Institutions Support Sei as a Link Between DeFi and Traditional Finance

- Sei Network's SEI token gains traction as institutional adoption accelerates, with $10B+ DEX volume and partnerships with BlackRock, Hamilton Lane, and Apollo. - Hamilton Lane's $1T tokenized private-credit fund on Sei in October 2025 highlights blockchain's role in real-world asset (RWA) integration and DeFi-traditional finance bridging. - SEI's Q3 2025 financials show $578.5M revenue and $164.2M net income, supporting long-term growth amid bullish price forecasts up to $2.08 by 2030. - Short-term techn

SEI, the primary token of the

The appeal of Sei among institutions is largely due to its function in bringing traditional assets onto the blockchain. In October 2025, Hamilton Lane, which manages $1 trillion in assets, introduced a tokenized private-credit fund on the Sei Network, marking a significant step in integrating RWAs with blockchain technology. This development follows earlier collaborations with Apollo, Ondo, and Securitize, all of whom have launched tokenization initiatives on Sei. The network’s DEX activity, now ranking among the top three for active users, demonstrates its expanding role beyond just speculative trading.

Regulatory shifts have also strengthened Sei’s story. Two ETFs with SEI exposure debuted in the U.S. in October 2025, taking advantage of a regulatory gap during a government shutdown, and several new SEI-related ETF filings point to ongoing institutional interest.

Sei Investments Co., the parent company, posted strong third-quarter 2025 results, as detailed in its

Short-term price projections for SEI are varied. As of October 2025, SEI was trading at $0.1934, reflecting a 1.12% drop over 24 hours in line with overall market movement. Technical analysis points to a bearish trend, with the Relative Strength Index (RSI) at 41.32 and moving averages (SMA/EMA) indicating selling pressure. Still, some analysts see room for a recovery. A return to the $0.21–$0.24 range could indicate renewed bullishness, and a breakout above $0.27 might challenge resistance at $0.30.

Longer-term predictions are more positive. Cryptopolitan anticipates SEI could reach $0.38 by the end of 2025, gradually rising to $0.73 in 2027 and potentially hitting $2.08 by 2030. These projections depend on ongoing institutional adoption and the network’s continued role as a link between DeFi and traditional finance. More aggressive forecasts, such as $1.21 in 2028 and $3.51 by 2031, are contingent on favorable macroeconomic trends and regulatory developments.

Despite the optimistic outlook, there are still risks. SEI’s volatility—17.55% swings over 30 days—shows its vulnerability to shifts in overall crypto sentiment. Regulatory challenges, including the SEC’s review of SEI ETF applications, could slow institutional investment. Competition from other Layer 1 blockchains and the possibility of broader market corrections also pose significant hurdles.

SEI’s future is being shaped by a mix of institutional participation, strategic advancements, and speculative interest. While technical signals point to short-term consolidation, the broader narrative—driven by RWAs and DeFi integration—supports a positive long-term outlook. Investors must weigh optimism against caution, especially given the sector’s inherent instability. As Merlijn The Trader, a well-known crypto analyst, remarked: "The institutional pipeline isn’t coming. It’s already on Sei."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Canary Capital Sets November 13 Launch for XRP Spot ETF

Canary Capital removes delay clause in updated S-1 filing, confirming XRP Spot ETF launch on November 13.XRP Spot ETF Nears Launch with New S-1 FilingWhy Removing the ‘Delaying Amendment’ MattersGrowing Institutional Interest in XRP

BlockDAG’s $435M+ Presale and Testnet Outshine Filecoin & Chainlink in 2025’s Investing in Crypto Race

See why BlockDAG’s $435M+ presale, verified testnet, and hybrid system make it the top choice for investing in crypto compared to Filecoin and Chainlink.Filecoin’s Gradual Rise Shows Renewed ConfidenceChainlink’s On-Chain Data Reveals Heavy Whale BuyingBlockDAG’s Verified Testnet Redefine Investing in CryptoLooking Ahead: Why BlockDAG Leads the 2025 Market

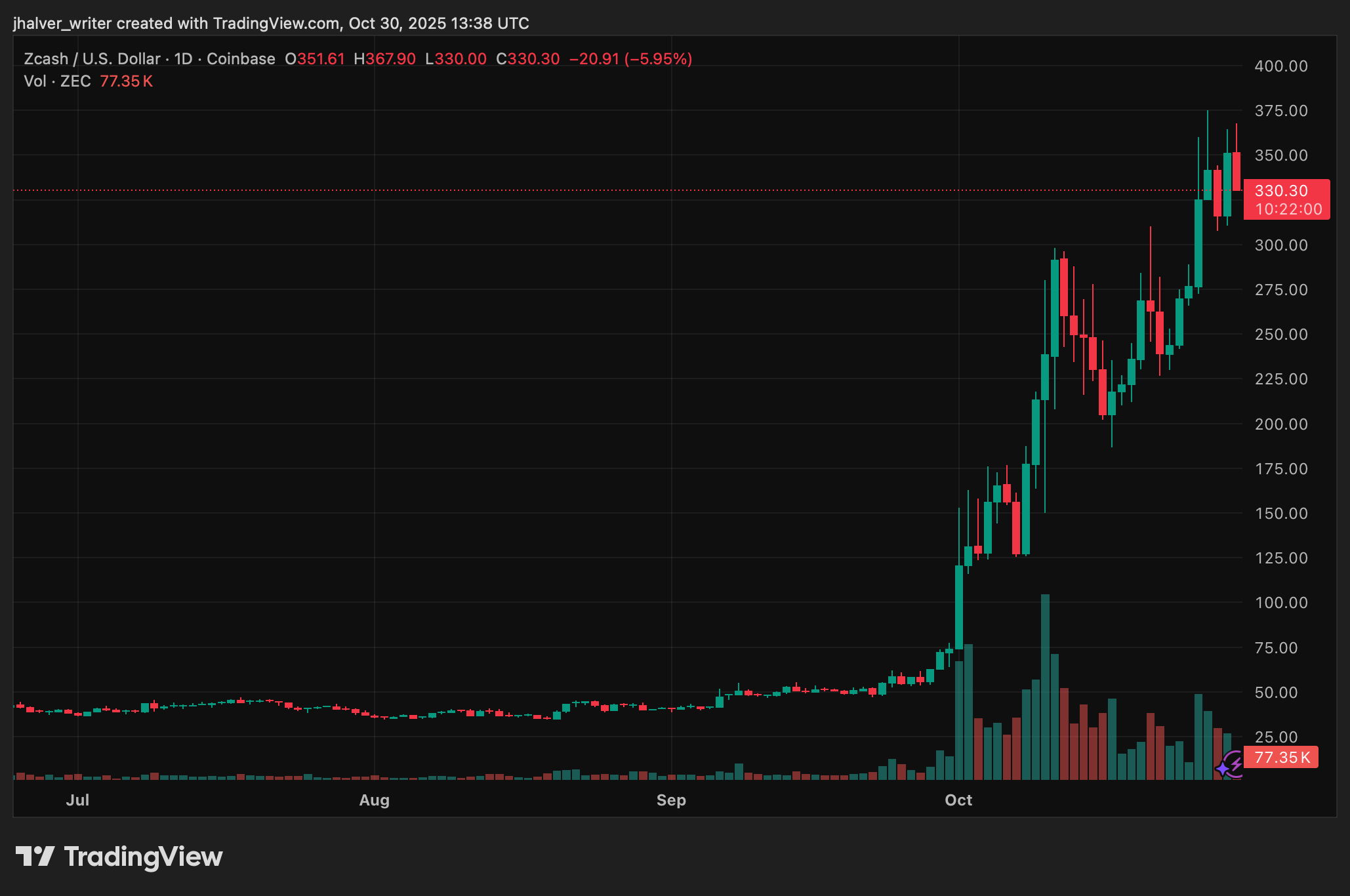

Zcash Rally Gains Steam, Can ZEC’s 4.5M Shielded Supply Push It Back Into the Top 20?

Saylor says Strategy unlikely to buy up rivals as there’s too much uncertainty