Key Market Information Discrepancy on October 29th, a Must-See! | Alpha Morning Report

1. Top News: BSC On-Chain Chinese Narrative Meme Trading Slumps, 'Binance Life' Holds the Fort Alone, 'Hakimi' Heat Stable 2. Token Unlocking: $TREE, $CELO, $GFAL, $STIK, $ZORA

Featured News

1. BSC On-chain Chinese Narrative Meme Trading Sluggish, "Binance Life" Solo Holding the Flag, "Hakimi" Heat Stable

2. Monad MON Airdrop Distribution Results Now Available for Query

3. U.S. Stock Market Continues to Hit New Highs, Crypto Market Slightly Down Against the Trend

4. Visa to Accept Four Stablecoins on Four Blockchains, Support Currency Exchange

5. OpenAl Announces Completion of Capital Restructuring, May Prepare for Listing

Articles & Threads

1. "Why Didn't the x402 Protocol Flash in the Pan?"

It's been almost a week since the x402 Protocol ignited the market enthusiasm with the meme coin $PING. So far, the majority of market views are positive, with optimistic expectations for the future development of the x402 Protocol and discussions on various projects. However, some voices also believe that the rapid rise of x402 may not be able to sustain the overheated market expectations in the short term, leading to a lack of follow-up strength. So, what changes have occurred in the x402 Protocol ecosystem in this nearly week-long period?

2. "After Speculating on Coins for a Year, My Earnings Are Lower Than My Mom's Stock Speculation"

This is a year of "everything rising," but the crypto circle is widely recognized as a "very difficult year to make money." Compared to the past few years, 2025 seems like a rare "leap year." The U.S. stock market hits new highs again, A-shares' core assets rebound, gold hits historical highs, commodities rebound collectively, and almost all markets are rising. However, in the crypto circle, even though Bitcoin hit a new all-time high of $120,000, many are complaining that this is the "hardest year to make money in the crypto circle." When friends talk about their family's investment operations this year, they say, "In terms of ROI from speculating on coins this year, it is completely lower than my mom's stock speculation."

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

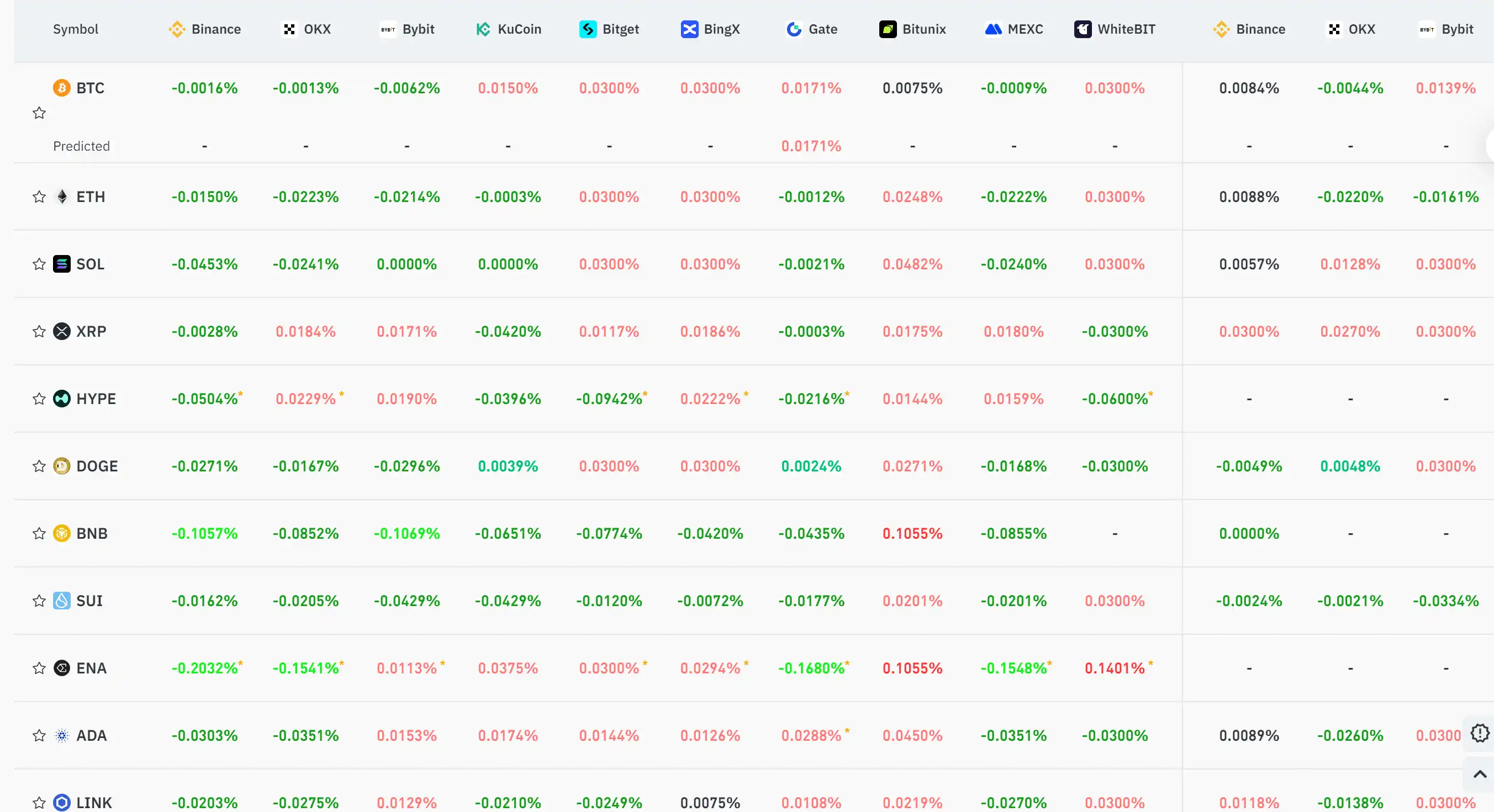

Funding Rate

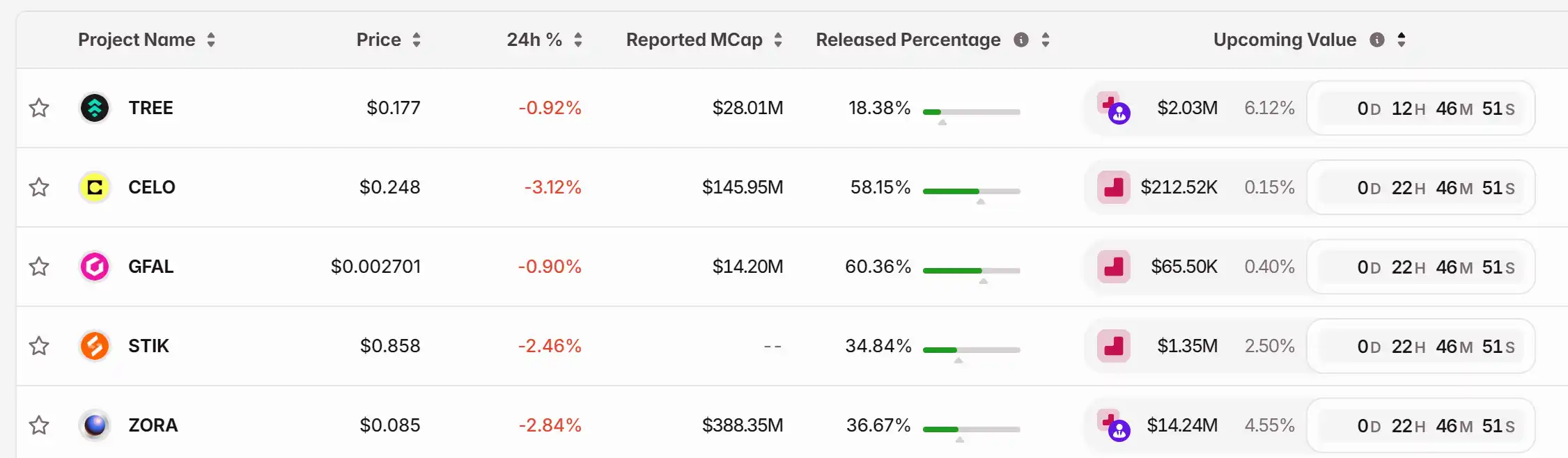

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Long-term holders sell 325,600 Bitcoin in sharpest monthly drawdown since July 2025

XRP News Update: Solana’s Stablecoin Strategy Ignites Competition with XRP in Global Remittance Market

- Western Union partners with Solana to launch USDPT stablecoin, bypassing XRP despite prior 2015-2018 XRP trials, citing Solana's speed, low fees, and institutional readiness. - XRP's 27.2% Q3 price surge and 215% RWA growth highlight its competitive edge, yet critics argue Solana's choice allows Western Union to retain transaction fee control over XRP's near-zero-cost model. - Blockchain adoption in remittances accelerates as firms like MoneyGram reduce correspondent bank reliance, while Solana's stablec

Solana News Update: Companies Move Their Treasuries to Solana for Portfolio Diversification and Protection Against Inflation

- Reliance Global Group acquires 1M Solana tokens, expanding its digital asset holdings to include five top-10 cryptocurrencies. - Solana’s high transaction speed and institutional interest, driven by ETF launches and Fidelity’s trading access, boost its appeal as a hedge against inflation. - Growing corporate adoption, including Solana Company’s 2.3M SOL holdings and 7.03% staking yield, highlights its role in diversified treasury strategies. - Market dynamics like low fees, DeFi/NFT ecosystems, and regul

Fed Interest Rate Reductions and Reduced Trade Frictions Push Dow Above 48,000

- - Dow Jones hit 48,000 for first time on Oct 25, 2025, driven by Fed rate-cut expectations, eased U.S.-China trade tensions, and strong corporate earnings. - - Fed's 25-basis-point rate cut and December reduction prospects boosted risk appetite, particularly in rate-sensitive sectors like tech and industrials. - - U.S.-China trade tensions eased as Trump and Xi discussed tariff reductions on Chinese goods amid fentanyl crisis, reducing global market uncertainty. - - Strong corporate results included Carp