The mysterious team that dominated Solana for three months is now launching their own coin on Jupiter?

An anonymous team with no official website or community has devoured nearly half of the transaction volume on Jupiter in just 90 days.

To delve deeper into this mysterious project, we must first witness an ongoing on-chain transaction revolution happening on Solana.

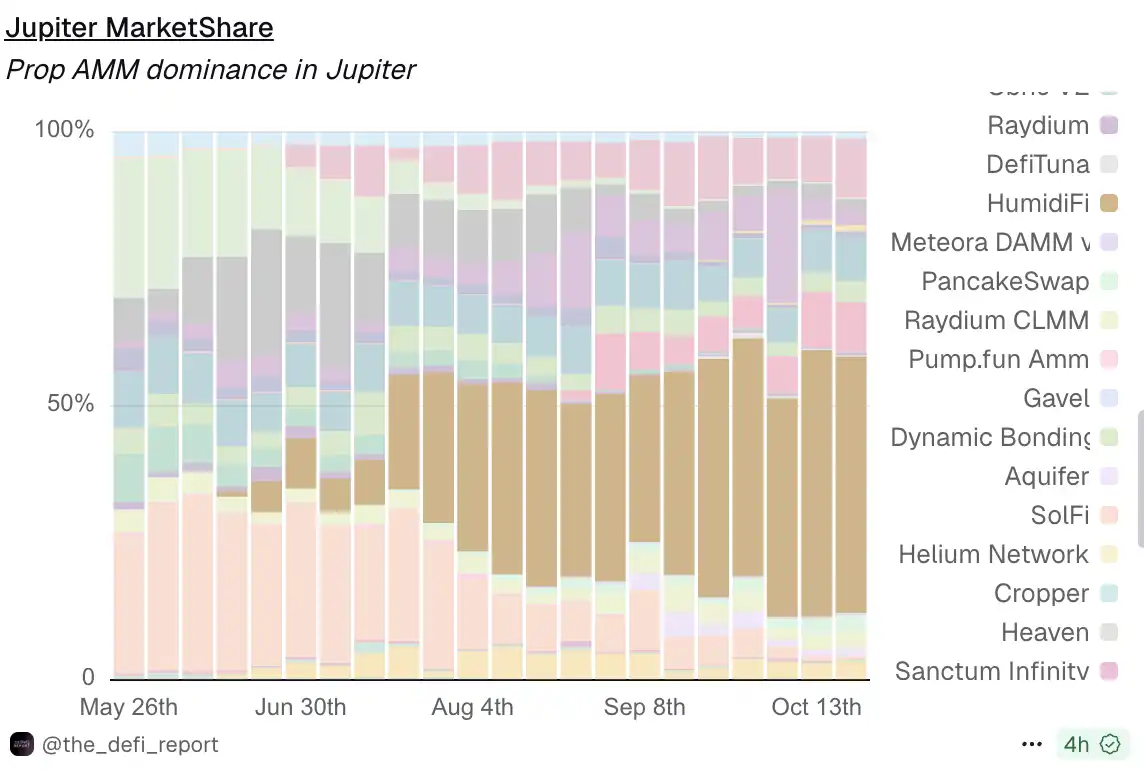

HumidiFi accounts for 42% of Jupiter's transaction volume

Source: Dune, @ilemi

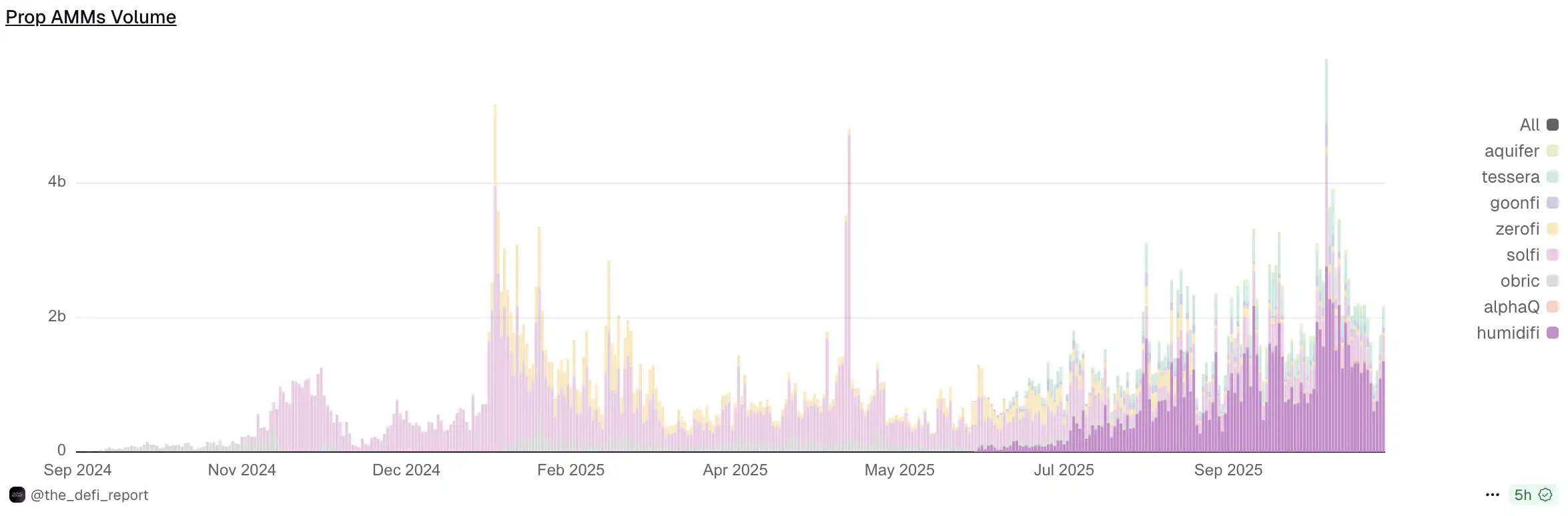

How Proprietary AMMs Are Restructuring On-Chain Transactions

In the context of AMMs, toxic order flow refers to high-frequency arbitrageurs leveraging low-latency connections and advanced algorithms to preemptively capture price differentials and swiftly arbitrage the price delta between on-chain and price-discovery venues (typically centralized exchanges like Binance). The profits taken by these toxic order flows are ultimately borne by traders, liquidity providers, and on-chain market makers.

In traditional financial markets that utilize a Central Limit Order Book (CLOB) to match trades, professional market makers can cope with toxic order flow in various ways (such as adjusting spreads or pausing quotes). By analyzing order flow patterns, they can identify traders with an informational edge and adjust quotes accordingly to mitigate losses caused by adverse selection. Therefore, market makers operating on Solana naturally opted for DEXes like Phoenix that employ a CLOB. However, during Solana's "meme frenzy" period from 2024 to early 2025, the Solana network, overwhelmed by unprecedented demand, struggled to handle market maker orders, and updating quotes required significant expensive computation, leading to a steep increase in market makers' costs.

A series of thorny practical issues is compelling a cohort of the most seasoned AMM market makers to fundamentally rethink how on-chain markets operate, giving rise to a revolutionary new market structure.

This new paradigm is known as a Proprietary AMM (Prop AMM), aiming to provide lower spreads and more efficient liquidity on-chain while minimizing the risk of exploitation by high-frequency arbitrageurs.

SolFi, ZeroFi, and Obric were the initial triumvirate of Proprietary AMMs, which did not expose contract interfaces publicly but instead directly provided interfaces to major trading routes like Jupiter and demanded that Jupiter route orders to their AMMs. This design makes it extremely difficult for external professional arbitrageurs like Wintermute to directly interact with the contracts as they cannot comprehend or predict the trading logic, thereby preventing the replacement of market maker quotes and the adverse selection problem of informational advantaged entities.

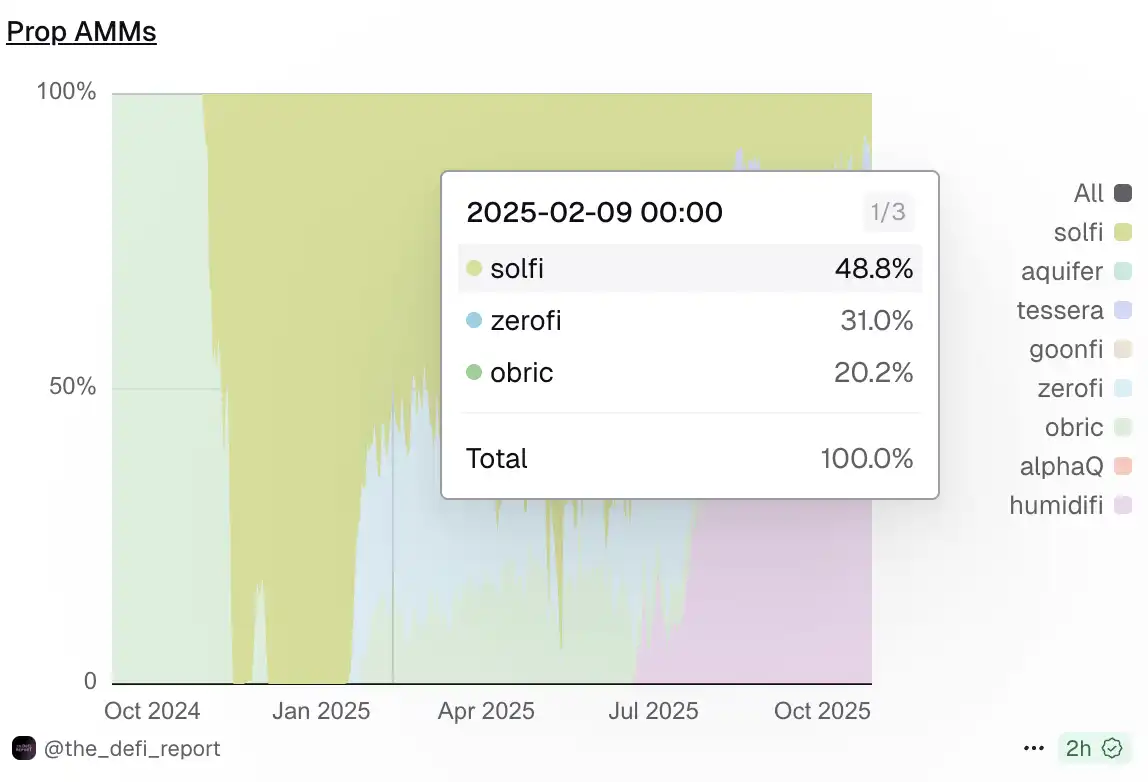

In February 2025, SolFi, ZeroFi, and Obric were the three main proprietary AMMs.

Source: Dune @the_defi_report

HumidiFi's Blitzkrieg

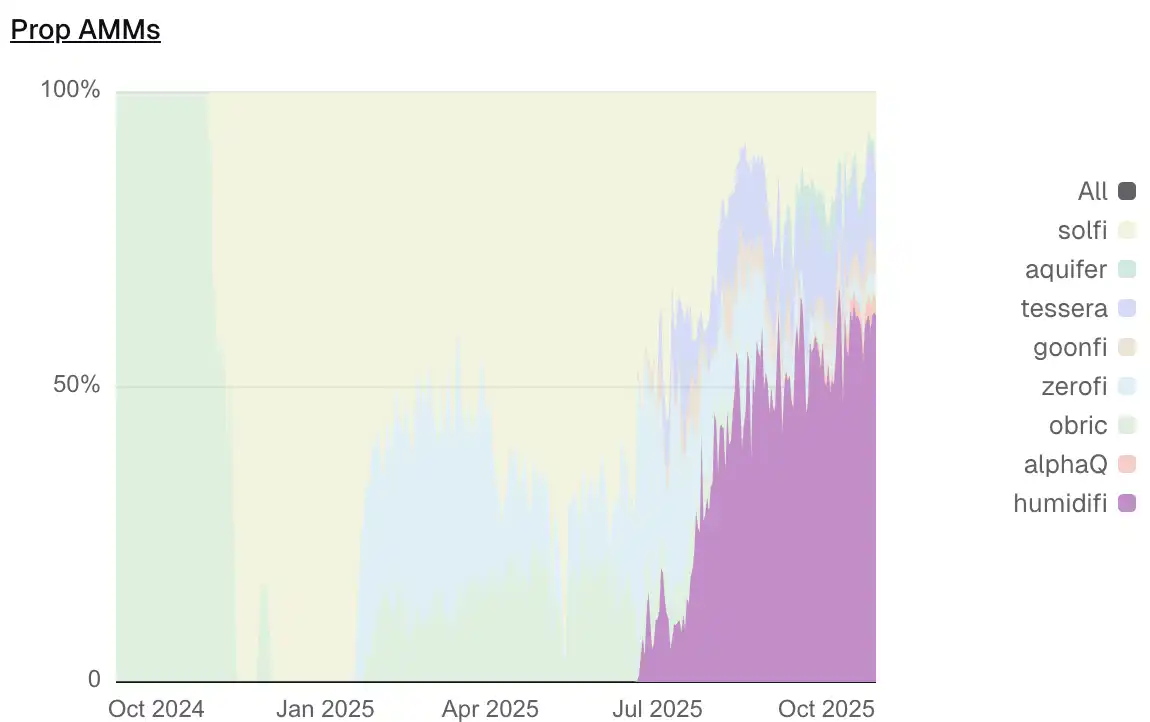

The competition among proprietary AMMs had heated up by July 2025, and a project called HumidiFi rapidly reshaped the entire market landscape.

HumidiFi officially launched in mid-June 2025, and just two months later, it had captured 47.1% of all proprietary AMM trading volume, establishing itself as the undisputed market leader. In contrast, the former dominator SolFi saw its market share plummet from 61.8% two months prior to 9.2%.

Source: Dune @the_defi_report

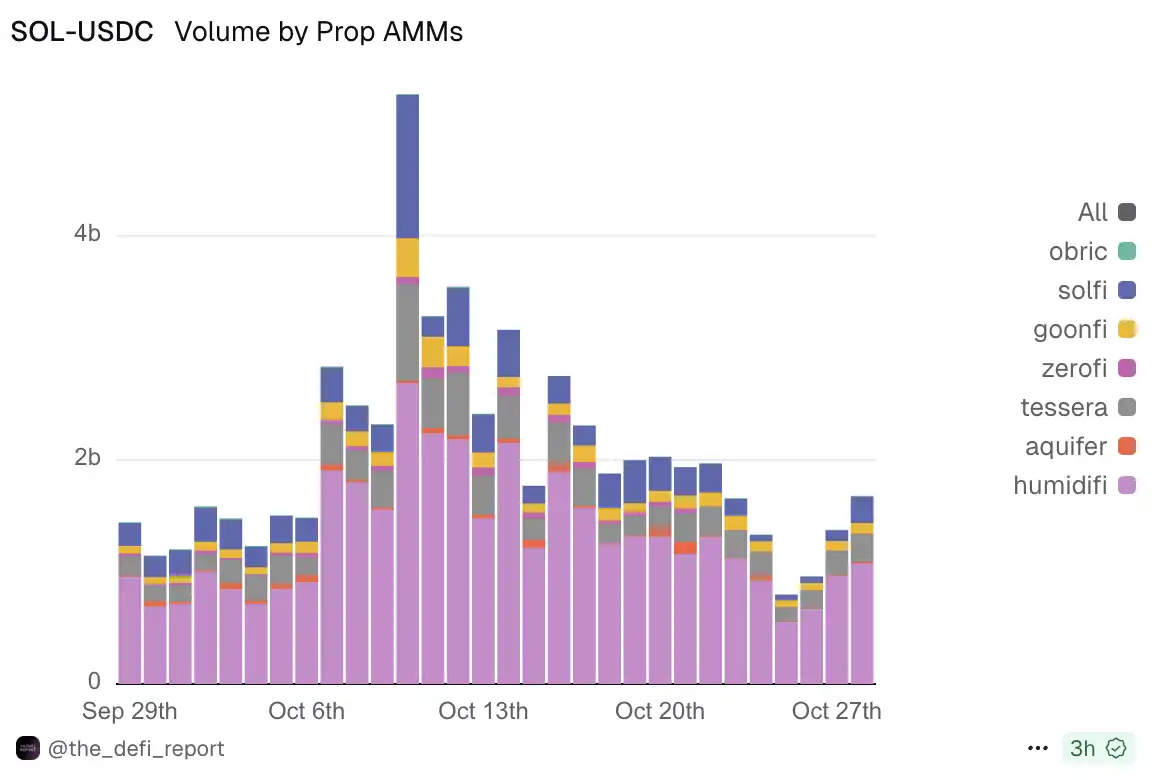

HumidiFi's dominance was particularly evident in the SOL/USDC trading pair. On October 28th, HumidiFi processed $1.08 billion in SOL/USDC trades in a single day, accounting for 64.3% of that day's total volume for the pair.

Source: Dune @the_defi_report

HumidiFi also exhibited a high penetration rate in the Jupiter routing. As an aggregator that holds an 86.4% market share on Solana, Jupiter's routing choices largely dictate traders' actual experiences. Data from October 20th showed that HumidiFi held a market share of 46.8% in Jupiter, more than four times that of the second-place TesseraV (10.7%).

Source: Dune @the_defi_report

Zooming out to the entire self-custody AMM ecosystem, HumidiFi's dominance remains strong. On October 28, the total trading volume of all self-custody AMMs reached $21.8 billion, with HumidiFi alone occupying $13.5 billion, accounting for a significant 61.9%. This number not only far exceeds the second-place SolFi's $3.09 billion but even surpasses the total trading volume of competitors ranked 2-8.

Source: Dune @the_defi_report

This victory of HumidiFi was achieved almost in complete "stealth" mode. It had no official website, no early Twitter account, and no information about team members was ever disclosed.

HumidiFi doesn't need marketing, airdrops, or storytelling. It only needs to provide better price spreads and execution prices than its competitors in every transaction. When Jupiter's routing algorithm repeatedly chose HumidiFi, the market had already cast its vote in its own way.

The Race to the Limits of Speed and Cost

The key to HumidiFi's success lies in compressing the computational cost of oracle updates to the extreme and cleverly converting this technological advantage into absolute market dominance through the Jito auction mechanism.

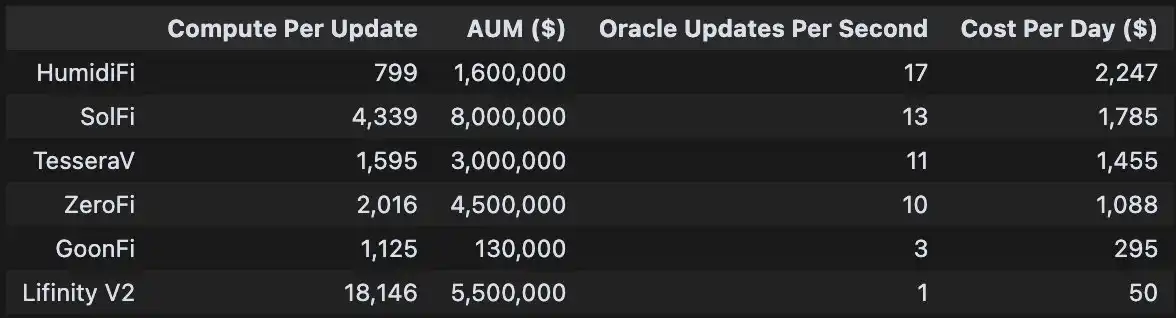

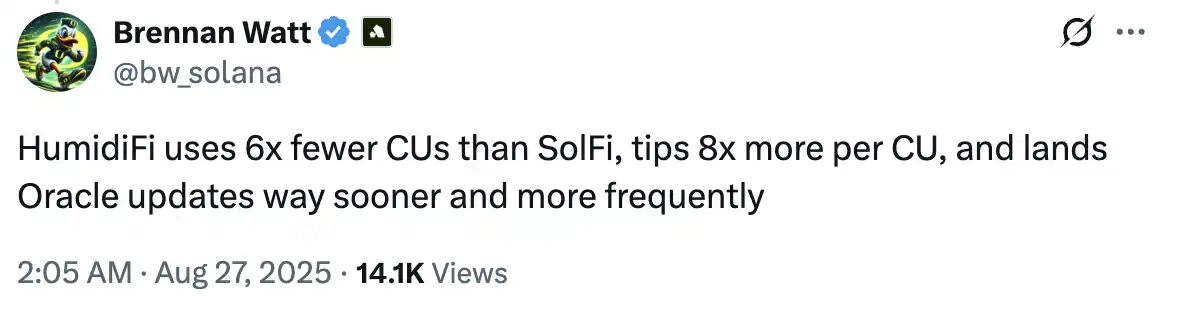

Firstly, HumidiFi has low resource consumption. According to data provided by @bqbrady, each oracle update of HumidiFi consumes only 799 CUs (Compute Units). In comparison, its main competitor SolFi requires 4339 CUs. TesseraV, operated by top market maker Wintermute, also needs 1,595 CUs, which is double that of HumidiFi.

Source: X, @bqbrady

HumidiFi also leveraged its advantage of low CU consumption to gain absolute transaction priority in Solana's MEV infrastructure Jito auction. In the Jito auction, transaction priority is not determined by an absolute tip but by a Tip per CU. HumidiFi pays around 4,998 lamports as a fee for each oracle update. Due to its extremely low CU consumption (799 CUs), its Tip per CU ratio reaches an astonishing 6.25 lamports/CU.

According to data provided by Brennan Watt, an engineer at Anza, a core developer of Solana, HumidiFi used 6 times less CU than the former flagship SolFi Prop AMM and paid over 8 times more in gas fees.

Another key advantage of HumidiFi is the oracle update frequency. HumidiFi updates its oracle 17 times per second, far exceeding its main competitors (SolFi at 13 times, TesseraV at 11 times, and ZeroFi at 10 times).

In the intense volatility of the cryptocurrency market, this almost real-time price tracking ability enables it to always peg near fair value, avoiding opportunities for arbitrageurs, and providing tighter liquidity without the need to self-protect through widening spreads.

Furthermore, HumidiFi has also done well in cost control. HumidiFi's daily operating cost is only $2,247. In comparison, although SolFi manages 5 times the assets under management (AUM) of HumidiFi ($80 billion vs. $16 billion), its daily cost is only 20% lower than HumidiFi at $1,785.

WET Token相关动态

According to the disclosed demo webpage, the allocation is divided into three parts:

A whitelist (acquisition rules to be determined) can ensure a portion of the allocation.

JUP stakers can secure an allocation based on their staked amount.

The public allocation follows a first-come, first-served (FCFS) model, with immediate on-chain circulation once filled, without a lock-up period.

It is worth noting that the HumidiFi team explicitly stated on Twitter that there are "no VC allocations," which is particularly rare in the current market environment dominated by VC presales and low-circulating high FDV projects.

Proprietary AMM is a "winner-takes-all" race, and HumidiFi has achieved its dominant position today based on its technological prowess. However, this also means that once a new competitor makes a breakthrough in CU efficiency or oracle speed, it could quickly erode its market share. This Prop AMM war is clearly just beginning.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KRWQ Emerges as a Pioneer in Stablecoin Innovation

In Brief IQ and Frax launched KRWQ, a stablecoin pegged to the South Korean won. The multi-blockchain KRWQ aims to fill gaps in the current stablecoin market. South Korea's regulatory stance still prevents local access to KRWQ.

Fight Fight Fight LLC in Talks to Acquire Republic’s U.S. Unit as TRUMP Token Targets Startup Funding Push

Consensys Advances IPO Plans With JPMorgan and Goldman Sachs Amid Crypto Market Shift

Hong Kong Regulators Block Multiple Listed Firms From Shifting Toward Digital Asset Treasury Business Models