Key Market Insights for October 29th, how much did you miss?

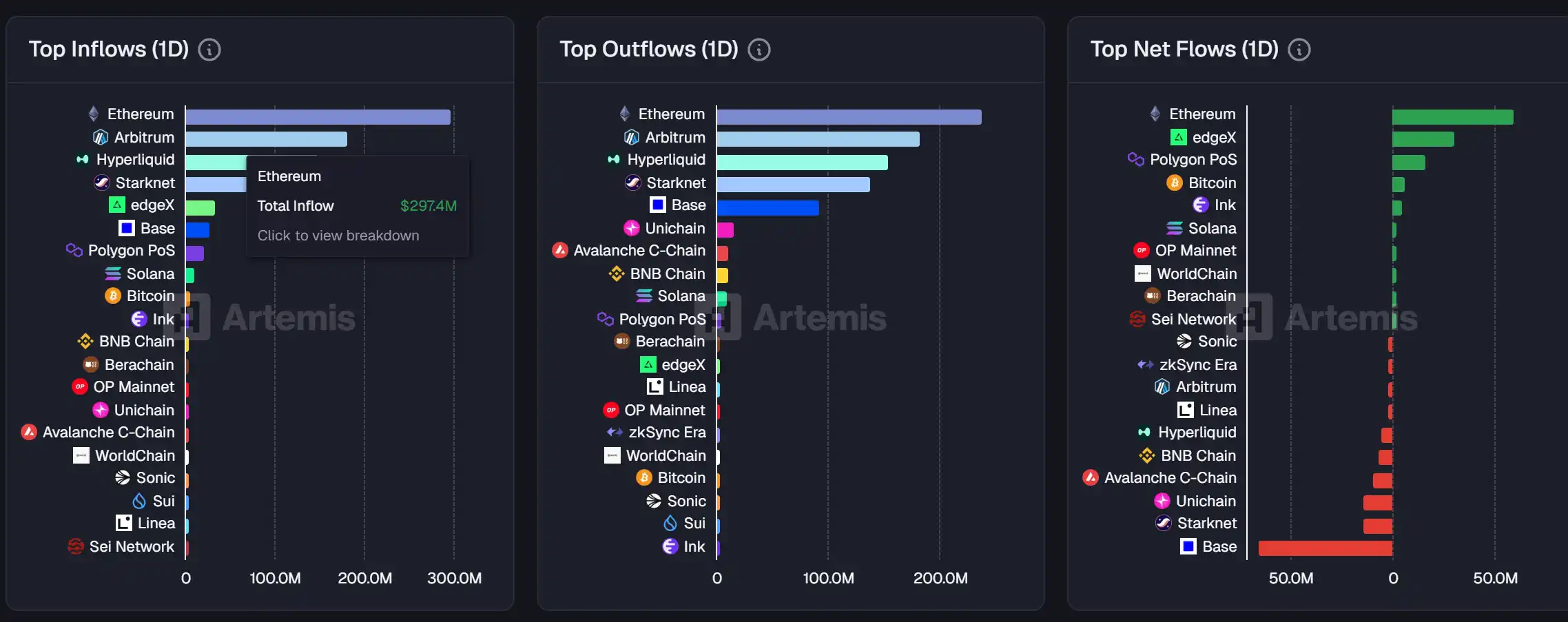

1. On-chain Fund Flow: $59.2M inflow to Ethereum today; $65.1M outflow from Base 2. Largest Price Swings: $FACY, $VULT 3. Top News: Zhihu x Ludong jointly hosted a roundtable on "Stablecoin Transparency" today, with a total view count of 25 million

Top News

1. Zhihu x Eudemonia Co-hosted Roundtable on "Penetrating Stablecoins" is now online today, with a total views of 25 million

2. MegaETH's public sale has raised over $700 million, with an oversubscription of 14.2 times

3. A total of $376 million has been liquidated across the network in the past 12 hours, with long positions being the main liquidations

4. FLM surged over 30% briefly and then retraced, with a market cap currently at $11 million

5. Users with at least 240 points in Binance Alpha can claim 2,688 BOS airdropped tokens

Featured Articles

1. "Chillhouse Leading Alone: The Past and Present of "Web3 Fun People""

The long-lost Solana meme hasn't been as lively for a long time, and it's happening in a way we can hardly imagine—a Solana meme coin "abstraction" involving Jesse Pollak, Base Protocol's lead, well-known crypto KOL Cobie, Solana's founder Toly, and pump.fun's founder alon. Especially with the addition of the Base camp, there is a sense of "breaking the taboo barrier." In the current environment where each chain is enthusiastically competing with each other, it is beyond players' expectations.

2. "The Best Market Performance in the Last Two Months of the Year? Is it Time to Surge or Retreat?"

As October draws to a close, the cryptocurrency market seems to be showing some signs of an uptrend. Over the past two months, "caution" has almost become the theme of the cryptocurrency market, especially after experiencing the 10/11 crash. The impact of this major drop is gradually fading, and market sentiment seems not to have further deteriorated but instead gained new hope. Starting from the latter part of the month, some signals of an uptrend have gradually emerged: positive net inflow data, approval of a batch of altcoin ETFs, and increasing rate cut expectations.

On-chain Data

Chain data for the week of October 28th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Fed's Interest Rate Reduction Triggers Caution While Bitcoin Teeters on the Edge

- Fed's 25-basis-point rate cut stabilized Bitcoin above $108,000 despite $550M liquidations, with traders adopting defensive positions ahead of policy statements. - Zcash surged 14.8% to $6.22B market cap, surpassing Shiba Inu and Monero, driven by privacy-focused interest and Solana integration plans. - Ethereum's ZKSync Atlas upgrade targets 15,000 TPS and $0 fees, aiming to enhance layer-2 programmability and network efficiency through security audits. - BlockDAG raised $434M in presale with 1,400 TPS

Privacy Takes the Throne: Zcash Overtakes Monero with a $6.2 Billion Market Value

- Zcash (ZEC) surged 16% to $435, hitting an eight-year high with a $6.2B market cap, surpassing Monero and Shiba Inu. - High-profile endorsements from Arthur Hayes and Mert Mumtaz, plus Grayscale's $151.6M Zcash Trust, fueled retail and institutional demand. - Privacy-focused zk-SNARKs and the Orchard protocol drove 30% shielded supply adoption, aligning with global regulatory debates over digital surveillance. - Upcoming November halving and $10,000 price predictions contrast with risks of retracement be

Making AAA Web3 Gaming Accessible to All: Aethir and SACHI Eliminate Hardware Limitations

- Aethir and SACHI integrate GPU cloud tech into SACHI’s Unreal Engine 5 platform, enabling instant, high-fidelity Web3 gaming across devices without hardware constraints. - Leveraging Aethir’s 400,000+ GPU containers, the partnership removes high-end hardware and download barriers, democratizing AAA-quality blockchain gaming access. - The collaboration addresses scalability and security challenges in blockchain gaming, aligning with growing demand for decentralized, cloud-based solutions. - Aethir’s CEO e

Hyperliquid News Today: SEC Decisions Open Doors for Altcoin ETFs, Institutional Demand Rises

- SEC 2025 staking rulings enabled altcoin ETFs like 21Shares' HYPE and Bitwise's BSOL, unlocking institutional crypto access. - BSOL's $55.4M Nasdaq debut with 7% staking yields highlighted Solana's institutional appeal amid $223M AUM. - BNB Chain surpassed TRON in DEX volume (47%) via zero-fee trading, while HYPE's $12.7B cap signaled altcoin diversification. - Ethereum ETFs saw $9.6B Q3 inflows as regulatory clarity and custody solutions drive crypto-mainstream integration.