Bitcoin Mining in 2025: Is the Boom Over—or Just Beginning?

As Bitcoin stabilizes above $100,000 in 2025 and on-chain transaction fees reach new highs, Bitcoin mining has once again become a central topic of global investor interest. The question resurfaces: Is mining still profitable in the current environment?

According to leading data providers like Hashrate Index and Glassnode , while traditional mining profitability continues to shrink due to record-high network difficulty and increasing hardware costs, new models such as cloud mining, hashrate leasing, and financialized mining products are rapidly taking over.

Today, mining profitability is no longer just about Bitcoin price. It depends on a complex mix of platform architecture, service fees, payout methods, electricity sources, contract mechanisms, and withdrawal efficiency.

Insights from the Cambridge Bitcoin Electricity Consumption Index further confirm that miners using clean energy and AI-optimized load balancing now operate at significantly lower costs compared to traditional setups.

Against this backdrop, we’ve selected 8 of the most representative Bitcoin cloud mining pools in 2025—spanning Swiss-compliant cloud mining services, decentralized hashrate markets, institutional pools, and financial asset management tools. These platforms reflect where Bitcoin mining is headed—and how users can still profit within this evolving ecosystem.

1️⃣ AutoHash – Swiss-Registered, AI-Driven Cloud Mining with Daily Payouts

AutoHash is a cloud mining platform operated by Switzerland-based Blockchain Finance AG. Its model combines clean energy data centers in Europe with AI-based hashrate scheduling, allowing users to mine BTC without owning any hardware.

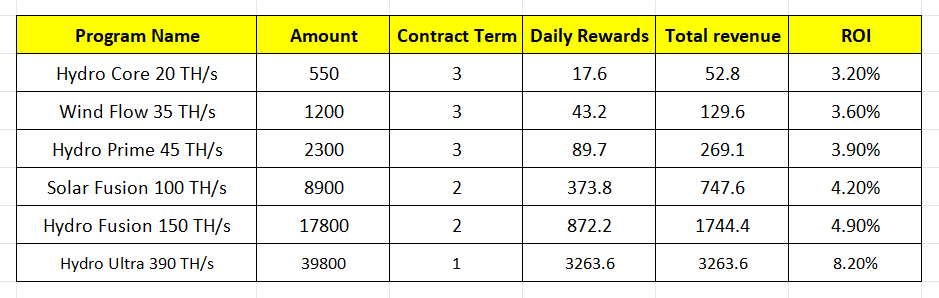

The platform is beginner-friendly, offering $100 in free hashpower upon sign-up and daily automated payouts across mobile and desktop. Contract tiers range from $550 to $39,800, with daily ROI up to 8.3%. The AI engine optimizes mining performance based on real-time network difficulty and fee rates.

Ideal for those seeking low-barrier, hardware-free mining and stable passive income.

AutoHash profitability example:

👉 Visit AutoHash to get $100 for free and start mining cryptocurrency!

2️⃣ NiceHash – Global Hashrate Marketplace for Strategic Miners

Is NiceHash profitable?

Yes—under the right conditions. Profitability with NiceHash depends on your ability to time purchases based on low hashrate costs and high fee periods. While it isn’t a passive solution, experienced users can still achieve significant gains.

NiceHash operates a global hashrate marketplace that allows users to buy and sell mining power. You can rent hashrate, select mining pools, and switch between coins as needed. On NiceHash Reddit , users frequently share real-world earnings and optimization strategies—showing that volatility is manageable with agile setups.

Best for active miners who are hands-on with cost and timing.

3️⃣ F2Pool – Established Mining Pool with Transparent Settlements

F2Pool is one of the world's oldest and most reliable mining pools, supporting BTC, LTC, ZEC, and more. It uses FPPS (Full Pay Per Share) for payouts, ensuring that miners also capture transaction fee rewards.

It’s a go-to choice for users running their own hardware or using colocation services. With global nodes, stable uptime, and transparent stats, F2Pool remains a pillar in the professional mining community.

If you value payout reliability and multi-coin support, F2Pool is a proven option.

4️⃣ YouHodler – Manage Mining Revenue and Earn Passive Yield

YouHodler review: Is it secure and efficient?

Reviews show that YouHodler offers fast withdrawals, reliable custody with third-party audits, and easy-to-use crypto savings products. It’s commonly used by miners to park earnings or access crypto-backed loans.

While YouHodler doesn’t offer mining itself, it plays a key role as a financial layer in mining ecosystems. With support for BTC, ETH, and more, miners can deposit funds to earn high APY returns. Using a YouHodler promo code, new users can unlock cashbacks or bonus interest rates.

Best for optimizing idle crypto through short-term lending or compounding.

5️⃣ KuCoin – Global Exchange Used for Payout Conversion and Fund Management

Is KuCoin legit?

Yes. KuCoin is a globally recognized exchange registered in Seychelles and operates under multiple regional regulatory frameworks. Its security record and trading infrastructure make it a top choice for miners converting payouts to stablecoins or fiat.

The platform also supports affiliate programs such as the KuCoin referral code skool, allowing users to earn commission by inviting others.

Is KuCoin available in the US?, certain features may be restricted due to jurisdictional regulations—users should check the latest regional availability before signing up.

Overall, KuCoin is a versatile liquidity bridge between mining rewards and broader crypto finance.

6️⃣ Libertex – Bitcoin Price Exposure Without Owning Hardware

What is Libertex Bitcoin Mining?

Despite the name, Libertex does not provide actual Bitcoin mining services. Instead, it offers BTC-based CFDs (Contracts for Difference) that allow users to speculate on Bitcoin price movements without holding the asset or running any mining equipment.

It’s a financial tool rather than a blockchain-based mining service. While not suitable for earning block rewards, it does enable exposure to Bitcoin price action—ideal for users with trading experience rather than mining knowledge.

7️⃣ Binance Mining Pool – Integrated Pool + Exchange Solution

What is Binance Pi Network?

This term refers to community speculation around whether Binance will support the Pi Network ecosystem. While no official listing exists, the topic continues to trend in forums and search traffic.

By checking the Binance latest news page, miners can stay updated on fee adjustments, mining pool changes, and payout model updates—all of which directly impact daily earnings. Binance supports both PPS+ and FPPS payout methods and offers seamless transfers between mining rewards and trading wallets.

A highly liquid and efficient ecosystem for existing Binance users.

8️⃣ ECOS Mining – Government-Backed Cloud Mining with Transparent Contracts

ECOS Mining review: Is it reliable?

User reviews consistently highlight ECOS as one of the most transparent platforms in the cloud mining space. All contracts clearly specify electricity costs, maintenance fees, and projected earnings—backed by real-time dashboards.

Headquartered in Armenia, ECOS operates in a government-supported free economic zone, which ensures long-term infrastructure stability and access to clean power. It’s a strong entry point for new users looking for clarity and minimal operational risk.

Conclusion: Bitcoin Mining in 2025 Is Still Profitable—But the Game Has Changed

Bitcoin mining remains a legitimate source of passive crypto income in 2025—but it's no longer about raw hardware or speculation. Success now depends on choosing the right platform, understanding cost structures, and managing payouts with precision.

With rising global hashrate and squeezed margins, the era of plug-and-play profits is over. In its place, cloud mining platforms, clean energy integration, and AI-driven optimization are allowing everyday users to mine profitably—with lower risk and higher efficiency.

Profitability is no longer dictated solely by the Bitcoin price. It now hinges on contract design, service transparency, fee efficiency, and liquidity access.

In 2025, Bitcoin mining is no longer a gold rush—it’s a numbers game.

Only those who calculate risk, evaluate terms carefully, and play the long game will succeed in this new mining landscape.

Thinking about entering Bitcoin mining? Ask yourself: is your challenge technical—or strategic?