Over 14x Surge, $15 Billion? MegaETH Valuation Speculation

While all L2s are competing for TVL, there is a project that has quietly achieved 100,000 TPS, even Vitalik Buterin has endorsed it—this is MegaETH, a disruptor claiming to build the "first real-time blockchain."

The market has already voted with real money, but what do professional analysts think?

0xResearch analysts Boccaccio & Marc Arjoon :

We believe that if you can obtain an allocation above the minimum, this could be one of the best opportunities of the year.

This auction adopts an English auction format, starting at 9:00 AM ET on October 27 and lasting for 72 hours.

Unlike traditional token sales, this English auction format allows the market to determine a fair price through competitive bidding. The system works by determining a clearing price—the lowest price point at which the total bids can fill the entire allocation of 500 million tokens.

All successful bidders pay the same clearing price regardless of their individual bid amounts, meaning that even if someone bids as high as $0.0999 per token, if the final clearing price is lower, they only pay the final clearing price.

Bidders below the clearing price will receive a full refund, while those at or above the clearing price will receive an allocation. The auction format eliminates gas fee competition and first-come-first-served advantages, creating a fairer allocation mechanism.

This sale offers 500 million MEGA tokens, accounting for 5% of the total supply of 10 billion tokens, conducted entirely on the Ethereum mainnet, using USDT as the payment method.

The auction price range is $0.0001 to $0.0999 per token, with a starting price of $0.0001, representing a fully diluted valuation (FDV) of $1 million, and a cap price of $0.0999, representing an FDV of $999 million.

Individual participants can bid a minimum of $2,650 and a maximum of $186,282, with bid increments of $0.0001. The structure includes a mandatory one-year lock-up period for US qualified investors, who can enjoy a 10% discount, while non-US participants can opt for the same lock-up conditions to receive the discount.

After the auction ends, the allocation calculation period will last from October 30 to November 5, the refund and withdrawal period will be from November 5 to November 19, and the final allocation and reallocation will take place from November 19 to November 21.

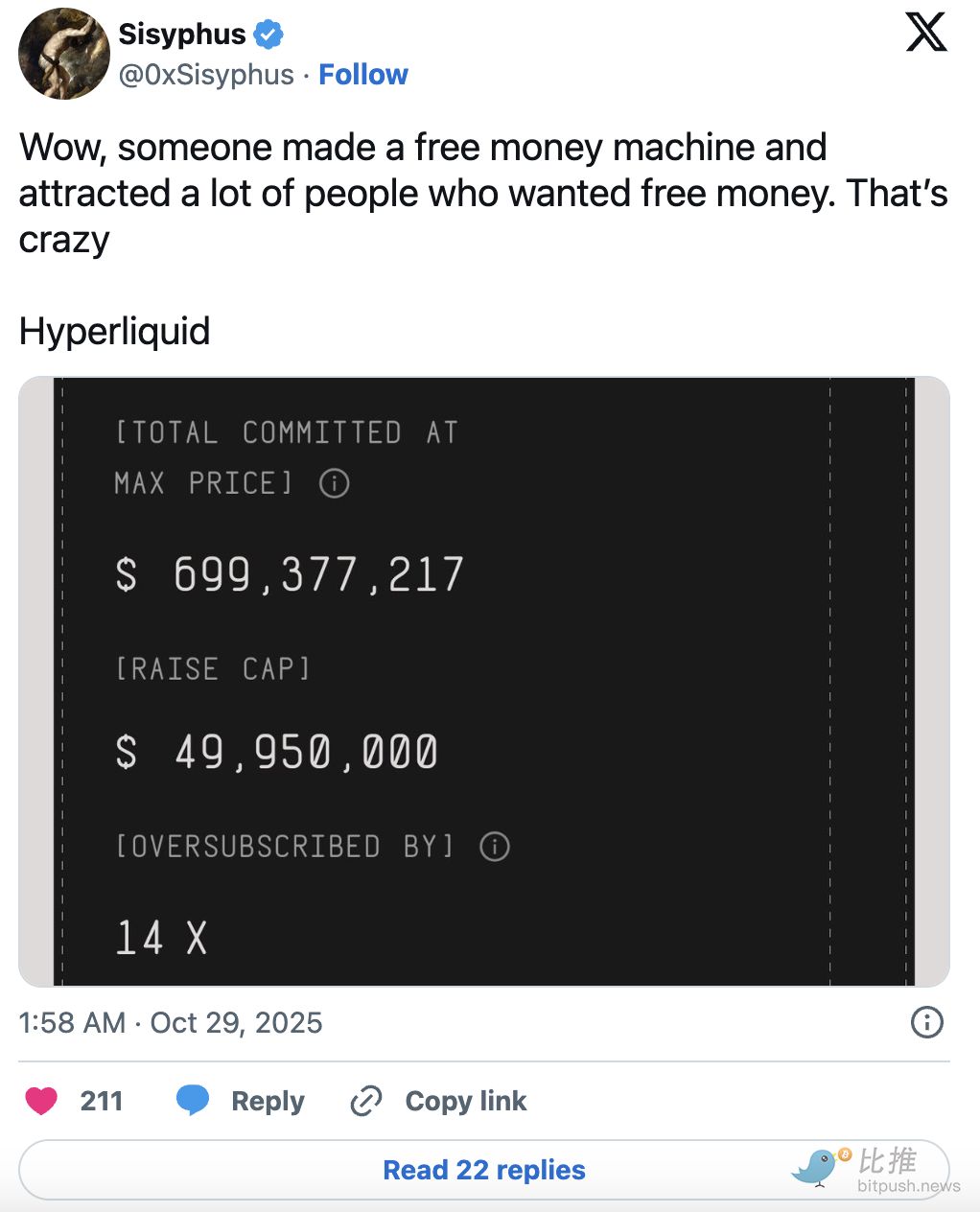

As expected, MegaETH's public sale has been extremely successful so far, with oversubscription reaching 14 times as of now. With the final day approaching, this number may only increase further, as most deposits/bids are expected to flood in during the last few hours.

After all, if someone gives you a free money-making machine, the only correct action is to deposit as much as possible.

Currently, MegaETH is trading at a $4.5 billion FDV valuation in the pre-market (on Hyperliquid), allowing depositors to achieve a 4.5x return. The main issue is that any depositor may only be able to achieve a 4.5x return on the minimum bid amount ($2,650). The MegaETH team has publicly disclosed the factors affecting allocation, mainly including past wallet interactions, social media influence, and some new "social credit" platforms (such as Ethos).

As with any situation involving a free money-making machine, we have already seen a large amount of Sybil activity. If the minimum bid is $2,650 and you have 450 Echo/Sonar accounts, you can make more money and have a higher chance of profiting than savvy crypto enthusiasts with good social and DeFi/on-chain credentials.

We have discussed MegaETH multiple times on the podcast and are generally optimistic about this chain. The team has taken a unique approach to ecosystem building (MegaMafia is now in its second phase, with the third phase coming soon) and is focusing on unique applications—rather than forks of Uniswap, Aave, Morpho, or Compound (which seem to dominate most other chains).

No matter what you think of MegaETH's valuation, we have two key takeaways from the past few months:

1. Some chains are now clearly focused on revenue, while others focus on different narratives (such as decentralization). Which one provides better returns is still unclear (e.g., XRP vs. Hyperliquid, or ETH vs. SOL).

2. Many significant returns now come from private public markets (such as Echo, Sonar, etc.), pre-deposits, and so on. The whitelists and Discord roles of 2021 (and the subsequent Sybil attacks, whitelist and Discord role trading) have now evolved into Sonar and Echo (and the subsequent Sybil attacks, KYC-certified Sonar and Echo account trading).

Former Messari executive Kunal G (@kunalgoel) posted:

The scale of MegaETH is astonishing, and every time I run the numbers, it overturns all intuitive expectations. While the market sees it as just another ordinary L2, my model shows that its actual opportunity is far beyond imagination.

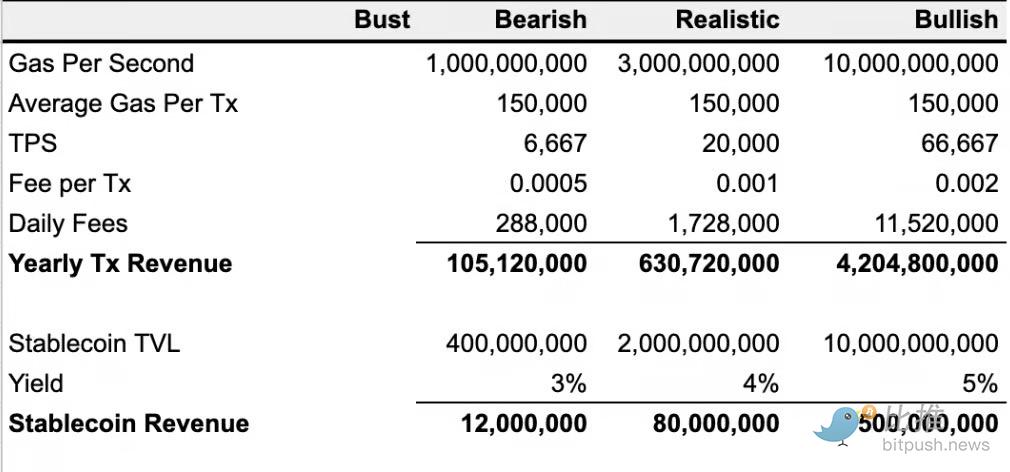

I built four scenario models:

Optimistic scenario – MegaETH achieves its advertised performance, reaching 10 Gigagas per second or 66,667 typical transactions per second

Realistic scenario – Actual scale reaches one-third of expectations, i.e., 3 Gigagas per second, 20,000 transactions

Pessimistic scenario – Scale is only 10% of the advertised, 1 Gigagas per second, 6,667 transactions

Failure scenario – The project completely fails, and the final fully diluted valuation (FDV) is locked at $200 million

Even in the pessimistic scenario, assuming a transaction fee as low as $0.0005 (lower than most L1 and L2), MegaETH could generate $288,000 in daily revenue from transaction fees alone, with annualized revenue exceeding $100 million.

Revenue potential surges with scale:

- In the realistic scenario, annual revenue reaches $600 million

- In the optimistic scenario, if transaction fees rise slightly to $0.001-0.002, annual revenue will soar to $4.2 billion

In addition, MegaETH's native stablecoin MegaUSD can generate additional revenue through protocol yields. Depending on the total value locked (TVL) of the stablecoin, this part may contribute eight to nine figures in annual revenue.

The project also plans to internalize MEV revenue through sequencer privileges and cabinet hosting services. The recently launched "staking for access" model will have a similar positive impact by reducing circulating supply and generating delegated staking returns.

The model has conservatively deducted 50-70% of transaction revenue for data availability layer (DA), sequencer, proofs, oracles, and other infrastructure costs. Although the project has extremely high operational requirements, costs scale in sync with throughput, making the calculation logic clear.

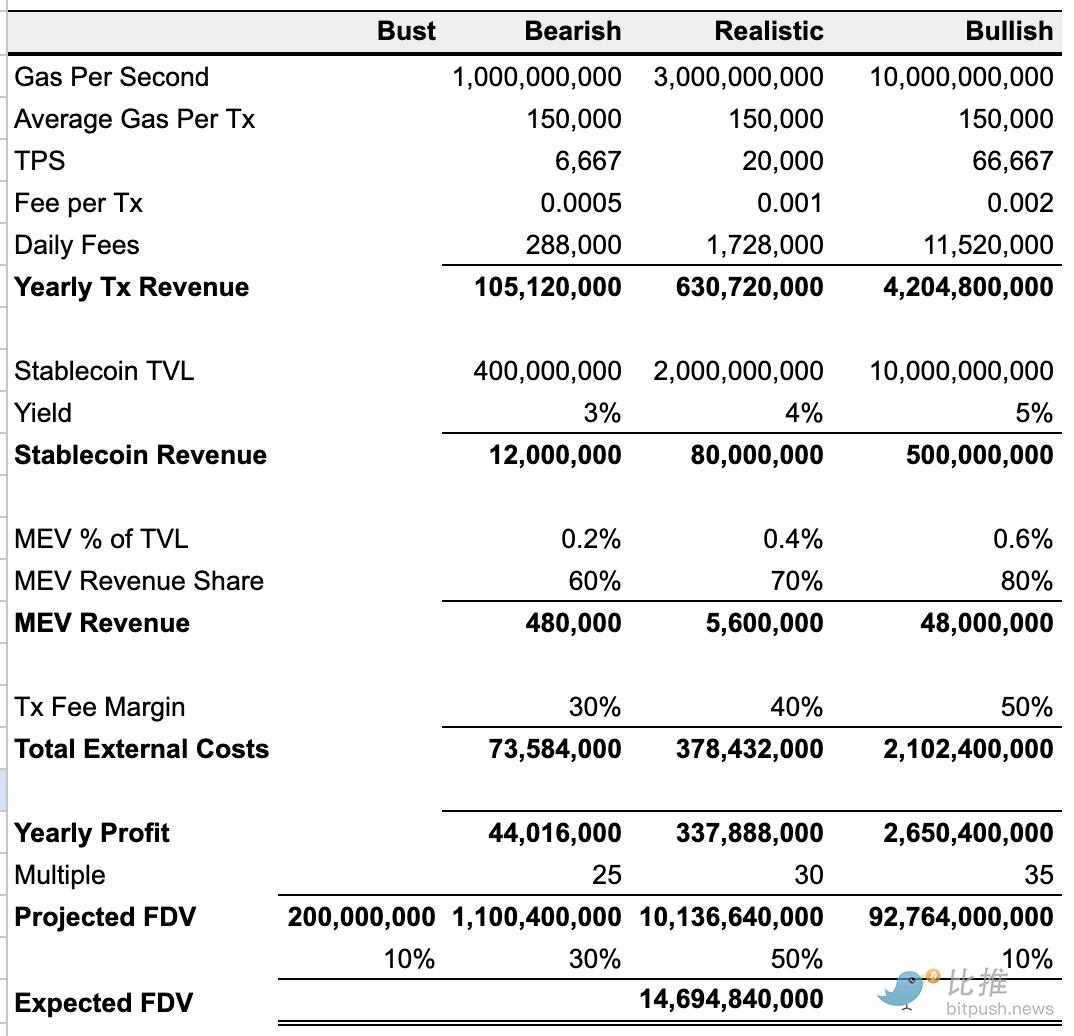

My baseline scenario predicts an average annual profit of over $300 million, and at a 30x P/E ratio, this corresponds to an FDV of about $10 billion.

Taking into account the probabilities of all scenarios, the weighted expected FDV is as high as $14-15 billion—more than 3x the current price of Hyperliquid perpetual contracts, and over 14x the ICO price.

The main risks are the execution efficiency of the mainnet launch and the quality of ecosystem applications. Execution difficulty is especially critical due to its unprecedented scale; if successful, they will be pioneers. The second is ecosystem applications, which currently seem fine, as both new and established projects are on the initial list, making the lineup relatively healthy.

Author: oxStill

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KRWQ Emerges as a Pioneer in Stablecoin Innovation

In Brief IQ and Frax launched KRWQ, a stablecoin pegged to the South Korean won. The multi-blockchain KRWQ aims to fill gaps in the current stablecoin market. South Korea's regulatory stance still prevents local access to KRWQ.

Fight Fight Fight LLC in Talks to Acquire Republic’s U.S. Unit as TRUMP Token Targets Startup Funding Push

Consensys Advances IPO Plans With JPMorgan and Goldman Sachs Amid Crypto Market Shift

Hong Kong Regulators Block Multiple Listed Firms From Shifting Toward Digital Asset Treasury Business Models