Ethereum News Update: Major Ethereum Holders Amass $898M While Solana Investors Spread $93M, Underscoring Market Differences

- Ethereum whales accumulated $898M in ETH since October, contrasting Solana's $93M outflows to Binance, signaling diverging institutional interest. - Bitcoin whales profited $6.6M from short positions, reflecting volatile crypto markets amid macroeconomic uncertainty and ETF outflows. - Ethereum's 6% price surge and whale repurchases suggest renewed institutional confidence, driven by smart contract adoption and upcoming Fusaka upgrades. - Analysts highlight Ethereum's superior liquidity and infrastructur

An increase in

Institutional interest in Ethereum has accelerated, with companies such as SharpLink and Bitmine Immersion Technologies acquiring 203,826 ETH and 19,271 ETH, respectively. Their combined ETH holdings now total $866.9 million at current market value, as reported by Coinotag. These acquisitions reflect a broader pattern of treasury inflows and enhanced liquidity, which Jamie Elkaleh, CMO of Bitget Wallet, attributes to Ethereum’s “advanced smart contract features and increasing enterprise use.” The network’s price stability—up 1.2% to $3,882—sets it apart from

The differing actions of large holders reflect broader market attitudes. Since mid-October, Ethereum whales have accumulated a net 218,470 ETH ($870 million), reversing a previous outflow of 1.36 million ETH, as detailed in a

Meanwhile, Bitcoin’s market has seen opportunistic moves. One whale closed a 1,107

Technical signals for Ethereum also point to

The Ethereum Foundation’s internal transfer of 160,000 ETH ($596 million) further demonstrates institutional faith, coinciding with the network’s price recovery above $4,000. Upcoming improvements like the Fusaka hard fork on October 28 are expected to boost scalability, strengthening Ethereum’s role in DeFi and real-world asset tokenization.

As the market moves within narrow ranges and speculative trades, whale activity continues to serve as a key indicator. While Ethereum’s accumulation and technical patterns suggest further gains, Solana’s recent sales and Bitcoin’s short-term swings highlight the fragmented nature of institutional crypto investment. Observers are encouraged to keep an eye on blockchain data and macroeconomic trends for additional insight.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google and Apple reportedly warn employees on visas to avoid international travel

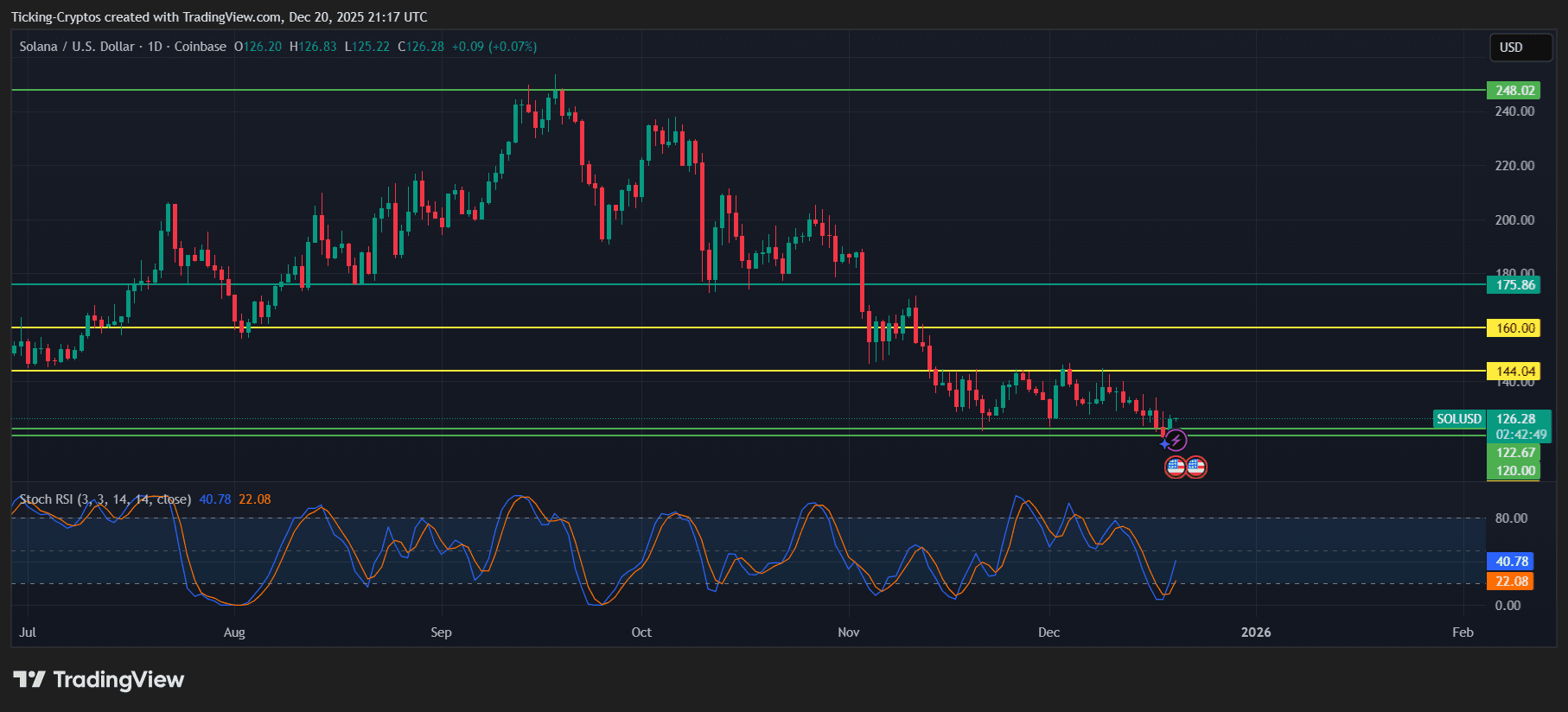

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels