigenCloud’s Autonomous Verifiable Services, and unique partner yields coordinated within Linea’s compliant infrastructure.

Linea, designed for high-volume institutional operations, offers lower fees and faster settlements while providing composability with the broader Ethereum ecosystem. SharpLink’s move establishes a new institutional pathway for ETH capital, reinforcing its disciplined treasury management and advocacy for Ethereum adoption.

Joseph Chalom, Co-CEO of SharpLink, emphasized the firm’s commitment to responsible asset deployment and enhanced yield generation. He mentioned the institutional safeguards maintained for stakeholders.

This move is similar to what ETHZilla did in September 2024, when they restaked $100M with Ether.fi and EigenCloud. This shows a path that most Ethereum treasuries will follow to improve their returns.

SharpLink’s Stock Reaction

SharpLink Gaming trades under the ticker SBET on Nasdaq. As of today, SBET stock has seen low activity, reflecting only a few investors’ attention following the announcement of this ETH deployment. Its share price is down only 0.80%, with a low volume of 3 million shares.

The company’s position as the second-largest Ethereum treasury holder is viewed as instrumental in supporting liquidity and confidence in broader digital capital markets. Now, it is generating yield through DeFi.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple CEO Declares ‘Nobody Can Manipulate XRP Prices’ amid December Volatility. Here’s Why.

Expert to XRP Holders: This Will Be One of the Biggest Fakeouts in History If This Happens

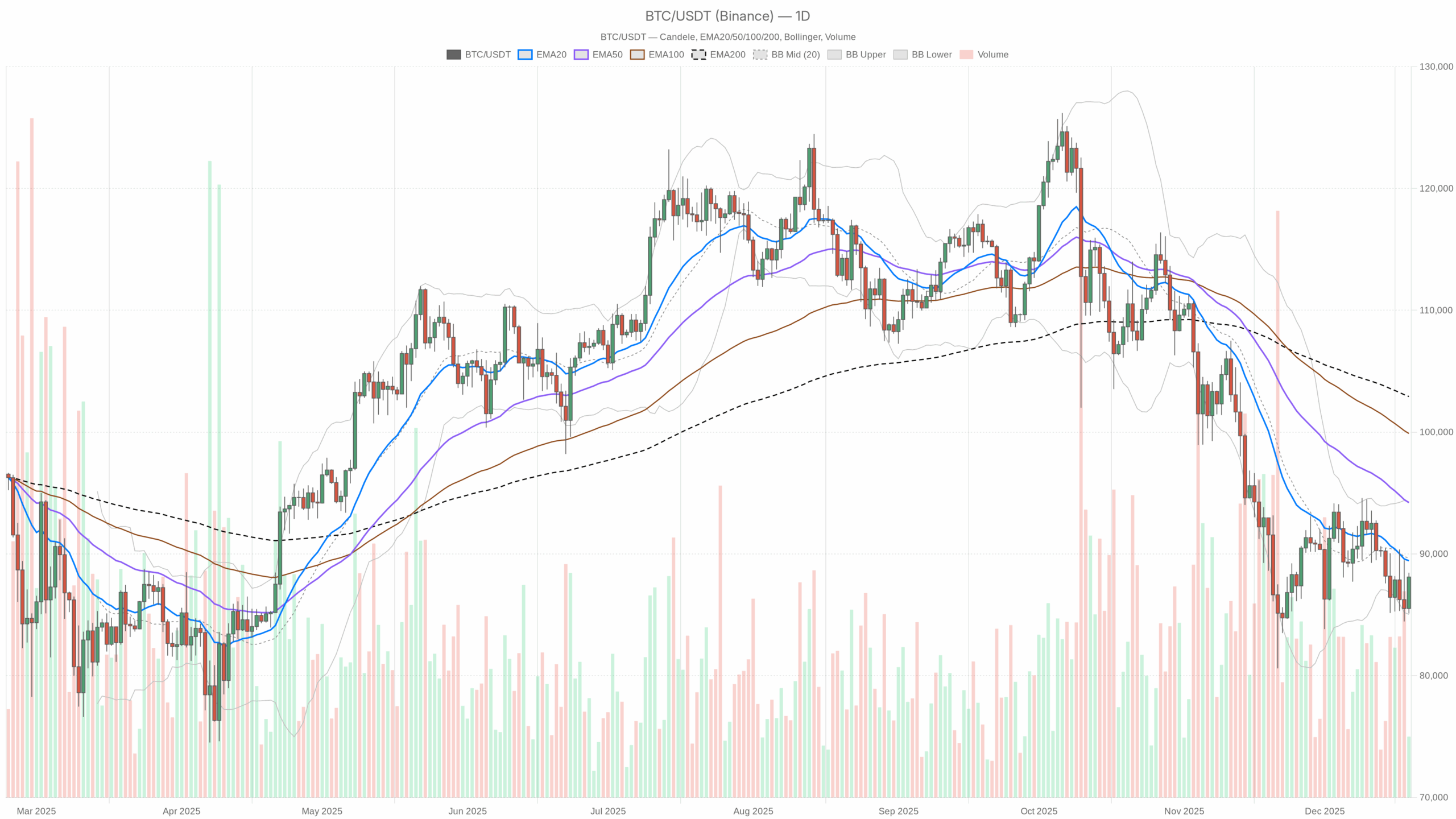

BTC price outlook: short-term bounce inside a larger downtrend

Best Solana Wallets as Visa Chooses Solana and USDC for US Bank Settlements