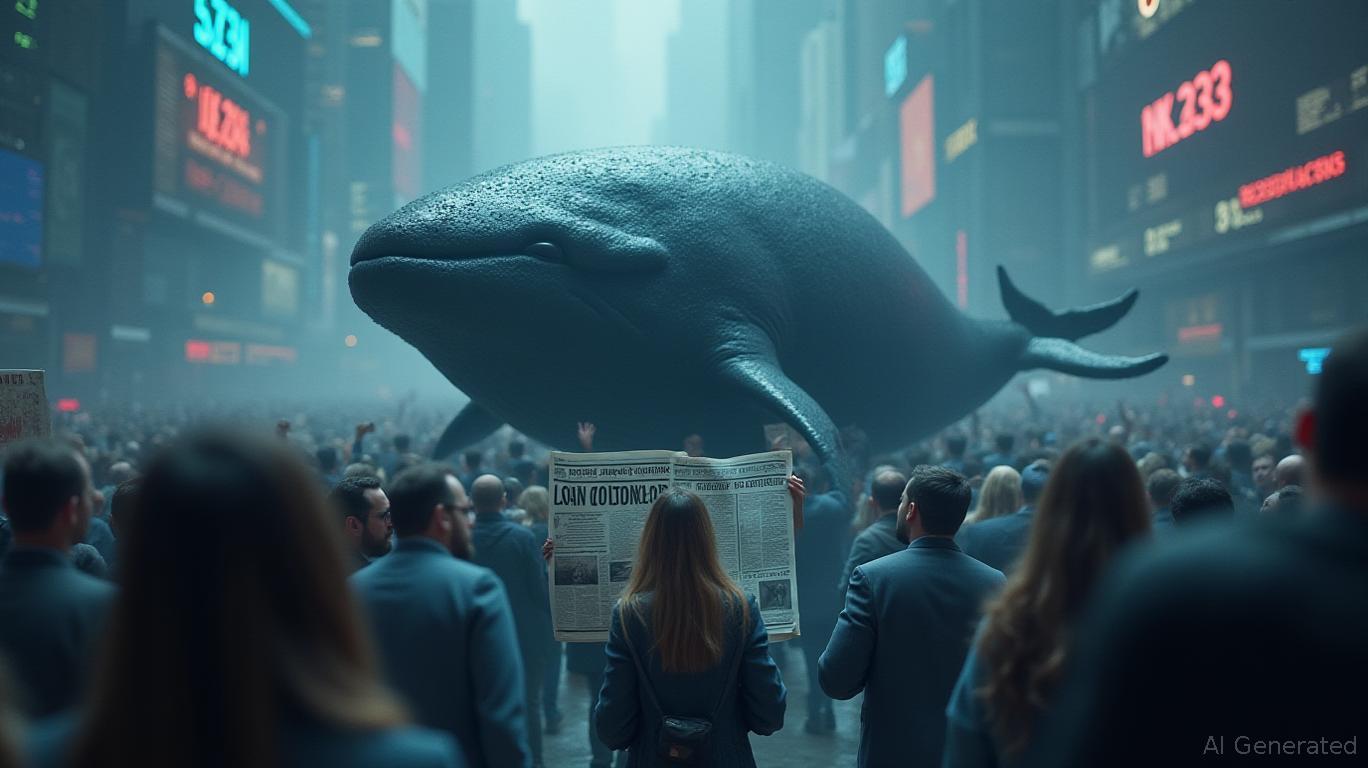

Crypto’s Ideal Whale: Absorb a $7M Deficit or Weather the Turbulence?

- A top crypto whale with 100% historical trade success now faces $7M in losses amid market shifts. - Analysts link the downturn to macroeconomic pressures, regulatory risks, and reduced speculative trading. - The whale's position volatility highlights risks even seasoned traders face in crypto's unpredictable market. - Market observers watch whether this whale will adjust strategies, potentially signaling broader sentiment changes.

An influential crypto whale, previously recognized for an unbroken streak of successful trades, is now facing substantial unrealized losses exceeding $7 million based on the most recent market figures, as reported by

The whale’s long-standing position, once regarded as a model for effective trading, is now being tested as market dynamics evolve. Experts point to several contributing elements, such as global economic challenges, regulatory ambiguity, and a decline in speculative trading, as noted by

Industry watchers are paying close attention to see if this well-known investor will alter their strategy or remain steadfast during the downturn. Should the whale reverse their position, it could indicate a broader change in market sentiment; holding steady, however, may strengthen belief in the long-term prospects of cryptocurrencies. This scenario highlights the difficulties that even veteran traders encounter in a market renowned for its volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Crypto Market Surges as US-China Agreement Eases Supply Chain Pressures

- U.S.-China trade deal suspends sanctions expansion and rare-earth export controls, easing global market tensions and boosting crypto markets with Bitcoin rising 1.59%. - India secures six-month sanctions waiver for Chabahar Port operations, enhancing regional trade routes while U.S.-China cooperation on blockchain/AI regulation gains momentum. - Analysts warn of fragile truce vulnerability, citing October's $200B crypto crash triggered by tariff threats, as Trump-Xi summit faces pressure to deliver concr

Bitcoin Updates: Lombard’s BTC.b Initiative Bridges DeFi Shortcomings Left by Major Centralized Players

- Lombard Finance acquires BTC.b from Ava Labs to expand Bitcoin DeFi offerings, transitioning infrastructure while retaining Avalanche integrations. - BTC.b, valued at $502M, integrates with Aave and BENQI, complementing Lombard's $1.3B LBTC token to offer yield and non-yield bitcoin assets across chains. - The $2.1T bitcoin market has less than 1% onchain activity, with BTC.b's permissionless minting and MegaETH launch aiming to bridge liquidity gaps left by centralized alternatives. - The internally neg

Bitcoin News Update: Hyperliquid Faces $21 Million Liquidation, Highlighting Dangers of Leverage in Unstable Crypto Markets

- Crypto markets saw $1.134B in 24-hour liquidations, led by BTC-USD position closures as leverage risks intensified. - Hyperliquid's $21.43M BTC liquidation highlighted platform's role in volatile trading, outpacing Bybit and Binance. - Fed Chair Powell's caution against rate cuts and Trump's fentanyl tariff deal triggered renewed crypto selling pressure. - Bitcoin's "death cross" pattern and $470M ETF outflows signal bearish momentum amid leveraged position fragility.

Human Insight Unlocks Digital Safe in $6 Million Cryptocurrency Confiscation

- Australian police seized $6M in crypto by decoding a tampered 24-word seed phrase manipulated by a suspect. - A data scientist identified human-generated numerical anomalies, revealing the original phrase to unlock the wallet. - The breakthrough followed a suspect's refusal to cooperate, enabling authorities to confiscate funds and pursue further investigations. - The case highlights Australia's intensified crypto crime focus, with recent regulatory actions and Operation Kraken's $6.1M seizures. - It und