Is Bitcoin Outgrowing Its 4-Year Cycle? 2026 Could Mark a Turning Point

Bitcoin’s price cycles appear to be shifting as institutional capital and global liquidity replace halvings as key market drivers, with analysts expecting the bull phase to continue into 2026.

According to Bitcoin’s traditional four-year cycle, 2026 could mark the onset of a bear market for the world’s largest cryptocurrency. However, many analysts suggest that this familiar pattern may no longer apply in today’s market.

This shift reflects a market now influenced more by institutional capital and global liquidity than by protocol events. This maturation may redefine Bitcoin’s trajectory through 2026.

Bitcoin Outlook 2026: Beyond the 4-Year Cycle Pattern

In a recent post on X, veteran trader Bob Loukas observed that the current Bitcoin cycle differs from previous ones. He cautioned investors against rigid expectations, noting that a continued advance into the first or even second quarter of next year would still fall within the cycle’s normal bounds.

“This 4 yr cycle has been different to the priors, in many ways. And has a different class of participants. Therefore, we shouldn’t be too absolute in expectations. We need to give it room within the bounds of the cycle. As in, a move to a Q1 or even Q2. Well within the range of the cycle that affords room for the normal bear phase. 6-8 months would suffice,” Loukas wrote.

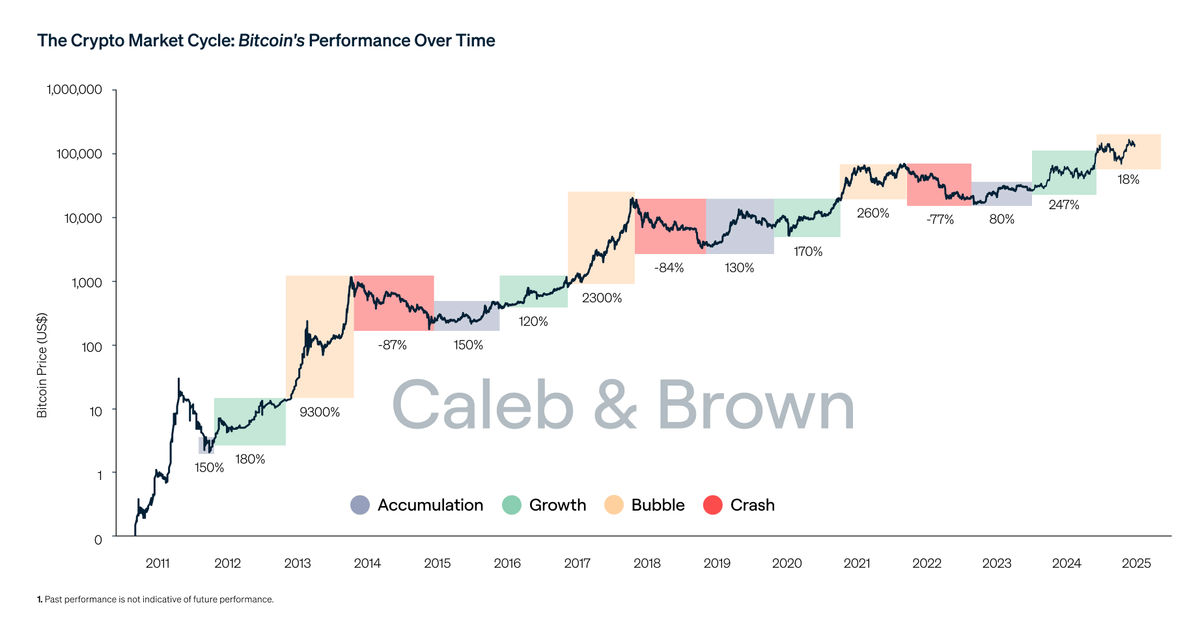

Nonetheless, other market watchers believe that BTC now follows a 5-year cycle instead of a 4-year one. In a detailed post, an analyst highlighted that for over a decade, Bitcoin’s price followed a clear pattern connected to its four-year halving events.

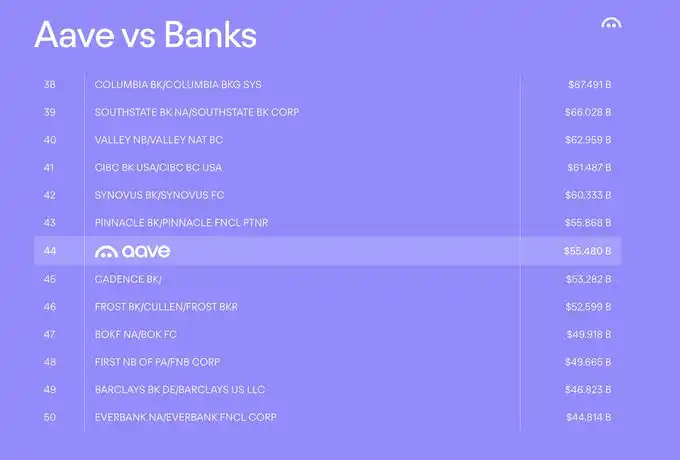

Each cycle delivered massive percentage gains, 9,300% in 2013, 2,300% in 2017, and 260% in 2021, followed by corrections of around 80%. However, data now shows this familiar structure is changing.

Bitcoin’s Market Cycles: Source:

X/BullTheoryio

Bitcoin’s Market Cycles: Source:

X/BullTheoryio

The analyst observed that the post-2024 halving phase has produced only an 18% gain so far. This is a notable shift from previous periods. It indicates that Bitcoin is no longer following a fast halving-driven rhythm.

Instead, it’s now reflecting slower global liquidity dynamics and institutional accumulation, with the bull phase likely extending through the first half of 2026.

“Bitcoin has shifted from a 4-year to a 5-year cycle, with the next peak expected around Q2 2026. This is due to a deeper structural shift in the global economy, governments are rolling over debt for longer periods, business cycles are stretching out, and liquidity waves now moving through the system more slowly,” the post read.

Other market watchers also agree that Bitcoin’s price moves are better explained by global liquidity cycles than halvings alone. A pseudonymous analyst, Master of Crypto, argued that halvings once mattered when Bitcoin was small and speculative, but today — as a $2.5 trillion asset — they have little real impact. The key driver now is global liquidity, not block rewards.

When money supply (M2) expands, liquidity flows into risk assets like Bitcoin, lifting its price. Conversely, when liquidity tightens, Bitcoin slows down. This pattern, he notes, held true in 2020, 2022, and 2023.

“That’s why 2025–2026 still look bullish. Global liquidity is rising once more. Japan, China, and the U.S. are all adding money in their own ways. Bitcoin will soak up a big part of those inflows. BTC in 2025 isn’t the same as BTC in 2013. It’s no longer just a retail-driven cycle play,” the analyst claimed.

Bitcoin’s Movements Driven By Global Liquidity. Source:

X/MasterCryptoHq

Bitcoin’s Movements Driven By Global Liquidity. Source:

X/MasterCryptoHq

So, it’s clear that Bitcoin’s market behavior is changing. While halvings still hold psychological significance, their direct impact on price appears to be diminishing. The cryptocurrency’s movements are now intertwined with global liquidity trends, institutional participation, and macroeconomic policy shifts.

As capital cycles stretch and liquidity waves move more slowly, Bitcoin’s next major peak — expected by some around mid-2026 — may confirm that the era of predictable four-year cycles is coming to an end.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Remarkable Surge: Bitcoin Lightning Network Capacity Hits Highest Level in Over a Year

Crypto lawyer: The SAFE crypto bill will make scammers tremble.

Aave founder outlines key focuses for 2026: Aave V4, Horizon, and mobile platforms