Date: Fri, Oct 31, 2025 | 06:05 AM GMT

The cryptocurrency market is once again witnessing high volatility, with both Bitcoin (BTC) and Ethereum (ETH) trading in the red, leading to total liquidations of around $883 million, out of which nearly $763 million came from long positions.

Amid this broader market pullback, Pump.fun (PUMP) has declined over 13% today, extending its monthly loss to around 31%. However, the recent drop has brought PUMP’s price to a critical support zone — a level that could decide its next big move.

Source: Coinmarketcap

Source: Coinmarketcap

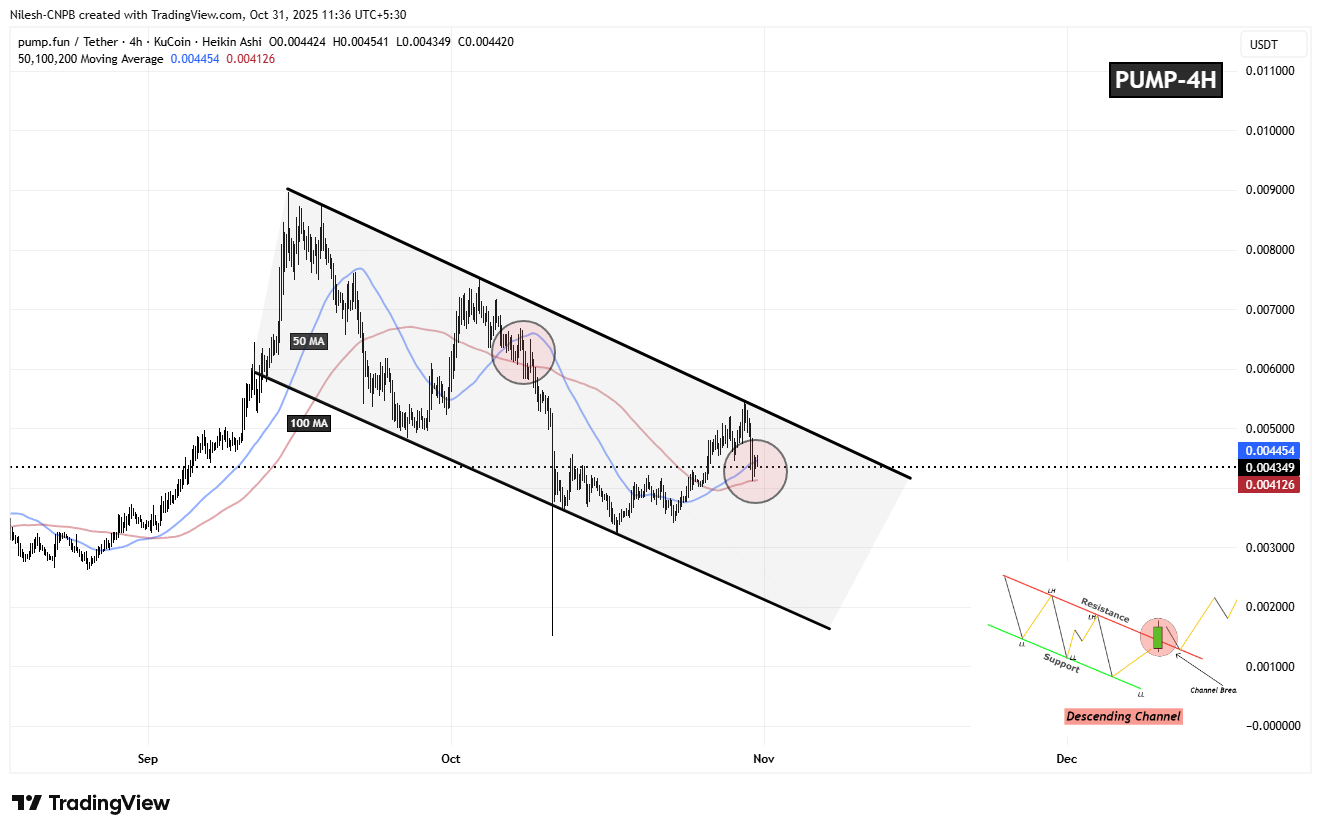

Descending Channel in Play

On the 4-hour chart, PUMP continues to trade within a classic descending channel pattern, moving between two parallel, downward-sloping trendlines.

The current correction began near $0.005479 after a rejection from the channel’s upper boundary. Since then, the price has retreated to $0.004349, which coincides with a key confluence zone around the 50 and 100 moving averages (MA). At present, PUMP is testing the 100 MA support near $0.004126, a crucial short-term level.

PUMP 4H Chart/Coinsprobe (Source: Tradingview)

PUMP 4H Chart/Coinsprobe (Source: Tradingview)

Interestingly, during its previous correction, PUMP also broke below these moving averages — a move that triggered a sharp sell-off. This time, traders will closely watching whether the token can defend this support zone and reverse its trend.

What’s Next for PUMP?

Holding above the 100 MA will be essential for buyers to keep the potential for an upside breakout alive. Historically, descending channels tend to resolve bullishly when price action shows signs of exhaustion near support.

However, failure to maintain this level could invite renewed selling pressure, potentially dragging PUMP toward its next key support around $0.003450.

For now, the short-term outlook hinges on how the price reacts at its current support. A successful rebound from this zone could mark the early stages of a trend reversal, while a breakdown could confirm continued bearish control.