Political Connections Drive $1.2 Million Airdrop, Boosting Trump-Associated Stablecoin to $2.9 Billion Valuation

- World Liberty Financial, a Trump-aligned crypto project, airdropped $1.2M in WLFI tokens to USD1 stablecoin users, boosting USD1 to $2.94B market cap. - The airdrop incentivized trading activity exceeding $500M, with tokens distributed across six exchanges via customized eligibility rules. - WLFI's 13% recent price rebound followed Trump's pardon of Binance's CZ, while USD1 gained institutional traction via a $2B Abu Dhabi investment. - Plans include DeFi integrations, real-world asset tokenizations, and

World Liberty Financial, a crypto initiative associated with U.S. President Donald

The token distribution will take place on six centralized exchanges—Gate.io, KuCoin, LBank, HTX Global, Flipster, and MEXC—with each exchange determining its own requirements and schedule, as noted by

Currently priced at $0.14, the WLFI token has experienced volatility, dropping nearly 70% from its September high of $0.46 but climbing 13% in recent sessions as political and market interest revived, Coinpedia reported. Analysts linked the recent price increase to Trump’s pardon of Binance’s Changpeng Zhao (CZ), which boosted confidence in crypto assets tied to Trump, Coinpedia said. The token’s 24-hour trading volume also jumped 170% to $437 million, showing strong demand from both retail and institutional investors, Coinpedia added.

World Liberty’s USD1 stablecoin, fully backed by the U.S. dollar and held by BitGo, has attracted institutional interest. Earlier this year, Abu Dhabi’s MGX firm used USD1 to complete a $2 billion investment in Binance, marking a major step in institutional adoption, Cointelegraph reported. Despite questions about its reserve attestations, the project is expanding its ecosystem, with plans to tokenize assets and connect with DeFi protocols, Crypto.news reported.

This airdrop highlights World Liberty’s approach of encouraging stablecoin use through loyalty rewards. Community members have praised the move for focusing on “genuine users rather than hype,” pointing to the USD1 Points Program’s achievement of $500 million in volume in just two months, Coinpedia reported. The company also revealed a token buyback and burn strategy to further enhance WLFI’s value, according to

Although the Trump-affiliated project faces both regulatory and market headwinds, its swift expansion mirrors larger trends in crypto adoption and the growing political impact on digital assets. With USD1’s market cap exceeding $2.9 billion and WLFI’s increasing utility, World Liberty is positioned to remain a significant force in the stablecoin and governance token sector, according to

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Market Cap Surge Threatens Ethereum’s ‘Main Altcoin’ Status in 2026

XRP Price Prediction: Short-Term Momentum Improves While Downtrend Remains Intact

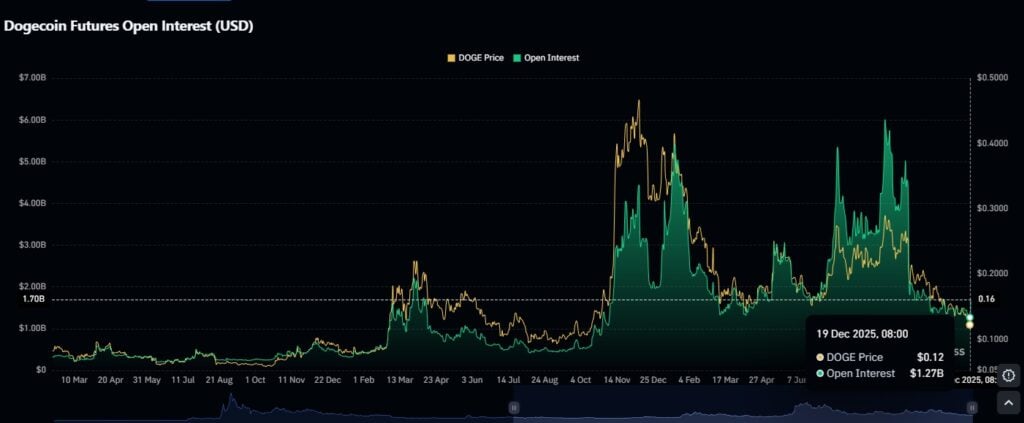

Best Meme Coins to Buy – AIC, DOGE, PEPENODE, SHIB, PEPE

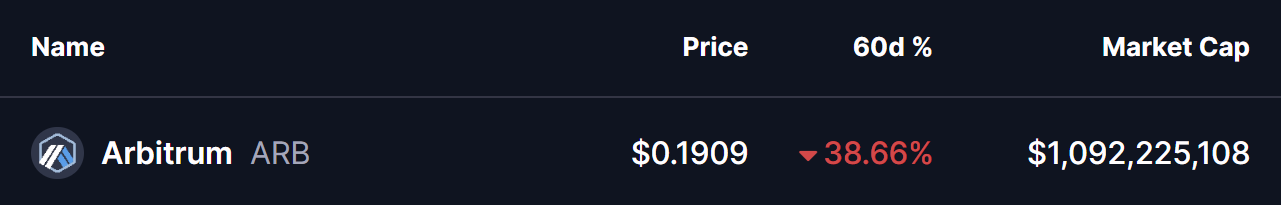

Arbitrum (ARB) Flashes Potential Reversal Setup – Will It Rise Higher?