Cardano News Update: ADA Faces Crucial $0.63 Threshold—Bulls Eye $1.70 While Bears Remain Watchful

- Cardano (ADA) tests $0.63 support, with analysts predicting a potential rebound to $0.85 and $1.70 if held. - Institutional accumulation and x402 payment integration signal growing confidence in ADA's long-term utility and infrastructure goals. - A breakdown below $0.63 risks a decline to $0.50, while declining trading volume and cautious positioning highlight volatility risks ahead of a potential breakout.

Cardano (ADA) has drawn significant attention in the crypto space as both analysts and traders keep a close eye on its price movement near the crucial $0.63 support. According to a

The price chart has developed a symmetrical triangle formation, a well-known technical sign of consolidation that often comes before a major price move. This structure, present since early 2025, signals reduced volatility and growing buying interest at the $0.63 mark, as highlighted in the Coinotag analysis. Analysts such as Ali Charts point out that if ADA can stay above this support, it would confirm the bullish outlook of the triangle, with resistance first appearing at $0.736 and a potential target of $1.70 should the breakout occur, as noted in the CryptoFront report. Past trends show that 70% of similar patterns on

Large investors and institutions are adding to the positive sentiment. While some

Still, the journey to $1.70 comes with challenges. If ADA drops below $0.63, it could fall toward $0.50, which would invalidate the bullish triangle scenario outlined in the Coinotag analysis. Traders are also cautious due to a 38% drop in trading volume to $448 million, suggesting a wait-and-see approach before any major price swings, as the Coinotag article points out. Conversely, on-chain data such as a 5% monthly increase in wallet addresses indicates growing long-term adoption, another highlight from the Coinotag piece.

Regulatory and institutional developments could further strengthen ADA’s outlook. Cardano’s addition to Grayscale’s Digital Large Cap Fund (GDLC) on the NYSE has already led to a 1.75% price jump within a day, according to a

As ADA nears important resistance levels, the market remains split. Some expect a short-term climb to the $0.70–$0.80 range, while others caution that losing the $0.63 support could trigger further declines, a sentiment echoed in the BTCC write-up. The next few weeks will be pivotal for ADA, with technical experts urging investors to watch trading volume and on-chain trends for signs of a breakout. For now, the $0.63 support stands as a crucial threshold for Cardano’s outlook in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Market Cap Surge Threatens Ethereum’s ‘Main Altcoin’ Status in 2026

XRP Price Prediction: Short-Term Momentum Improves While Downtrend Remains Intact

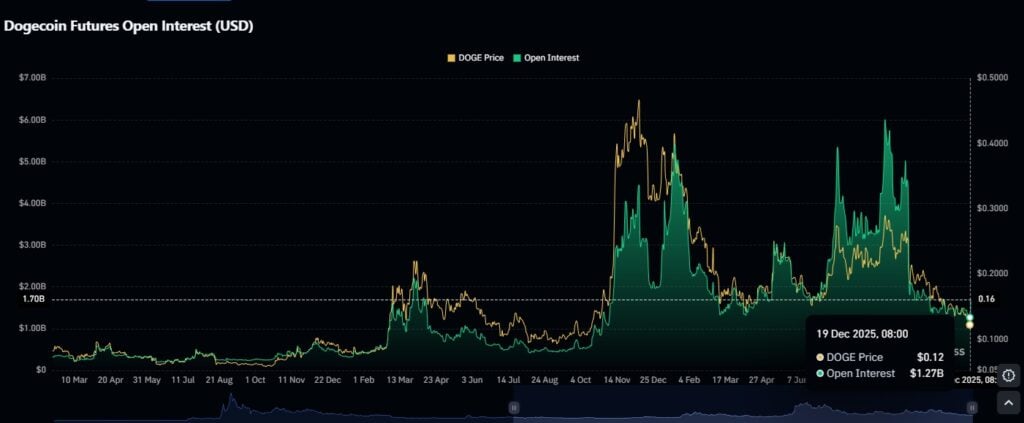

Best Meme Coins to Buy – AIC, DOGE, PEPENODE, SHIB, PEPE

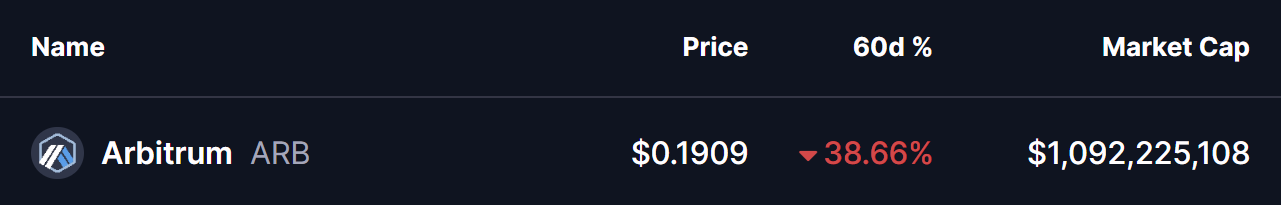

Arbitrum (ARB) Flashes Potential Reversal Setup – Will It Rise Higher?