FourMeme Surpasses Pumpfun With $43 Million in Monthly Revenue

Mutlichain memecoin launchpads continue to pop up, and with BNB Smart Chain (BSC) activity taking off, the chain’s go-to memecoin launchpad, FourMeme, is now earning more revenue than Solana-based pumpfun.

Over the last 30 days, FourMeme has earned $43 million in fees, outpacing pumpfun by 13%, making it the fourth-largest revenue generator in DeFi, trailing only Hyperliquid, Circle, and Tether.

While memecoin trading activity has fallen off significantly from the beginning of the year, memecoin trading infrastructure continues to rake in profits, with FourMeme, Pumpfun, Jupiter, Axiom, and PancakeSwap accounting for five of the top ten revenue generators in DeFi over the last month.

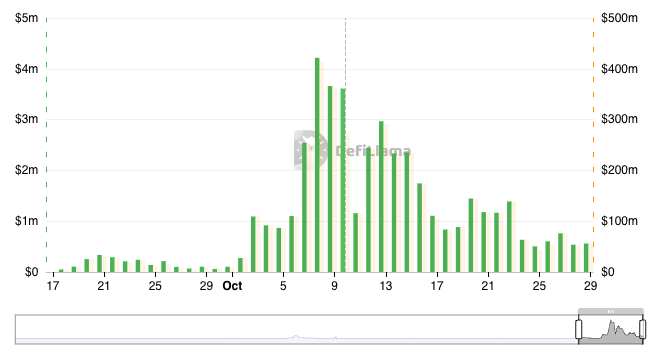

The rotation to Binance memecoin trading was potentially catalyzed by two token launches, ASTER and STBL, which both released on BSC and rallied more than 10x after traders bridged to the network to buy them. Aster furthered its hold on the BSC ecosystem through its post-TGE airdrop farm, which concluded in the first week of October, right when FourMeme volumes began to rise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navan shares plunge 20% following landmark listing amid SEC closure workaround

XRP News Today: Crypto's 2025 Crossroads: Speculative MoonBull or Practical Utility with LTC & RLUSD?

- 2025 crypto focus shifts to Litecoin (LTC), Ripple's RLUSD, and MoonBull ($MOBU) as key growth drivers amid market evolution. - Litecoin strengthens retail adoption with 8.7M active users and 50% retail ownership, while institutional interest in treasuries grows. - Ripple’s RLUSD gains traction via cross-border aid partnerships, showcasing blockchain’s potential to disrupt traditional banking systems. - MoonBull ($MOBU) targets 9,256% ROI through presale liquidity locks and supply reduction, appealing to

Regulatory Changes Pave the Way for dYdX to Become the First Decentralized Exchange to Launch in the U.S.

- dYdX, a decentralized crypto exchange, plans to launch U.S. spot trading by late 2025, reversing prior restrictions due to regulatory clarity under Trump’s administration. - The platform will slash fees (50-65 bps) for major cryptos like Solana and adopt a non-custodial model with KYC, while delaying U.S. perpetual contracts until regulatory frameworks finalize. - A $5M–$10M token buyback program and lessons from a recent chain outage highlight efforts to stabilize operations and boost token value ahead

Decentralizing AI: Pi Network Backs OpenMind's Blockchain Partnership Platform

- Pi Network Ventures invests in OpenMind to co-develop a decentralized AI-robotics framework using blockchain technology. - The partnership aims to create a transparent, community-driven ecosystem for AI development with token-based rewards. - This marks Pi Network's expansion into Web3 infrastructure, aligning with trends in decentralized tech and AI governance. - Challenges include scaling technical complexities and competing with centralized AI providers while ensuring data privacy and interoperability.