Three cryptocurrency exchange-traded funds (ETFs) have made a notable debut on Wall Street, bringing attention and significant interest to digital currencies beyond Bitcoin $112,730 and Ethereum $3,988 . These funds are pioneering a path for alternative coins by achieving considerable trading volume on their first day. The eye-catching performance underscores a broader trend toward diversification in the cryptocurrency market , drawing both retail and institutional investors.

What Sets Solana Staking ETF Apart?

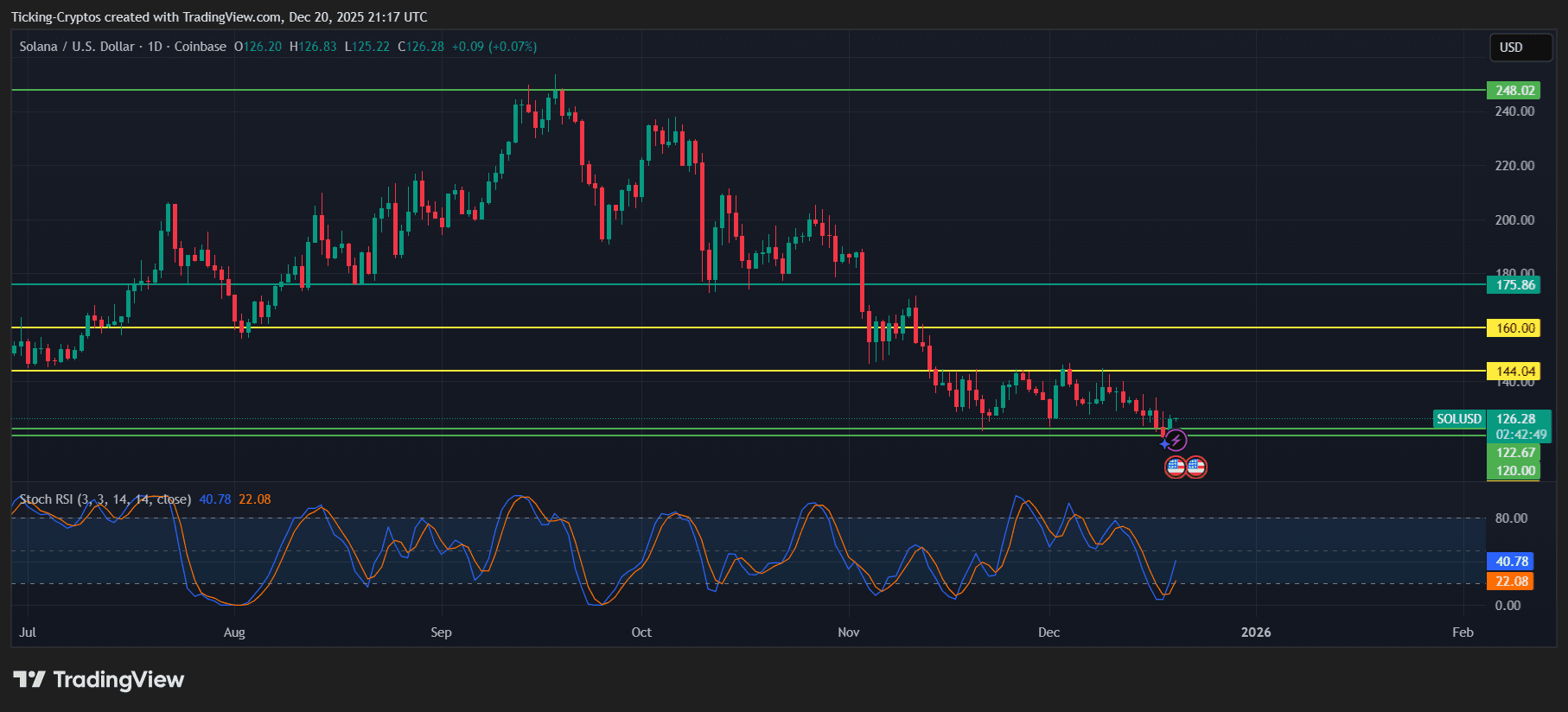

Leading the charge is Bitwise’s Solana $195 Staking ETF, which claims the title of the first U.S. ETF offering full exposure to Solana. On its launch day, the fund hit an impressive US$56 million in turnover, setting itself apart as the frontrunner in terms of volume. A zero-fee initiative, coupled with a 7% annual yield staking model powered by Helius Labs’ on-chain infrastructure, makes it especially attractive. Bitwise seeks to pull in a substantial institutional investor base with this offering.

How Are Other ETFs Faring?

The Hedera and Litecoin ETFs, managed by Canary Capital, also gathered attention as the first to provide direct, spot exposure to these digital assets post-regulatory approval. They mark a pivotal point for the management firm following initial regulatory challenges. Canary Capital’s strategic decisions drive growth amid an expanding market for alternative digital currencies.

Gregg Bell from the Hedera Foundation commented on the regulatory clearance as an important development:

This represents a new chapter for regulated crypto access.

What Lies Ahead for Cryptocurrency ETFs?

There’s an unprecedented wave of ETF filings with the U.S. Securities and Exchange Commission, reflecting burgeoning institutional interest. Over 150 applications, involving 35 digital assets, await review. Projections by investment banking giant JPMorgan suggest inflows could reach up to US$6 billion for Solana-related funds within their first year, illustrating the immense investment potential these funds hold.

Acknowledging these developments, a representative from Bitwise noted:

We’re prepared to meet the increasing demand from institutional investors seeking diversified portfolios.

The introduction of these ETFs marks a significant shift for cryptocurrency engagement in regulated markets, primarily driven by the robust performance of Solana, Hedera, and Litecoin vehicles. The combination of regulatory green lights and varied investment strategies positions these assets as formidable contenders in the investment landscape.

This influx not only reflects a maturing cryptocurrency market but also demonstrates a growing acceptance and solidification of digital assets within traditional investment frameworks. With more diverse cryptocurrency products launched, retail and institutional investors alike can anticipate a dynamically evolving market, presenting both opportunities and challenges.