Bitcoin Updates Today: Are Bitcoin Repurchases a Risky Bet or a Brilliant Business Move?

- Metaplanet Inc. launched a $500M share buyback using Bitcoin-collateralized loans to close its stock price gap with $3.5B BTC holdings. - The 13.13% buyback aims to boost Bitcoin yield per share and restore investor confidence amid mNAV rebound to 1.03. - Critics warn Bitcoin-backed buybacks risk asset sales during price drops, while the strategy mirrors corporate crypto trends leveraging digital assets for capital optimization. - Shares rose 2.3% post-announcement, but sector remains polarized between b

Metaplanet Inc., recognized as Japan’s largest publicly traded

The credit line, backed by the company’s Bitcoin holdings, gives Metaplanet flexibility to finance share buybacks, acquire more BTC, or provide interim funding for an upcoming preferred stock offering, according to a

This move highlights the increasing trend of companies treating Bitcoin as a central tool for capital allocation. By leveraging crypto assets to fund buybacks, Metaplanet aims to decrease the number of shares in circulation and boost each share’s exposure to Bitcoin—a tactic that can lead to outperformance during Bitcoin bull runs but also heighten losses in downturns, according to a

Despite recent market swings caused by geopolitical and regulatory factors, the company’s long-term objective to accumulate 210,000 BTC (representing 1% of the total 21 million supply) by 2027 remains intact, according to

Following the announcement, Metaplanet’s share price climbed 2.3%, reflecting investor optimism that the buyback could reduce the equity discount and improve capital efficiency, as reported by Coinpedia. Still, the broader corporate Bitcoin landscape remains divided. While firms like Strategy and

The success of Metaplanet’s approach will depend on its ability to manage Bitcoin’s price volatility, use leverage responsibly, and comply with regulations. With a $500 million credit facility and a year-long authorization period, the company is set to test whether corporate crypto treasuries can serve as a stable asset class or remain a high-risk momentum play, as discussed by CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sei (SEI) To Dip Further? This Key Fractal Setup Suggest Potential Downside Move!

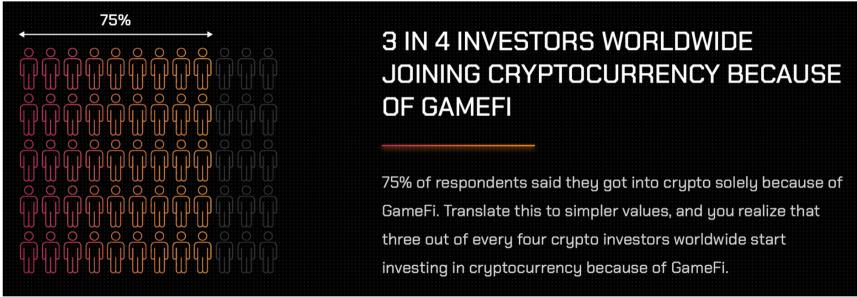

GameFi或將在加密市場下一輪週期中扮演關鍵角色

Trump Family Profits from ‘Crypto Capital’ Push as Conflicts Mount

Bitcoin steady at $86,650; Trump says new Fed Chair will cut rates by 'a lot'