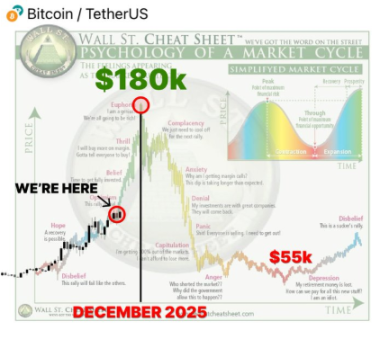

Bitcoin will start a new growth cycle in 5 days—retail investors are fearful, while institutions are quietly positioning themselves!

In the past few weeks, the crypto market has experienced a dramatic correction,

and most retail investors believe the bull market is over.

However, after I spent 18 consecutive hours analyzing on-chain and macro data,

I found that this is merely the prelude to the next super cycle.

1. Beneath the Surface of Fear Lies a Historic Opportunity

When 99% of traders are panicking, exiting, or waiting on the sidelines,

a true tidal wave is brewing in the shadows—the largest Altseason in history is about to begin.

The market is sending out multiple synchronized signals,

and whether you can understand these signals within 5 days

will determine if you can seize the next leap in wealth.

2. Signal One: Institutional Funds Are Flowing Back In

Bitcoin ETF is not just present—it is continuously absorbing billions of dollars in capital inflows.

This is not retail buying, but long-term allocation by the world’s largest funds.

Institutional capital never chases highs—

they only quietly build unshakable positions at the bottom and in chaos.

3. Signal Two: The Halving Effect Is Being Realized

The halving has already occurred, and new BTC output has dropped by half.

Sudden supply reduction + steadily growing demand = inevitable price increase.

This is the simplest and most ruthless arithmetic in the blockchain world.

All upward cycles are ultimately built on this “mathematical inevitability of scarcity.”

4. Signal Three: Political and Policy Shifts

For the first time, there is a public crypto-friendly wave in US politics.

Presidential candidates and members of Congress are supporting industry innovation and regulatory relaxation.

This means the crypto industry is receiving “top-down” institutional protection for the first time.

Capital and innovation will no longer be restricted, but will fully enter a stage of compliant growth.

5. Signal Four: L2 Ecosystem Rapidly Evolving

Arbitrum, Optimism, zkSync, Polygon and other layer 2 networks

are undergoing qualitative changes in performance, cost, and user experience.

Millions of developers and new users are flowing in,

which means the real demand of the Ethereum ecosystem is exploding, not just speculative bubbles.

6. Signal Five: Macro Environment Boosts Risk Assets

Global inflation is slowing, and the Federal Reserve is about to cut interest rates.

Historical experience tells us: every round of easing is accompanied by a surge in risk assets.

When the market seeks new high-yield channels,

cryptocurrencies will once again become the core battleground for capital competition.

7. Signal Six: Development and Innovation Have Never Stopped

Even during downturns, developers continue to build:

AI tokens, GameFi 2.0, RWA (real-world assets on-chain) and other new tracks are emerging one after another.

This shows that the underlying value of the market remains active, and the foundation for future growth is being accumulated.

Conclusion:

All macro, on-chain, and policy signals are converging to the same conclusion:

Bitcoin will start a new growth cycle within the next 5 days.

The fear of retail investors is the entry signal for institutions;

the silence of the market is the last gasp before an explosion.

You can choose to keep waiting,

or you can be that 1%—

position yourself early and rationally, and embrace the next decade’s wealth cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YouBallin: Reshaping the Reputation System of Decentralized Creator Platforms

The decentralized creator economy platform YouBallin has officially launched globally. The platform is built on the high-performance blockchain Solana, ...

Discussion on MSTR's Q3 2025 Financial Report

MSTR can purchase up to $42.1 billion worth of Bitcoin.

Fed turns hawkish? Barclays: Powell aims to "break the expectation of inevitable rate cuts," and data supports more rate cuts

Barclays believes that the market's hawkish interpretation of Powell's remarks is a misjudgment.

NEO ignites the robotics sector—what Robotic projects are worth paying attention to?

An overview of projects related to the Robotics sector.