Bloomberg: $263 Million Political Donation War Chest Set as Crypto Industry Ramps Up for U.S. Midterms

This time, there are more Super PACs, some of which have taken a more explicit stance aligning with Republican candidates.

Original Article Title: Crypto's Political Machine Amasses $263 Million to Rival Big Oil

Original Article Authors: Annie Massa, Olga Kharif, David Pan, Bloomberg

Original Article Translation: Luffy, Foresight News

Following the success in the 2024 U.S. elections, the crypto industry is ramping up its efforts in the 2026 midterm elections.

According to Federal Election Commission (FEC) filings and public statements, some Super Political Action Committees (SPACs) focused on cryptocurrency are raising approximately $263 million. According to OpenSecrets data, this amount is close to twice the largest SPAC Fairshake invested in 2024 and slightly higher than the total expenditure of the entire oil and gas industry in the previous election cycle.

After a significant investment by the crypto industry in 2024, with the Republicans controlling both houses of Congress, lawmakers passed multiple bills supported by the crypto industry and appointed regulation-friendly officials to key positions. This influence was evident again last week: former President Donald Trump pardoned Zhao Changpeng, co-founder of the cryptocurrency exchange Binance, who had previously admitted to violating U.S. anti-money laundering laws and was sentenced to four months in prison during the Biden administration.

Victories at the legislative level and the Trump family's embrace of cryptocurrency have prompted some of the newly formed SPACs to depart from their previous strategies, more explicitly supporting the Republican Party to help solidify its control of Congress.

The crypto industry is also leveraging political donations to advance a series of legislative and regulatory priorities, with the recent key focus being the Cryptocurrency Market Structure Act. This act would fundamentally reform the digital asset regulatory framework and potentially give the more crypto-friendly Commodity Futures Trading Commission (CFTC) greater authority over the crypto industry.

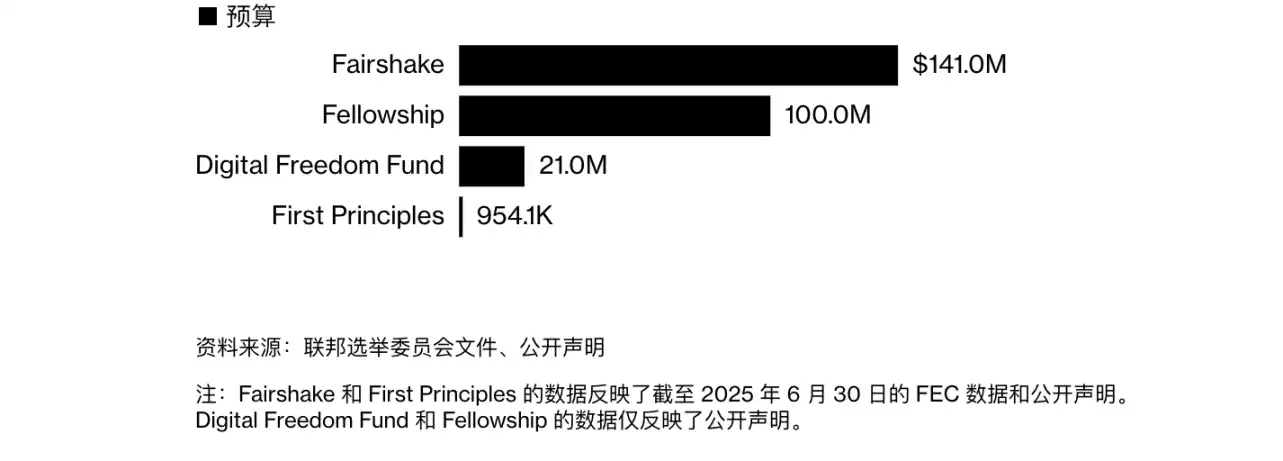

Midterm Election Budgets for Various SPACs

To push for the passage of the bill, around 12 top executives from the crypto industry traveled to Washington last week. Despite ongoing government shutdown-related negotiations, they held a one-hour meeting with a group of senior Republican senators and had longer meetings with Democratic senators, including Minority Leader Chuck Schumer.

「The industry has successfully laid out a roadmap for 2024 that has shown that whether you are an industry CEO or a regular user, cryptocurrency has a voice and can impact elections,」 said Cody Kealy, CEO of the Washington lobbying group The Digital Chamber, 「There will be more participants joining in the future, and more funds will be involved.」

Cryptocurrency companies and executives have supported policymakers and Trump's initiatives in various ways. Some cryptocurrency companies have engaged in business transactions with Trump family's cryptocurrency ventures, while others have made donations for the January inauguration and June parade. In addition, several companies are also contributing funds for the $300 million new White House banquet hall. According to the White House, these include the U.S. subsidiaries of Coinbase, Ripple, and stablecoin giant Tether.

U.S. President Donald Trump displaying a model of the planned triumphal arch at a dinner with corporate executives, highlighting the White House's new banquet hall construction project

Outside of the White House, SPACs are also a focus of congressional attention as they have the power to draft industry-related legislation.

According to public statements and FEC data, Fairshake remains the largest cryptocurrency SPAC, holding $141 million in funds as of the end of June. OpenSecrets data shows that the organization invested over $133 million in 2024 to support cryptocurrency-friendly candidates, making it one of the top organizations in single-issue spending in the previous election cycle. Its supporters include major U.S. cryptocurrency companies like Coinbase and Ripple, as well as venture capital firm Andreessen Horowitz.

In 2024, Fairshake and its two affiliated groups sought to make cryptocurrency-friendly policies a bipartisan issue. For example, the organization each invested around $10 million in Democratic senators Elissa Slotkin and Ruben Gallego to help them win Senate seats in Michigan and Arizona, respectively. These two senators are among the 18 Democratic senators who voted in favor of the "GENIUS Act," which paves the way for stablecoins favored by the cryptocurrency industry to have a broader integration into the financial system.

However, even in 2024, much of Fairshake's funding in the election stage was still used to support Republicans, including spending $40 million to successfully defeat then Senate Banking Committee Chair and Ohio Democrat Sherrod Brown.

In November 2024, Senate candidate Elisa Slotkin delivered a speech to supporters at her election night event in Detroit

This time, there are more SPACs, some of which have taken a clearer stance aligning with Republican candidates.

The cryptocurrency project World Liberty Financial, co-founded by the Trump family and Special Presidential Envoy Steve Witkoff's family, announced last month that it would support the Digital Freedom Fund SPAC. The PAC was established in August by cryptocurrency exchange Gemini co-founders Tyler Winklevoss and Cameron Winklevoss, who stated in an X platform announcement that they would donate 21 million dollars' worth of Bitcoin to support advocates of Trump's cryptocurrency agenda in the primaries and midterm elections. According to sources familiar with the matter, the organization plans to target Sherrod Brown, who is actively seeking to re-enter the Senate.

In July, Gemini co-founders Cameron Winklevoss (left) and Tyler Winklevoss (right) are seen talking to President Donald Trump at the White House during the signing ceremony of the "GENIUS Act"

Another newly formed group is the First Principles Digital PAC, which describes itself as "Republican-led, Republican-focused entities committed to supporting pro-crypto leaders." Led by Republican strategist Jason Tillman, it was formed after the 2024 election, and FEC files show it had a cash balance of approximately $954,100 as of the end of June. The organization has already supported Mike Rogers, who will run for a Michigan Senate seat in 2026.

Recently, Fellowship PAC announced its establishment in September and pledged to donate 100 million dollars. While the donors have not been publicly disclosed, preliminary filings indicate that the chief financial officer is an executive from the financial firm Cantor Fitzgerald—a company formerly led by Trump administration Commerce Secretary Howard Lutnick.

Representatives of Digital Freedom Fund, Fellowship, Fairshake, and First Principles Digital PAC have not commented on this.

The biggest wildcard is Tether. The stablecoin company based in El Salvador has close ties to Cantor Fitzgerald, and supporters of the Fellowship PAC are expected to include a recently formed U.S. entity of Tether, The New York Times reported.

In August of this year, Tether announced plans to launch a U.S.-based product and hired former Trump core crypto policy advisor Bo Heins to lead the effort.

Tether CEO Paolo Ardoino stated in an interview last week that the company is in discussions with several PACs. Foreign companies are prohibited from donating to SPACs, and Tether's new U.S. presence may enable it to qualify for donations.

On October 2, Tether CEO Paolo Ardoino spoke at the Token2049 conference in Singapore

Facing a funding surge from the crypto industry, the Democratic Party is becoming increasingly concerned.

Erica Baulsbaugh, who previously worked for Elizabeth Warren and Hillary Clinton's campaign teams, is now serving as the executive director of the newly formed group Open Frontier, which aims to align more progressive voices with the crypto industry.

“Many in my camp are still trying to understand this industry,” Baulsbaugh said. “There isn't a reliable voice right now, and trust in the crypto industry has been severely damaged.”

During a meeting last week where crypto executives traveled to Washington to meet with lawmakers, partisan divides were evident. Sergey Nazarov, co-founder of Chainlink Labs, who attended the meeting, stated that Republicans, including Senate Banking Committee Chair Tim Scott of South Carolina, clearly expressed alignment with industry priorities, while Democrats raised sharp questions regarding cryptocurrency's use in money laundering and decentralized finance.

“I believe Democrats have yet to truly understand our industry; they are concerned about illicit financial issues,” Nazarov said.

Another perspective suggests that the industry's substantial funding and newly gained political influence are forcing at least some Democrats to reassess their positions. Even Senator Brown, who was previously staunch in his stance, has moderated his critical comments.

“Cryptocurrency has become a part of the U.S. economy, increasingly popular in Ohio and nationwide,” Brown's campaign manager Patrick Eisenhart said in a statement, as more and more people adopt digital assets, Brown hopes to ensure “it can expand opportunities, improve the lives of Ohioans, and not expose them to risks.”

In 2024, Senator Sherrod Brown in a Senate campaign event in Ohio

The demands of the crypto industry executives go beyond the Republican Party's hopes to pass a market structure bill before the midterm elections, including adjusting cryptocurrency tax policies, anti-money laundering and sanctions-related rules, and the regulatory framework for decentralized exchanges.

Some donors are also looking at state and local elections, such as the New York City mayoral race. Crypto entrepreneur Brock Pierce donated over $1 million to groups supporting him just days before Eric Adams dropped out of the race.

For Nazarov of Chainlink Labs, there is a common thread in meetings with politicians. “They realize the enormous economic value of this industry, so they must clarify how to address it,” he said. “The industry will continue to grow, and they need to develop the right response.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.