Solana News Today: Data Indicates That FOMO-Induced Crypto Purchases Frequently Lead to More Significant Market Declines

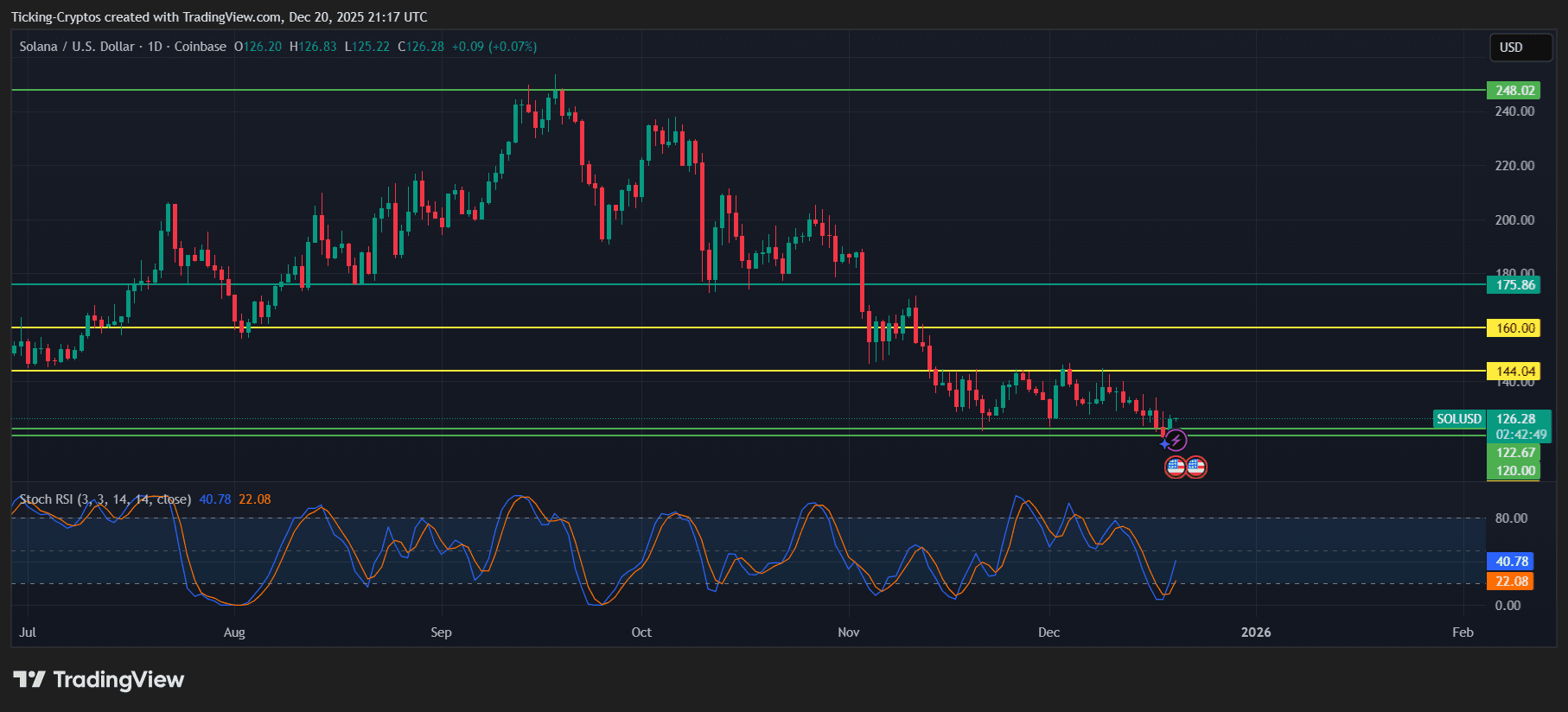

- Santiment warns crypto retail "buy the dip" FOMO often precedes deeper downturns, as historical patterns show optimism peaks before sharp corrections. - Bitcoin struggles below key support while Solana rebounds above $178, but TVL growth and liquidity-driven bounces remain fragile indicators. - MegaETH's $450M ICO surge highlights speculative risks, contrasting with durable bottoms that emerge when panic replaces optimism. - Market analysis emphasizes ideal buying windows occur post-capitulation, as seen

Retail traders have become increasingly focused on "buying the dip" amid this week's crypto market recovery—a tactic that, according to

This push and pull is evident in the current market.

Retail-driven rallies are not exclusive to cryptocurrencies. Alaska Air Group (ALK) posted a record $3.8 billion in revenue for Q3 2025, but its adjusted earnings per share missed forecasts, as outlined in an

Santiment's findings also resonate with broader market patterns. Such rapid inflows are often followed by sharp corrections, especially when underlying fundamentals don't support high valuations. In contrast, genuine market bottoms tend to form quietly, as seasoned investors avoid overcommitting during temporary recoveries.

For those willing to wait, the takeaway is straightforward: markets tend to reward patience when sentiment shifts from hope to fear. Santiment pointed out that the best buying opportunities usually arise when retail traders least expect a rebound—typically after markets have absorbed all the negative news. This was evident during the 2020 crypto crash, when Bitcoin surged 30% after a period of widespread capitulation. However, the current landscape is further complicated by macroeconomic factors, such as the Fed's attention to AI-driven changes in the labor market and corporate investments in AI infrastructure, which may further disrupt traditional market signals.

As the Fed operates in an environment with limited data and companies like Amazon and Nvidia make significant AI investments, the relationship between technological change and investor sentiment is likely to become even more pronounced. For now, Santiment's caution remains relevant: while market dips may attract buyers, history shows that the strongest recoveries often begin when the majority has turned pessimistic.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google and Apple reportedly warn employees on visas to avoid international travel

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels