Ethereum News Update: Ethereum’s Triple Bottom Faces Threats as ETF Outflows and Low Trading Volume Dampen Breakout Prospects

- Ethereum faces critical test at $3,950–$4,000 resistance, with triple bottom pattern suggesting potential 10% rebound but lacking confirmatory volume. - Mega whales accumulate 28 million ETH amid dips, signaling institutional confidence despite retail liquidation risks and weak on-chain buying momentum. - $550M ETF outflows triggered by Fed rate uncertainty weaken Ethereum's support defense, with Fidelity's FETH leading $69.49M exodus. - Network upgrades reduce gas fees to $0.01 but fail to drive sustain

Ethereum is finding it increasingly difficult to surpass the $4,000 mark as bearish indicators grow stronger. A combination of technical signals, on-chain trends, and broader economic headwinds is casting uncertainty over its short-term prospects. Although a possible triple bottom pattern around $3,750–$3,800 hints at a potential 10% rally, the asset faces a pivotal challenge at the resistance zone of $3,950–$4,000, which also coincides with the 50-period exponential moving average, as highlighted in a Cointelegraph report

The triple bottom formation, a well-known reversal signal in technical analysis, depends on steady buying interest at a specific support area. For

At the same time, Ethereum’s network has made notable strides in scalability and cost reduction, with transaction fees dropping to near-record lows of $0.01. Recent protocol upgrades such as Dencun and Pectra have cut Layer 2 (L2) fees by as much as 95% and 50%, respectively, and have shifted transactions off the mainnet to ease congestion, as reported by Cointelegraph

Broader economic forces are also adding complexity. A single-day net outflow of $550 million from Ethereum ETFs, prompted by uncertainty over the Federal Reserve’s rate decisions, has intensified selling pressure. Comments from Fed Chair Jerome Powell suggesting that the latest 25-basis-point rate cut could be the last for 2025 sparked a wave of panic selling, with Ethereum ETFs seeing $81.44 million in withdrawals. Fidelity’s FETH saw the largest outflow at $69.49 million, while Grayscale’s ETH and

The combination of technical, on-chain, and macroeconomic challenges presents a tough environment for Ethereum. While the triple bottom pattern offers a glimmer of hope for a short-term bounce, the lack of strong buying volume and continued ETF outflows indicate that bearish sentiment still dominates. Bulls will be watching closely to see if Ethereum can break and hold above $3,950—a move that could restore some optimism. Until then, Ethereum’s ability to defend the $4,000 level remains uncertain, with its future trajectory hinging on both network strength and the broader economic backdrop.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Timing the Cycle: 5 High-Potential Altcoins to Buy Before the Year-End Rally

Canary Capital Sets November 13 Launch for XRP Spot ETF

Canary Capital removes delay clause in updated S-1 filing, confirming XRP Spot ETF launch on November 13.XRP Spot ETF Nears Launch with New S-1 FilingWhy Removing the ‘Delaying Amendment’ MattersGrowing Institutional Interest in XRP

BlockDAG’s $435M+ Presale and Testnet Outshine Filecoin & Chainlink in 2025’s Investing in Crypto Race

See why BlockDAG’s $435M+ presale, verified testnet, and hybrid system make it the top choice for investing in crypto compared to Filecoin and Chainlink.Filecoin’s Gradual Rise Shows Renewed ConfidenceChainlink’s On-Chain Data Reveals Heavy Whale BuyingBlockDAG’s Verified Testnet Redefine Investing in CryptoLooking Ahead: Why BlockDAG Leads the 2025 Market

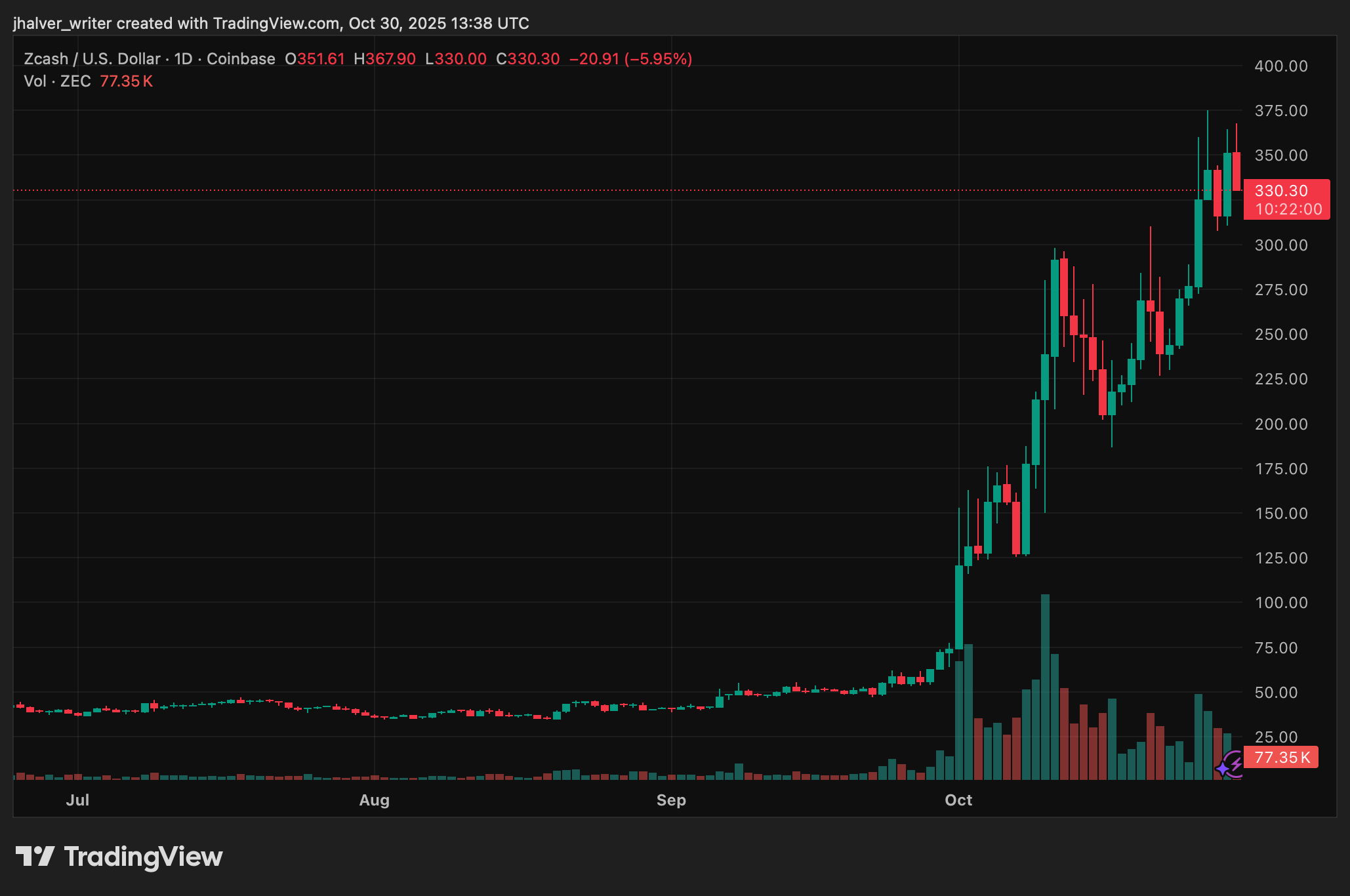

Zcash Rally Gains Steam, Can ZEC’s 4.5M Shielded Supply Push It Back Into the Top 20?