October 30th Key Market Information Gap, A Must-See! | Alpha Morning Report

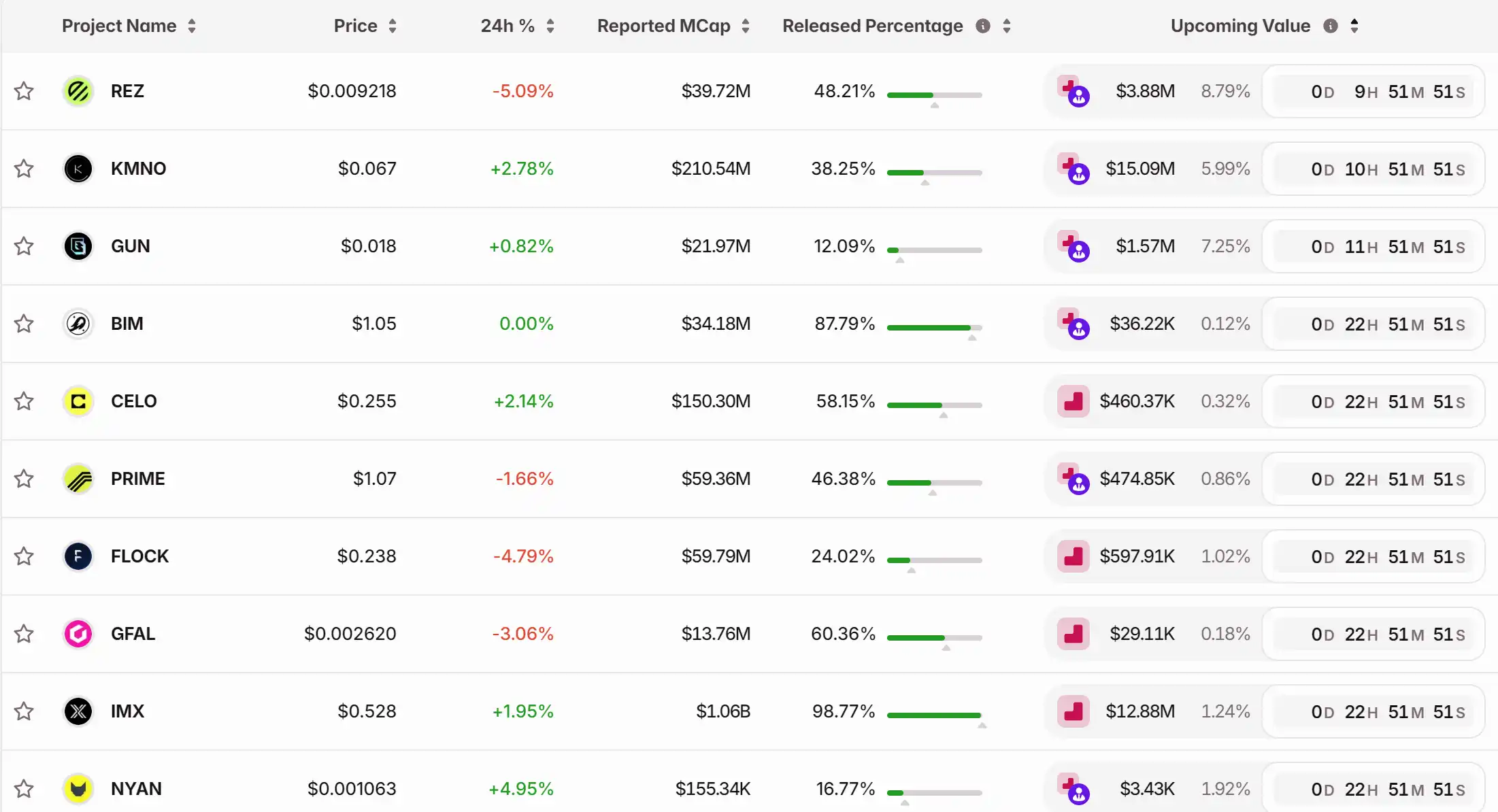

1. Top News: Powell's Hawkish Remarks, Bitcoin Drops Below $110,000, Ethereum Below $3,900 2. Token Unlock: $REZ, $KMNO, $GUN, $BIM, $CELO, $PRIME, $FLOCK, $GFAL

Top News

1. Powell's Hawkish Remarks Lead to Bitcoin Breaking Below $110K, Ethereum Below $3900

2. OpenAI Aims to Go Public in 2027 with Valuation Potentially Reaching $1 Trillion

3. BNB Expected to Cap Total Supply at 1 Billion, Current Circulating Supply Around 137 Million

4. MetaMask's Parent Company ConsenSys Hires JPMorgan and Goldman Sachs to Lead Its IPO

5. Cryptocurrency-Related Stocks See Mixed Performance After U.S. Market Open, Nasdaq Hits New Record High

Articles & Threads

1. "Chillhouse Leads the Rise Alone, The Past and Present of "Web3 Fun People""

The long-silent Solana meme hasn't been this lively in a long time, and it's happening in a way we can hardly imagine — Base Protocol's Jesse Pollak, renowned crypto influencer Cobie, Solana founder Toly, and pump.fun founder alon are "abstracting" each other over a Solana meme coin. Especially with the addition of the Base camp, there is a sense of "breaking the taboo" itself, and in the current environment where various chains are working vigorously to compete with each other, it has taken players by surprise.

2. "Best Market Performance in the Last Two Months of the Year? Should You Go All-In Now or Run?"

As October comes to a close, the crypto market seems to be showing some signs of an uptrend. Over the past two months, "caution" has almost become the theme of the crypto market, especially after experiencing the 10/11 crash. The impact of this major drop is slowly fading, and market sentiment does not seem to be deteriorating further but instead has found new hope. Starting from the latter part of the month, some signals of an uptrend have gradually emerged: net inflow data turning positive, altcoin ETF approvals in batches, and increased rate cut expectations.

Market Data

Daily Market Overall Fund Heat (reflected based on funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: MoonBull’s Innovative Approach Blends Meme Popularity with Governance Functionality

- MoonBull ($MOBU) presale raises $500K+ with 9,256% ROI potential if listing price hits $0.00616, outpacing BNB/SOL declines. - Community-driven mechanics include 15% referral bonuses, USDC rewards, and governance rights from Stage 12, blending meme virality with utility. - 23-stage presale (27.4% price hikes per stage) creates scarcity, contrasting with TON/LINK's stable but slower growth trajectories. - Audited contracts, locked liquidity, and 95% APY staking aim to mitigate meme coin risks while aligni

XRP News Today: Transforming Emergency Relief: Blockchain Reduces Wait Times and Enhances Transparency

- Ripple partners with WCK, Water.org, and Mercy Corps to use blockchain for faster, transparent humanitarian aid via RLUSD stablecoin. - WCK accelerates crisis zone fund disbursements from hours vs. days, while Water.org expands Latin American water access through Ripple's platform. - RLUSD's $900M+ market cap highlights institutional adoption, enabling real-time cross-border aid without traditional banking delays. - Mercy Corps and GiveDirectly test blockchain for emergency cash transfers, addressing tim

Bitcoin Updates: MicroStrategy Steers Clear of Bitcoin Mergers While Competitors Drive Treasury Accumulation

- MicroStrategy's Saylor rejects Bitcoin M&A due to uncertainties, focusing on core strategies. - Competitors like Strive merge to consolidate holdings, contrasting MicroStrategy's approach. - S&P downgrades MicroStrategy to junk rating, citing Bitcoin exposure and liquidity risks. - Saylor predicts Bitcoin could reach $150k by 2025, citing market maturity and regulatory progress. - Industry trends show diverging strategies between consolidation and disciplined Bitcoin accumulation.

Chainlink and Ondo Transform Capital Markets Through Cross-Chain Institutional Solutions

- Ondo Finance partners with Chainlink to provide institutional-grade tokenized stocks/ETFs via CCIP cross-chain protocol. - Integration delivers real-time pricing data for 100+ assets across 10 blockchains, enhancing transparency for institutional investors. - BNB Chain expansion and Global Market Alliance membership broaden access to U.S. equities for global investors. - Partnership accelerates tokenized RWA adoption, with $320M TVL and collaborations with Euroclear/DTCC modernizing market infrastructure.