CELR Rises 0.86% Over 24 Hours Despite Ongoing Downward Trend

- CELR rose 0.86% in 24 hours but fell 24.79% in one month and 72.19% in one year, highlighting short-term stabilization amid prolonged bearish trends. - Technical analysis focuses on $0.0053 as a critical support level, with potential for further declines if breached or a reversal if sustained above. - A proposed backtest evaluates trading strategies by analyzing price performance after 30-day -10% declines, using historical closing data without stop-loss parameters.

As of October 30, 2025,

CELR’s recent 24-hour gain stands in contrast to its ongoing downward trend over longer periods. Although the token saw a slight uptick in the last day, it remains well below its monthly and yearly peaks. The 72.19% drop over the past year highlights the persistent bearish outlook that has characterized its recent performance. Nevertheless, the short-term rebound hints at possible stabilization, but experts continue to anticipate volatility due to broader economic and industry-specific factors.

From a technical perspective, attention has shifted toward pinpointing possible turning points in CELR’s price movement. Both traders and investors are monitoring for indications of a reversal following the recent daily increase, especially given the token’s prolonged decline. Analysts are focusing on important support and resistance areas, with $0.0053 now acting as a significant psychological marker. A drop below this level could intensify downward pressure, while holding above it may indicate a potential shift in trend.

Backtest Hypothesis

To assess how a trading approach might perform based on CELR’s latest trends, a backtesting scenario was designed using a particular event-based rule. The hypothesis involves identifying each occurrence where the asset’s trailing one-month return was –10% or worse. After pinpointing these dates, the strategy would track the following 30 days of price movement to analyze average returns and possible gains. This test would utilize closing price data, with a one-month holding period after each event. No stop-loss or take-profit measures would be used, simulating a straightforward buy-and-hold method.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How Zero Knowledge Proof (ZKP) Could Redefine Performance Standards in Decentralized AI Systems

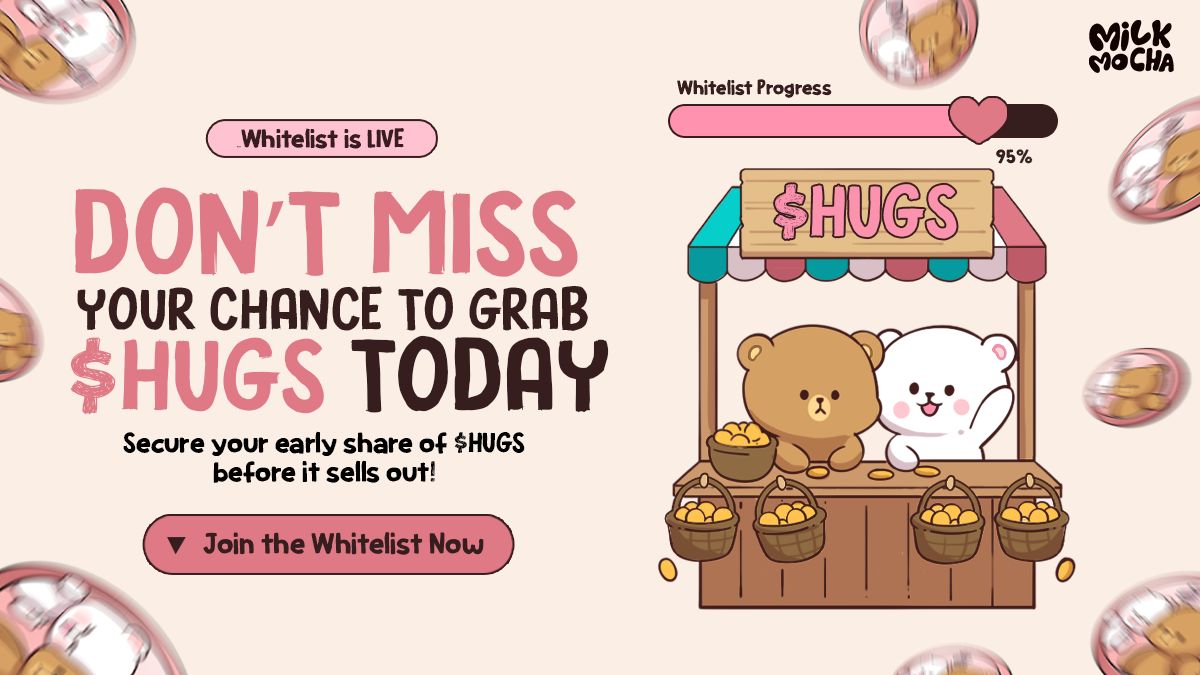

Everyone Laughed at This Cute Bear Token Until the Milk Mocha Whitelist Started Filling Fast

Ethereum Updates: Blockchain-Based RWA Tokenization Fuels $1.4 Billion Growth in Retail Investments

Ethereum News Update: XDC and Myexchange: Uniting Institutional Standards with Decentralized Advancements at SFF 2025

- XDC Network and Myexchange will host a Singapore Fintech Festival 2025 event to advance staking, stablecoins, and institutional-grade blockchain infrastructure. - Republic Technologies plans to expand Ethereum staking operations, emphasizing security and compliance to meet institutional transparency demands. - Xandeum transitions to DAO governance for staking rewards, aligning with decentralized decision-making trends after $8M TVL and 15% APYs in automated distributions. - Bernstein rates SharpLink "Out