Falcon Finance, Backed Finance Partner to Turn Tokenized Stocks Into Yield-Bearing Assets

Quick Breakdown

- Falcon Finance and Backed Finance integrate tokenized stocks into DeFi, enabling real-world equities to generate onchain yield.

- Users can now mint Falcon’s synthetic dollar, USDf, using xStocks like Tesla and Nvidia as collateral.

- The partnership bridges traditional finance with blockchain-based liquidity, advancing compliant tokenized asset adoption.

Falcon Finance has announced a partnership with Swiss-based Backed Finance to integrate tokenized equities, known as xStocks, into its collateral framework marking the first time real-world stocks are being used to generate onchain yield in DeFi

We’ve partnered with @BackedFi to integrate @xStocksFi (TSLAx, NVDAx, MSTRx, CRCLx, SPYx) as collateral for minting USDf, turning tokenized stocks into productive, yield-bearing assets.

xStocks are fully backed by the underlying equities held with regulated custodians. Unlike… pic.twitter.com/k08MfEQibf

— Falcon Finance 🦅🟠 (@FalconStable) October 28, 2025

Tokenized stocks enter the DeFi collateral space

Through this integration, Falcon users can now mint USDf, Falcon’s overcollateralized synthetic dollar, using compliant tokenized equities such as TSLAx, NVDAx, MSTRx, SPYx, and CRCLx. Unlike synthetic assets, xStocks are fully backed by real shares held by regulated custodians, ensuring both transparency and compliance.

This innovation allows traders to maintain exposure to major equities like Tesla and Nvidia while simultaneously unlocking stable, yield-generating liquidity. By bridging tokenized assets with Falcon’s liquidity protocol, the initiative transforms passive real-world assets into productive instruments within the DeFi ecosystem.

Building a bridge between TradFi and DeFi

Falcon’s integration of xStocks represents a key milestone in the growing intersection between traditional finance and blockchain infrastructure. Chainlink oracles will monitor pricing and corporate actions, ensuring real-time accuracy and transparency.

According to Falcon’s founding partner Andrei Grachev, the move strengthens the company’s position as a “universal collateralization platform,” expanding access to stable liquidity beyond crypto-native assets. David Henderson, Head of Growth at Backed, added that the collaboration demonstrates how “tokenized equities can evolve beyond static stores of value into dynamic financial building blocks.”

Falcon Finance’s synthetic dollar, USDf, currently boasts over $2.1 billion in circulation, backed by $2.25 billion in reserves verified through regular audits. The partnership signals a broader shift toward compliant onchain finance, linking regulated equity markets with DeFi’s open, composable infrastructure.

Meanwhile, in April, Falcon Finance announced the integration of its yield-bearing stablecoin, $sUSDf, into Pendle’s DeFi platform, opening up new opportunities for users to generate stable on-chain yields. Designed to generate consistent returns, $sUSDf offers over 14% annual percentage yield (APY) to users who stake $USDf.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pepe Coin price eyes 30% dip as whales start capitulating

Solana Stabilizes Near $128 as Support at $124 and Resistance at $134 Define Trading Range

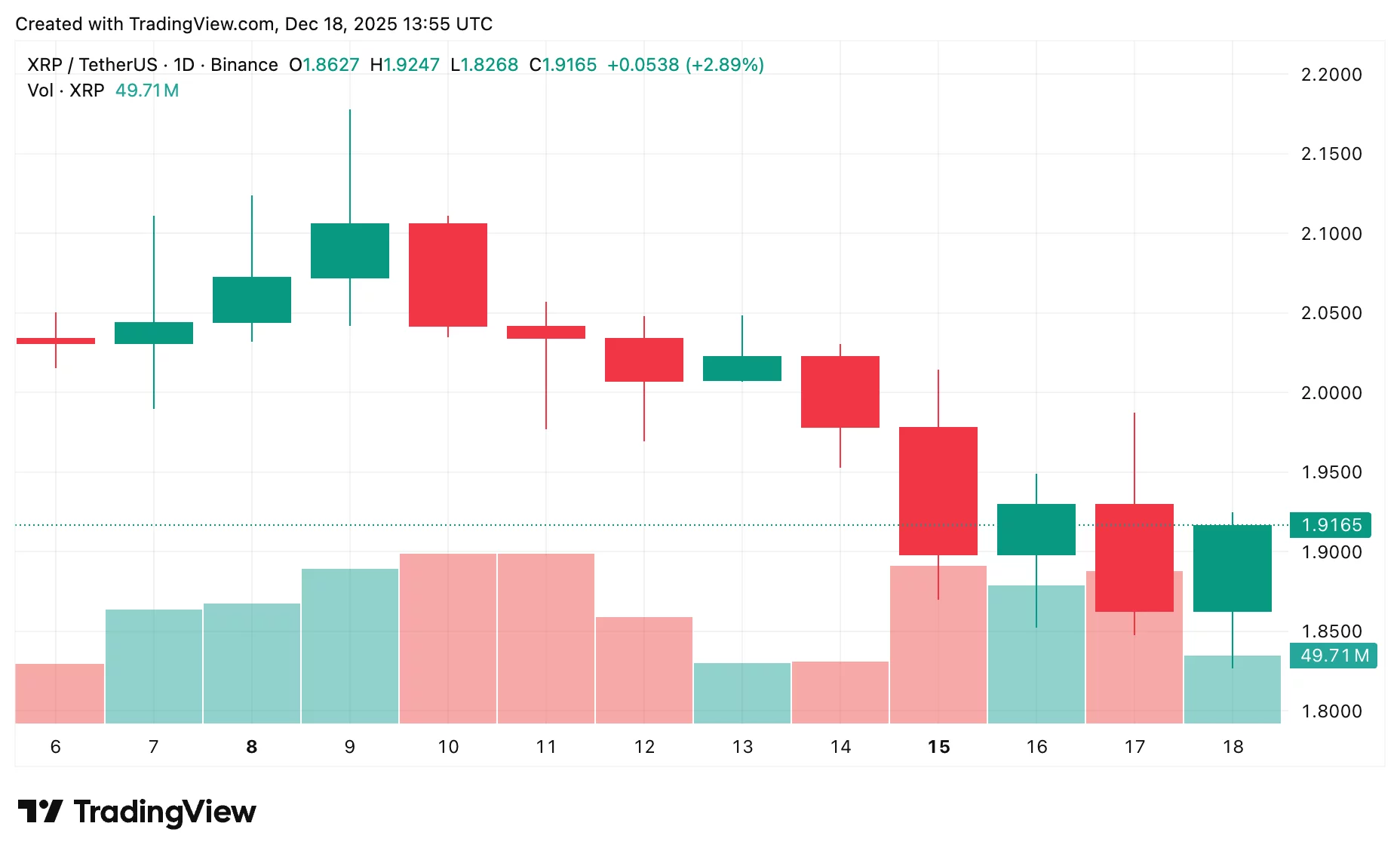

XRP price prediction: Will Ripple break $2 or slide lower?

XRP Faith Hits New Highs as Long-Term Holders Talk of a Historic Endgame