What's the story behind Pieverse, which hit the x402 wave just before the Pre-TGE?

Binance partners closely with the BNB Chain, its very own "brainchild."

Original Article Title: "What is the Origin of Pieverse, Riding the x402 Wave Right Before Pre-TGE?"

Original Article Author: Eric, Foresight News

The x402 wave added fuel to the AI payment narrative, but the fire did not spread to the BNB Chain immediately. The reason for this was that x402, being too early, only supported the ERC-3009 standard, while stablecoins on the BNB Chain, including USDC, do not support this standard.

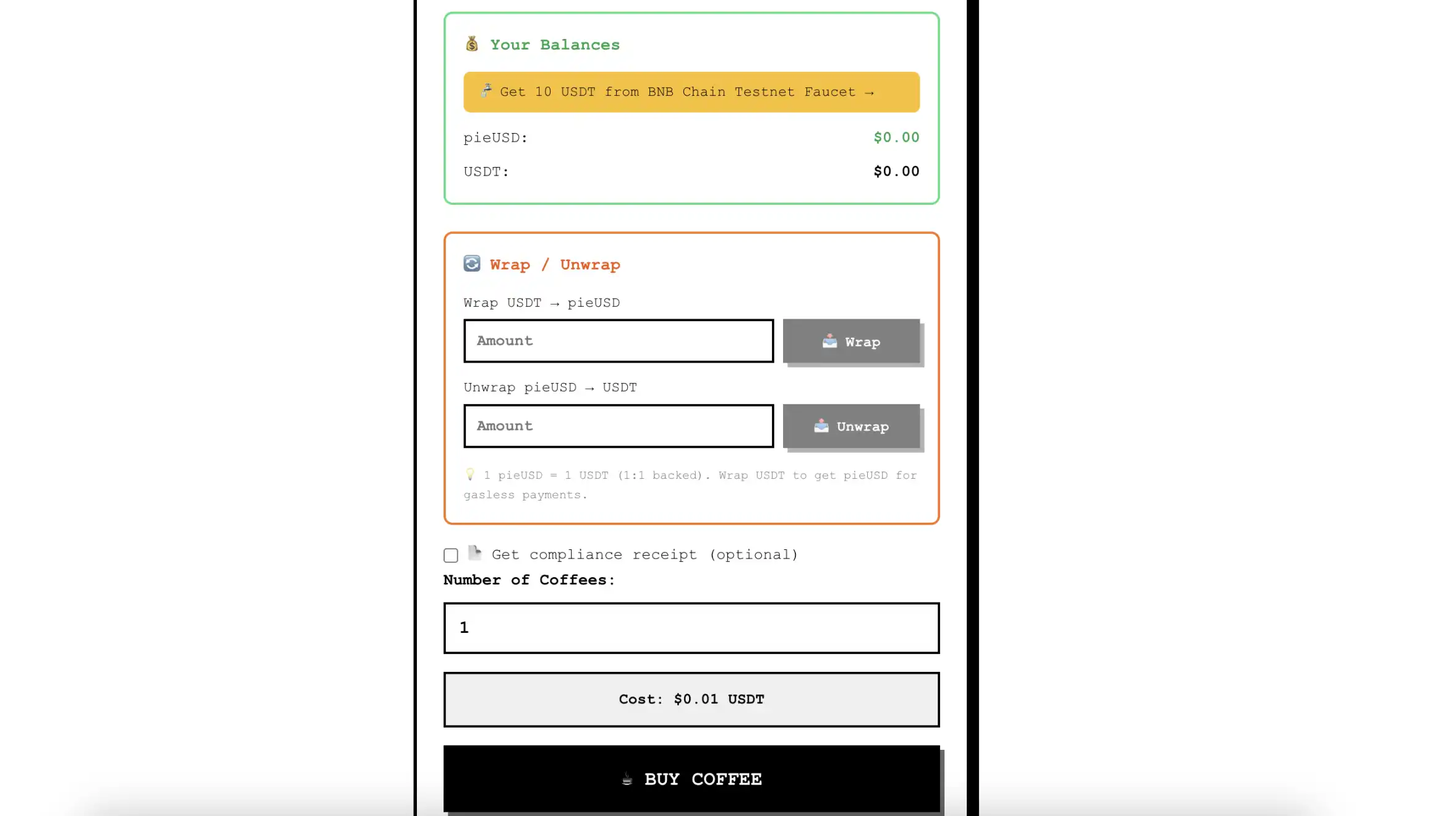

At this time, Pieverse, a payment protocol supported by Binance and the BNB Chain since being selected as an MVB, stepped forward. Not only did it solve the problem of BNB Chain not supporting x402 by launching the pieUSD wrapped token that supports the ERC-3009 standard, but it also upgraded x402, which originally only supported "payments," to x402b. In simple terms, Pieverse created verifiable receipts for payments, proving that the payment was a transaction between specific parties and not an AI's spontaneous action.

The Binance Wallet will launch Pieverse's Pre-TGE event on October 29th at 4 p.m. By serving the BNB Chain ecosystem, this quasi-new project that adds verifiable proof to on-chain payments is experiencing a small highlight in the era of AI payments.

A Protocol Associated with "Time"

Pieverse's development went through two stages. At its inception, it positioned itself as a "TimeFi" protocol. The core of the introduced Pieverse Timepot model is to allow people or resources that require time to match to find their corresponding targets more quickly through a series of platform mechanisms.

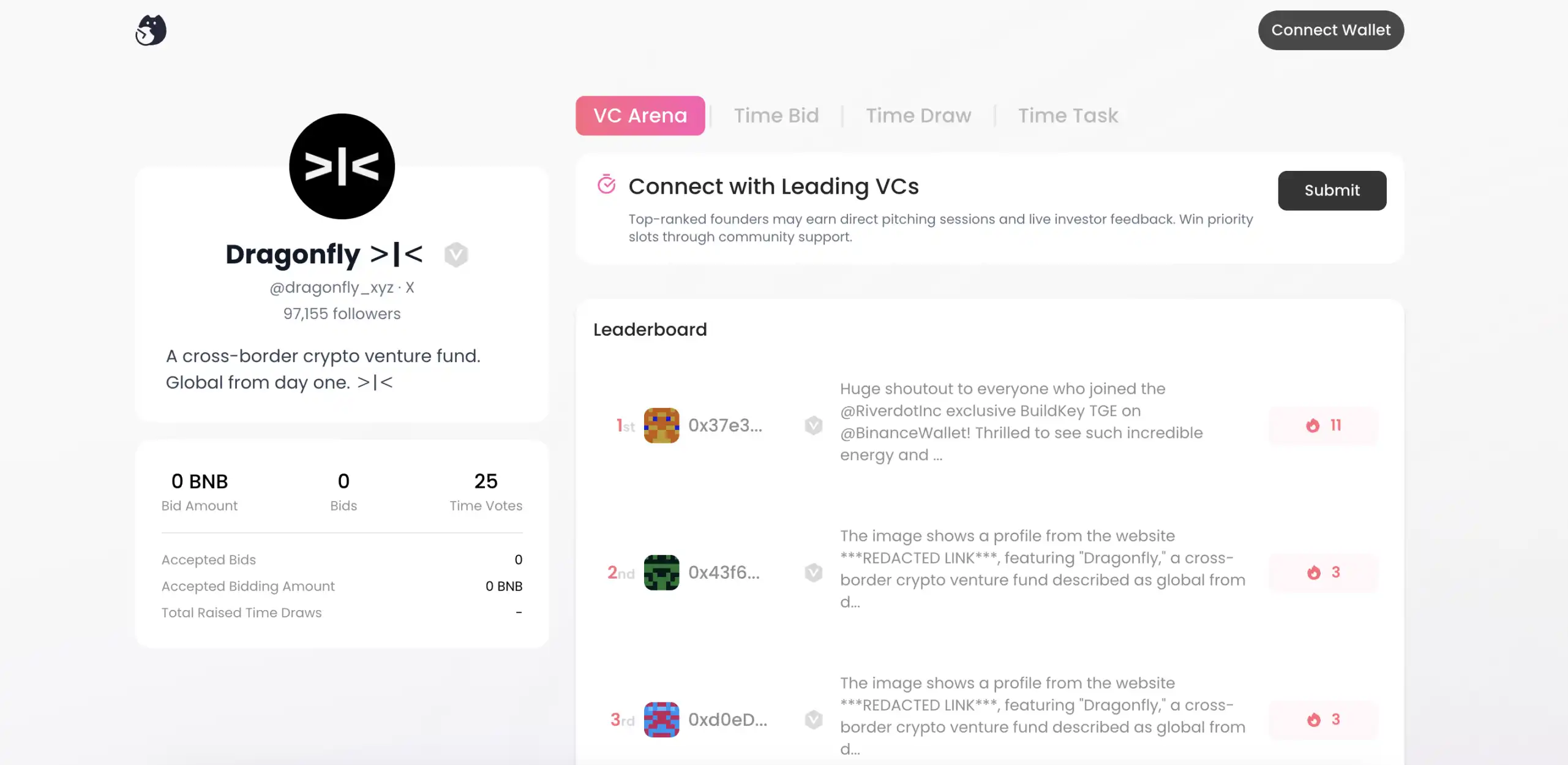

Pieverse's initial three products included Time Bid, Time Draw, and Time Task. Time Bid allows users to bid for professionals' time, and Pieverse will verify the "professional" level through platforms like LinkedIn. Successful bidders can directly communicate with professionals on the platform through Zoom, etc. Time Draw provides opportunities for private interaction with investors, traders, celebrities, etc., through a lottery system. Time Task provides a platform for anyone to post requirements and offer services.

Concept aside, this is just an intermediary platform, and forcibly linking it to time seems rather far-fetched. Currently, these three products, while still operational, appear to have lost any activity. The VC Arena launched by Pieverse later received some attention, as the platform applied the mechanism of the aforementioned products to match VCs with startup teams, catering to some practical needs.

Whether it was an acknowledgment of a design concept issue, Pieverse shifted its focus and released a more financially sophisticated and engaging product, Time Challenge.

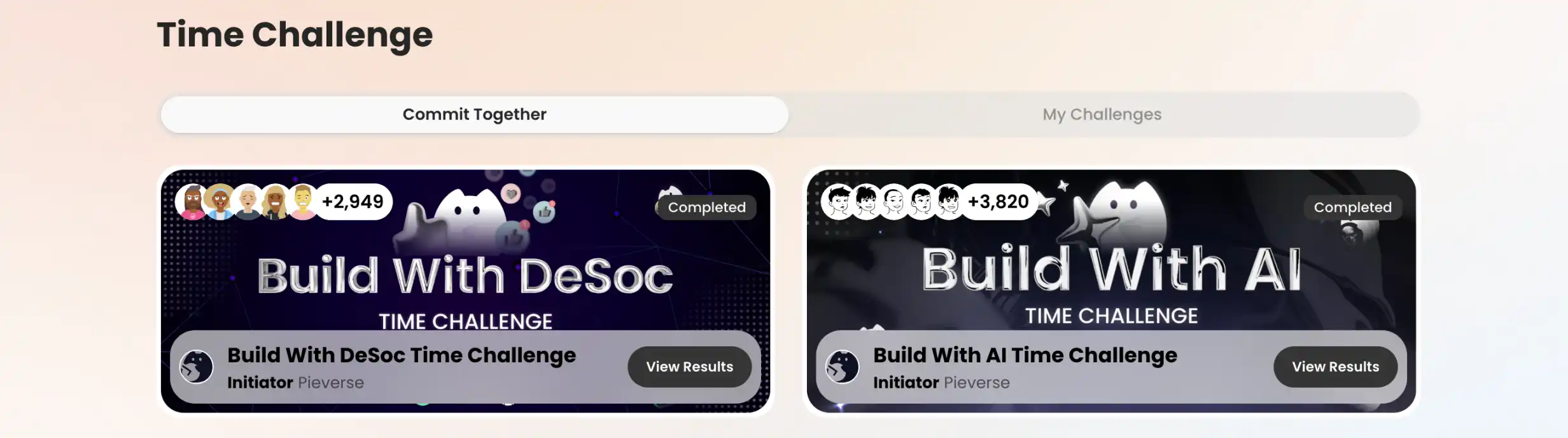

Time Challenge essentially transforms daily commitments into structured, time-limited challenges with real financial risks. Whether it's fitness goals, productivity targets, or personal milestones, users can create or join challenges, lock in risks, and receive rewards based on their evaluation of the outcomes.

The challenges are divided into two types: Prediction Challenges require participants to set their own goal and bet a certain amount; other users can also bet on whether the challenger can achieve the goal within the specified time. The ultimate winner receives the money bet by the challenger and the party that predicted incorrectly. Commit Together involves a group of people with the same goal betting the same amount on themselves to achieve the goal; the person who completes it takes the money from those who did not.

It's often said that when individual interests become collective interests, it motivates individuals. This game of inviting everyone to supervise oneself and collectively agreeing to achieve goals, when real money is put on the line, brings about an inexplicable sense of excitement, as evidenced by the number of participants. Although subsequent activities were all about Web3 projects setting challenges to see if they could accomplish certain tasks, it was indeed much more interesting than the previous scenario.

Transitioning into Payments Catches the Trend

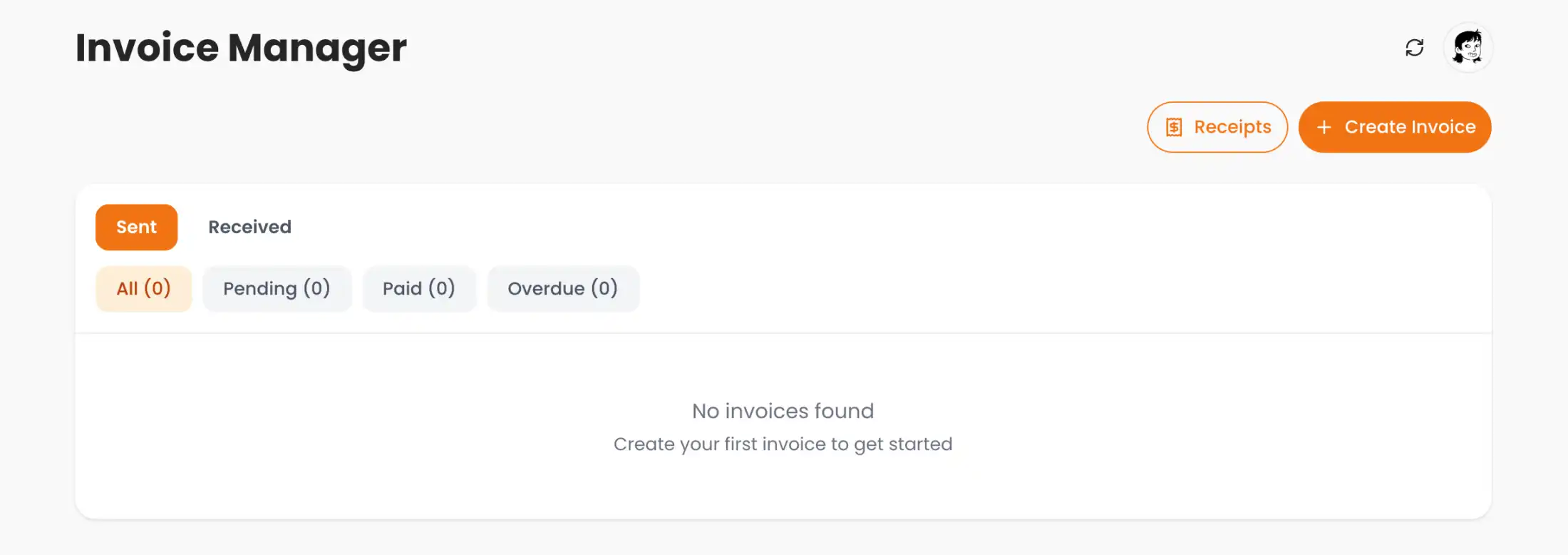

On the 9th of this month, Pieverse announced the launch of the payment tool Pieverse Timestamping. Setting it apart from most payment tools, Pieverse leveraged its previous experience related to "timeliness" to automate the process of creating invoices, stablecoin payments, generating receipts compliant with jurisdictional legal and tax requirements, and pairing each transaction with an on-chain timestamp to create an immutable, verifiable proof of payment.

At least for now, transitioning into payments seems to have been the right decision. Shortly after announcing the new product, x402 began dominating the front pages of major tech media outlets, and Pieverse conveniently utilized the freshly released Timestamping to add a verifiable component to x402 and launch it on the testnet, allowing the BNB Chain, which originally lacked token support for ERC-3009, to take a shortcut.

The transaction flow process using x402b is roughly as follows:

1. Client to Resource Server: Send an HTTP request with the X-PAYMENT header, containing the payment amount + optional compliance metadata.

2. Resource Server to Facilitator (Infrastructure service provider for "on-chain payment + validation + settlement"): Verify the signature and initiate settlement via /settle.

3. Facilitator to Blockchain: Use user-signed authorization to call transferWithAuthorization on the pieUSD contract (no need to pay Gas fees).

4. Facilitator to BNB Greenfield (optional): Generate a compliance receipt and upload it to Greenfield, ensuring the receipt is tamper-proof and auditable.

5. Facilitator back to Resource Server and then to Client: Return a standard x402 response, optionally including the Greenfield receipt URL.

In short, a single payment process includes user signature, service provider submission, BNB Greenfield proof preservation, propelling x402 on the BNB Chain forward by a significant step. It has also successfully attracted market attention before the token issuance.

Web3-Savvy Chinese Team

Currently, one of the publicly known co-founders of Pieverse is Colin Ho as mentioned in the funding press release, but further information is not available. However, three individuals on LinkedIn associated with Pieverse have demonstrated a strong Web3 Native background.

Chief Marketing Officer David Chung previously worked on user experience and copy content at the American Bitcoin peer-to-peer trading platform Paxful. An individual self-proclaimed as a "core contributor," H Fran, had prior investment experience at IDG Capital and later founded a startup that was acquired by Alibaba. Another co-founder, Junjia He (most likely the tech lead), worked as a software engineer at Uber and later joined QuarkChain in 2018, where, in addition to researching blockchain scaling through sharding, led various DeFi projects including stablecoins, DEX, and lending markets.

In April this year, Pieverse was selected for the ninth season of the Most Valuable Builder (MVB) on the BNB Chain, and just last week, Pieverse announced the completion of a $7 million strategic funding round led by Animoca Brands and UOB Ventures, with participation from 10K Ventures, Signum Capital, Morningstar Ventures, Serafund, Undefined Labs, and Sonic Foundation, among others.

From being called up by the BNB ecosystem to transitioning to payments, then fundraising and helping the BNB Chain support x402, Pieverse has been keeping up with the pace. If the market hype around AI payments and x402 continues for a while, then Pieverse may once again be in a hurry to list its token.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.