Data: 1kx report shows on-chain economy surpasses $20 billions

ChainCatcher reported that venture capital firm 1kx has released the "Onchain Revenue Report H1 2025," which aggregates on-chain verification data from over 1,200 protocols, showing that the crypto industry's "on-chain economy" has formed into an ecosystem worth $20 billions and is growing rapidly.

The report points out that on-chain fees have become the most direct indicator of real market demand. DeFi protocols still account for 63% of total on-chain fees, but emerging sectors are growing rapidly: wallet revenue increased by 260% year-on-year, consumer applications grew by 200%, and DePIN (Decentralized Physical Infrastructure Network) grew by 400%. Meanwhile, Ethereum's share of the overall market has declined; although its transaction fees have dropped by 86% since 2021, the number of ecosystem protocols has expanded eightfold.

1kx notes that the disconnect between market capitalization and actual revenue is becoming apparent: the top 20 protocols account for 70% of on-chain fees, but DeFi projects have a market capitalization only 17 times their revenue, while public chains have an average valuation as high as 3,900 times, indicating a premium placed by investors on "nation-state-like" narrative assets.

Looking ahead, 1kx expects total on-chain economic fees to reach $32 billions by 2026, a year-on-year increase of 63%, with the main drivers including RWA (Real World Asset Tokenization), DePIN networks, wallet monetization, and consumer-grade crypto applications. The report believes that as regulatory clarity improves and infrastructure expands, the on-chain economy is entering a "mature phase"—a new cycle jointly driven by usage, revenue, and value distribution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

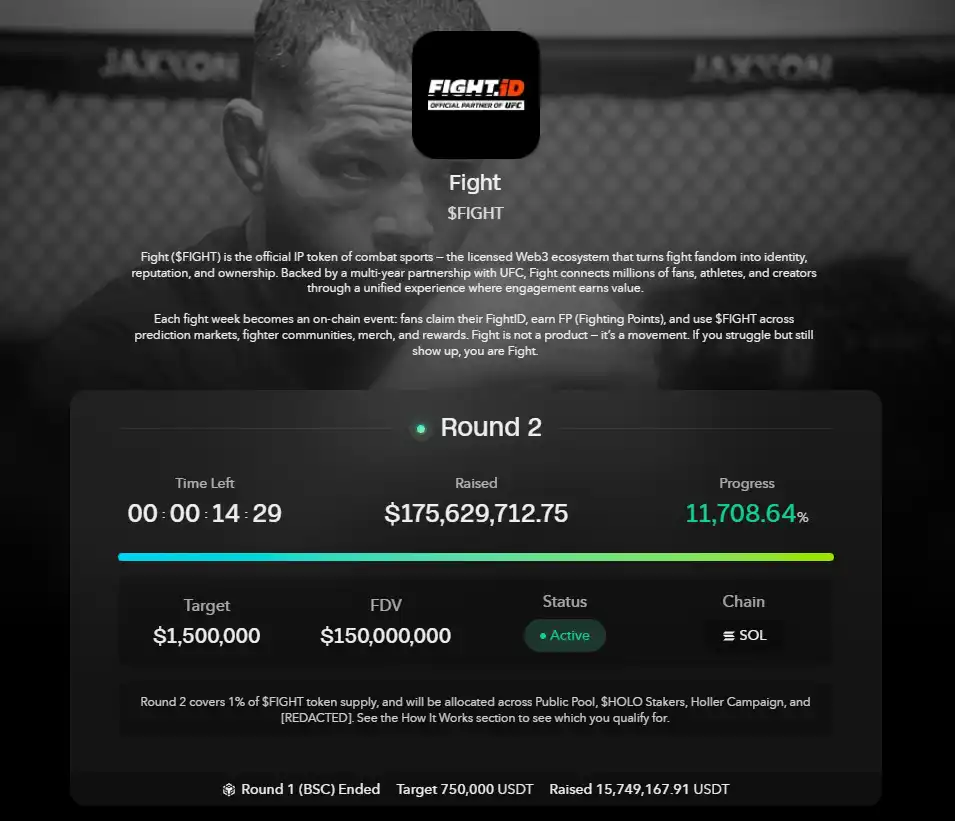

Holoworld AI's new TGE Fight oversubscribed by 116 times

Standard Chartered: The RWA sector market cap could reach $2 trillion by 2028

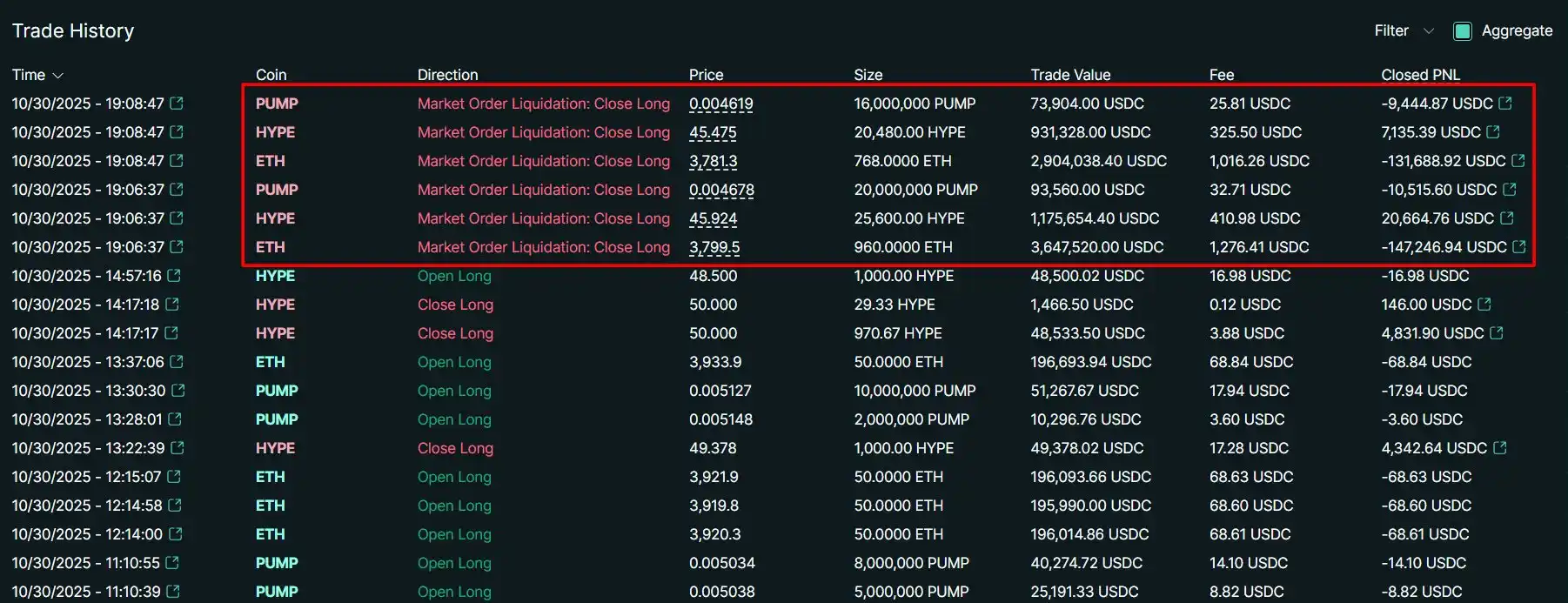

"Maji" long positions partially liquidated, with a loss of approximately $138,500