Ethereum News Update: Crypto’s Political Bet: Trump’s Clemency and $263M in Lobbying Fuel Regulatory Ambiguity

- Ethereum led $522M in crypto liquidations as ETF inflows ($246M) surpassed Bitcoin for first time, signaling institutional adoption shifts. - Crypto groups spent $263M lobbying 2026 U.S. elections, doubling 2024 efforts, while Trump's Binance pardon boosted XRP, ETH, and BTC prices. - Trump Organization's crypto income surged 17-fold to $864M via token sales, raising ethical concerns amid UK money laundering probes into linked partners. - CLARITY Act faces 20% passage chance by 2026 deadline despite clos

Within the 24 hours ending on October 29, 2025, the global cryptocurrency market experienced liquidations totaling $522 million.

The uptick in ETF activity reflects a broader pattern of political and regulatory shifts influencing the industry. Crypto advocacy groups have assembled a $263 million fund for the 2026 U.S. midterm elections, nearly twice their 2024 expenditure and exceeding the lobbying budgets of the oil and gas sector, as reported by

At the same time, the

Despite these shifts, regulatory ambiguity remains. Bipartisan lawmakers are working to pass the CLARITY Act before a February 2026 deadline, as reported by

Amid these changes, the recent wave of liquidations underscores the dangers of leveraged trading. Ethereum’s leading role in liquidations—driven by its price falling to $4,010—illustrates the persistent challenges of volatility management, as Coinotag highlighted. Nevertheless, projects such as Blazpay are leveraging the current momentum.

As the industry continues to navigate evolving regulations, political dynamics, and market trends, the balance between institutional investment and speculative trading is expected to shape the course of 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google and Apple reportedly warn employees on visas to avoid international travel

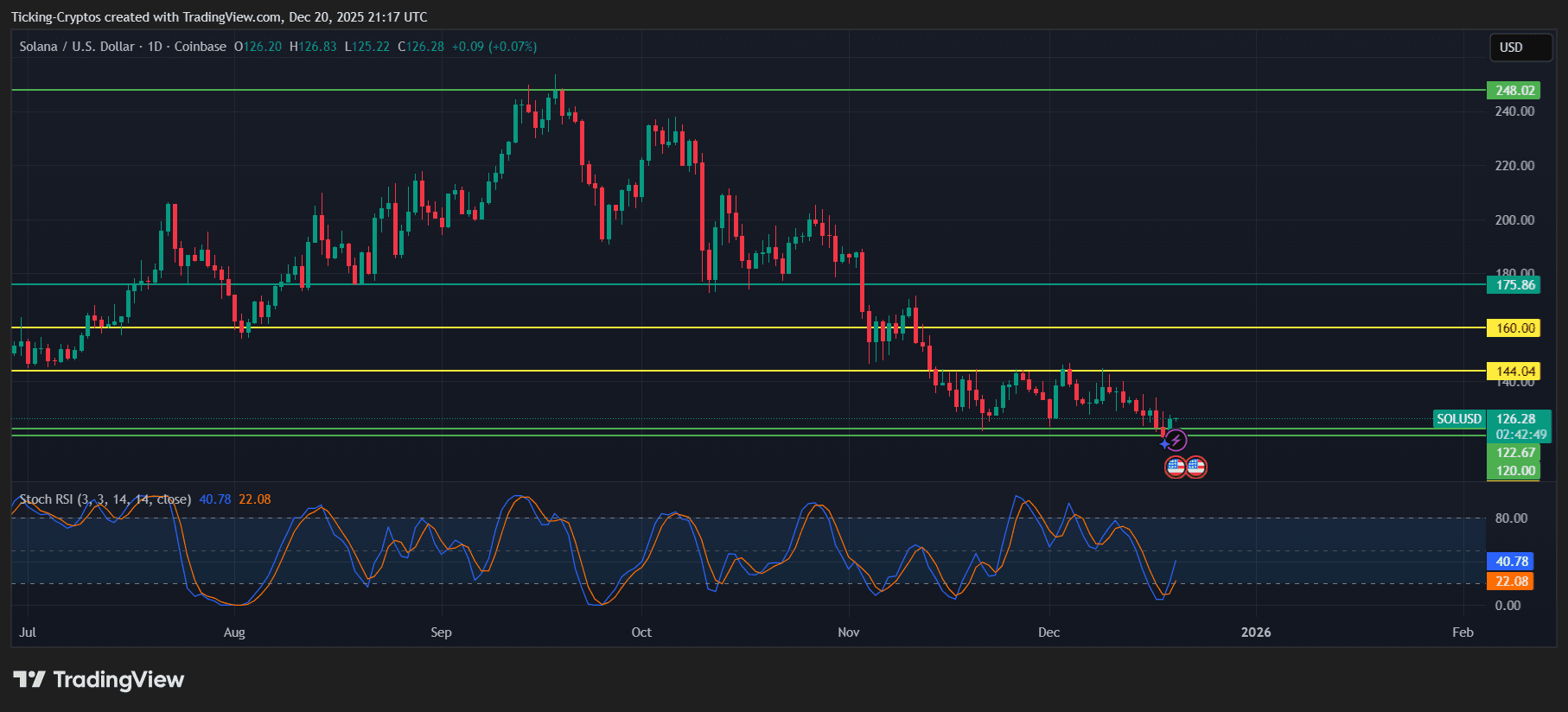

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels