Written by: Robert Osborne, Outlier Ventures

Translated by: AididiaoJP, Foresight News

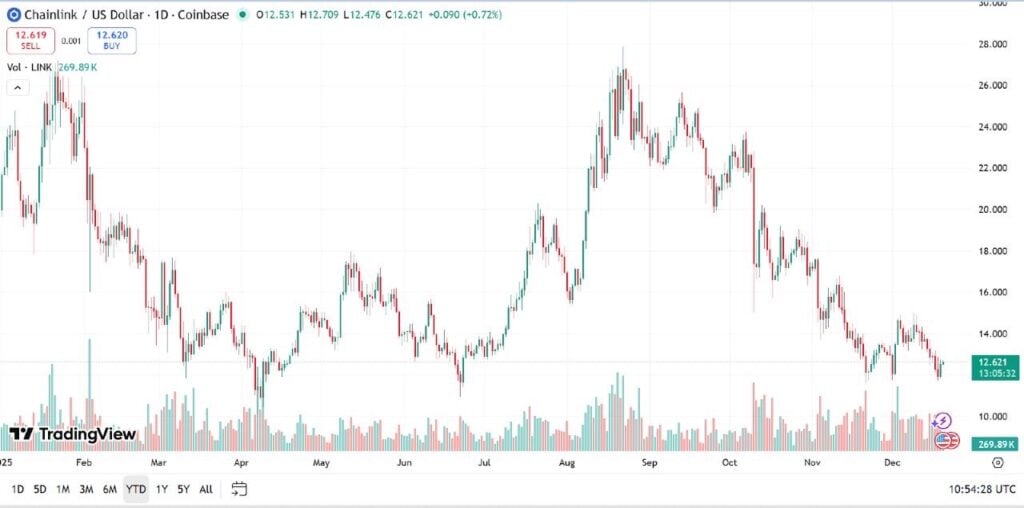

Web3 financing saw strong momentum in September 2025 but did not reach its peak.

160 deals raised $7.2 billions, the highest total since the spring surge. However, aside from the notable exception of the seed-stage Flying Tulip, late-stage capital investment dominated, just as in the previous two months.

Market Overview: Strong but Top-Heavy

Figure 1: Web3 capital deployment and deal count by stage, January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised (disclosed): $7.2 billions

-

Disclosed deals: 106

-

Total deals: 160

At first glance, September appeared to mark a high-profile return of risk appetite. But except for Flying Tulip, most capital was invested in late-stage companies. This continues the trend observed in our recent quarterly market report and aligns with VC insights from Token2049 Singapore. September 2025 again shows that while early-stage deal activity remains lively, real capital is seeking maturity and liquidity.

Market Highlight: Flying Tulip ($200 millions, Seed Round, $1 billions Valuation)

Flying Tulip raised $200 millions at a unicorn valuation in its seed stage. The platform aims to unify spot, perpetuals, lending, and structured yield into a single on-chain exchange, using a hybrid AMM/order book model, supporting cross-chain deposits and volatility-adjusted lending.

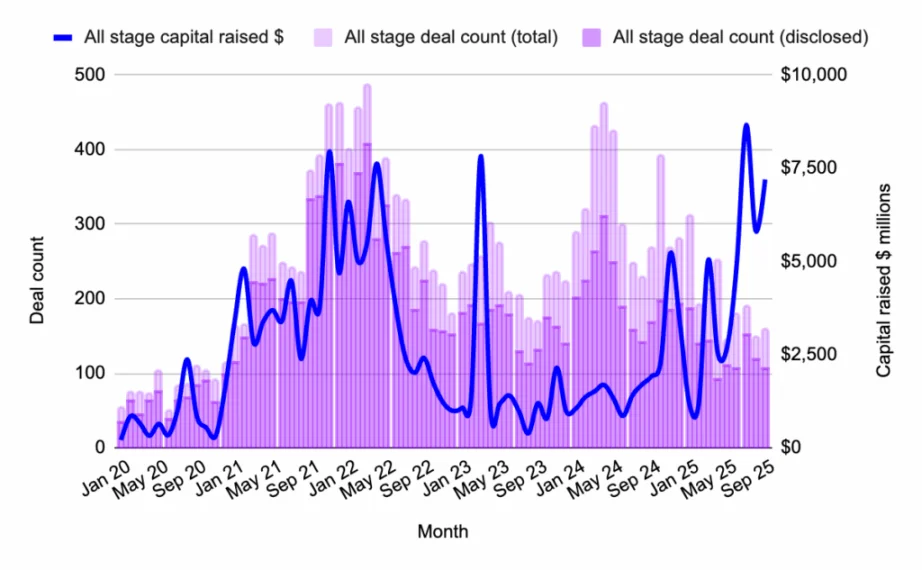

Web3 Venture Funds: Shrinking in Size

Figure 2: Number of Web3 venture funds launched and capital raised, January 2020 to September 2025. Source: Messari, Outlier Ventures.

New funds in September 2025:

-

Onigiri Capital, $50 millions: Focused on early-stage infrastructure and fintech in Asia.

-

Archetype Fund III, $100 millions: Focused on modularity, developer tools, and consumer protocols.

Fund launches cooled in September 2025. Only two new funds started, both relatively small and highly focused in theme. This trend points to selectivity rather than slowdown: VCs are still raising funds, but around sharper, more focused themes.

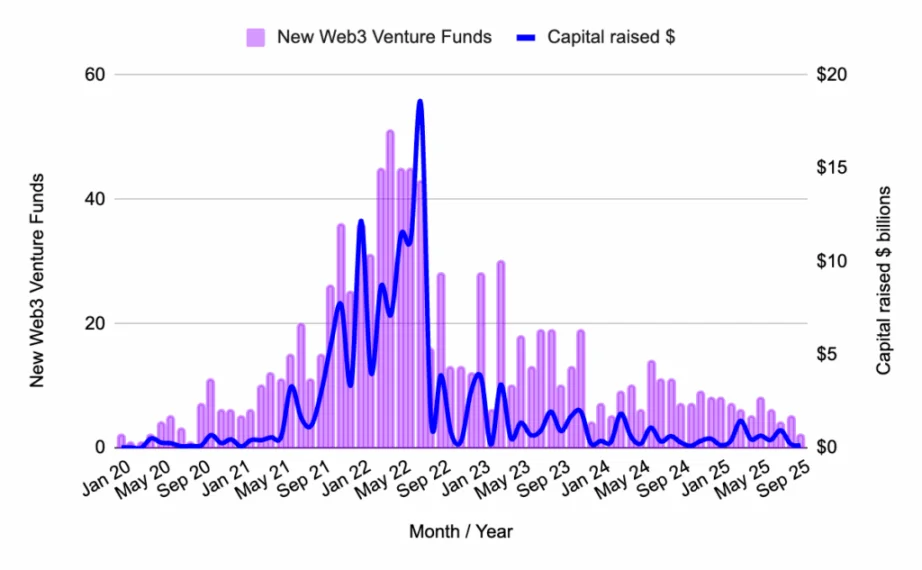

Pre-Seed Rounds: Nine Months of Downtrend

Figure 3: Pre-seed capital deployment and deal count, January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $9.8 millions

-

Disclosed deals: 5

-

Median round size: $1.9 millions

Pre-seed financing continues to decline, both in deal count and capital raised. This stage remains weak, with few well-known investors participating. For founders at this stage, capital is scarce, but those who succeed do so with tight narratives and strong technical conviction.

Pre-Seed Highlight: Melee Markets ($3.5 millions)

Built on Solana, Melee Markets allows users to speculate on influencers, events, and trending topics, combining prediction markets and social trading. Backed by Variant and DBA, it’s a clever attempt to capture attention flows as an asset class.

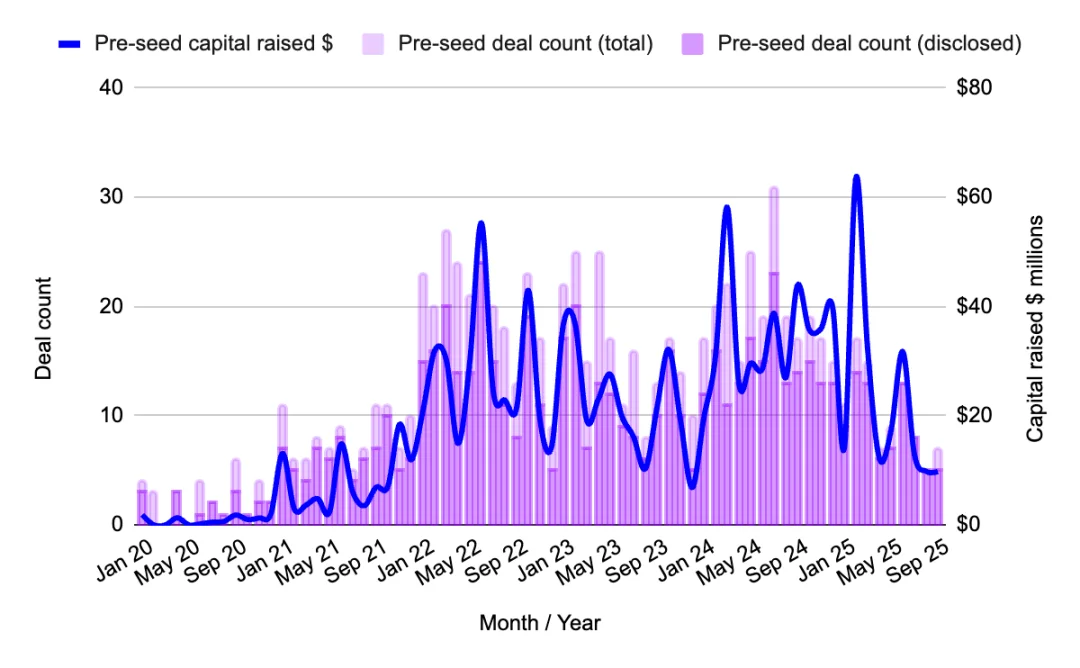

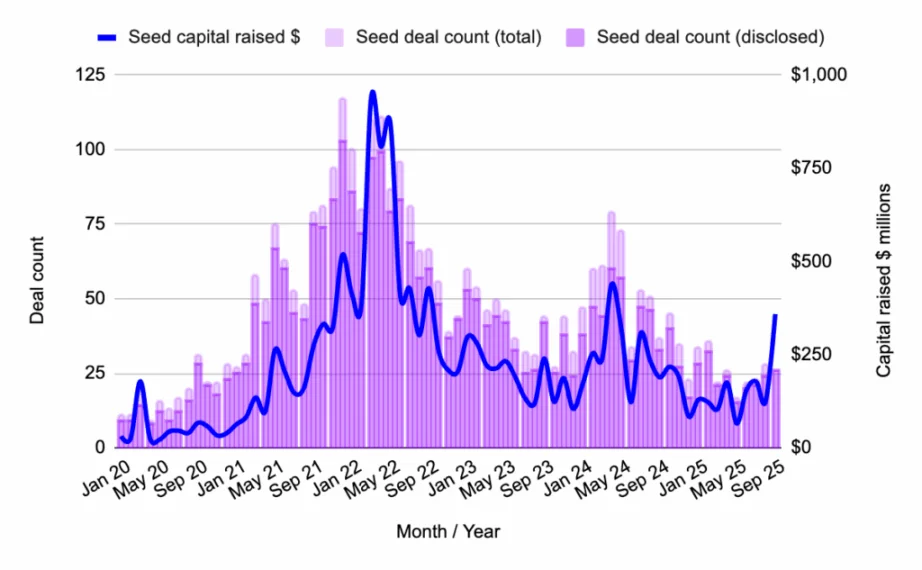

Seed Rounds: Tulip Mania

Figure 4: Seed-stage capital deployment and deal count, January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $359 millions

-

Disclosed deals: 26

Seed-stage financing saw significant growth, but this is entirely due to Flying Tulip’s $200 millions round. Without it, funding in this category would be roughly in line with previous months.

More importantly, Flying Tulip’s structure is not a typical financing. Its on-chain redemption rights provide investors with capital security and upside exposure without sacrificing potential gains. The project is not burning through its raise; instead, it uses DeFi yields to fund its growth, incentives, and buybacks. This is a DeFi-native innovation in capital efficiency that could influence how protocols self-fund in the future.

Although Flying Tulip’s investors do have the right to withdraw these funds at any time, it is still a significant capital investment by Web3 VCs that would otherwise have been invested in other early-stage projects through less liquid instruments: namely SAFE and/or SAFT. This is another manifestation of the current trend among Web3 investors to seek more liquid asset exposure.

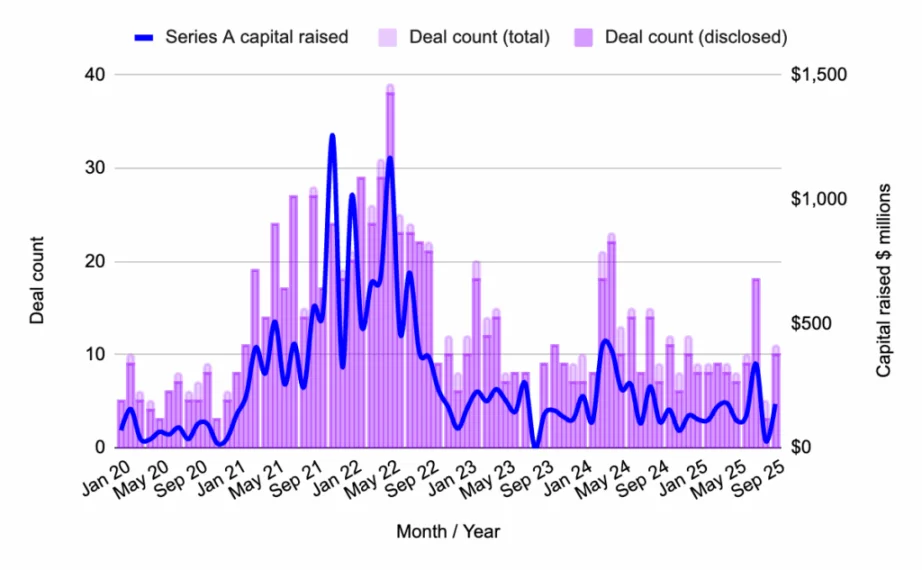

Series A: Stabilizing

Figure 5: Series A capital deployment and deal count, January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $177 millions

-

Disclosed deals: 10

-

Median round size: $17.7 millions

After a sharp drop in August, Series A activity slightly recovered in September, but it was not a breakout month. Deal volume and deployed capital were just around the 2025 average. Investors remain selective, backing late-stage momentum rather than chasing early-stage growth.

Series A Highlight: Digital Entertainment Asset ($38 millions)

Singapore-based Digital Entertainment Asset raised $38 millions to build Web3 gaming, ESG, and advertising platforms with real-world payment functionality. Supported by SBI Holdings and ASICS Ventures, this reflects Asia’s ongoing interest in combining blockchain with mainstream consumer industries.

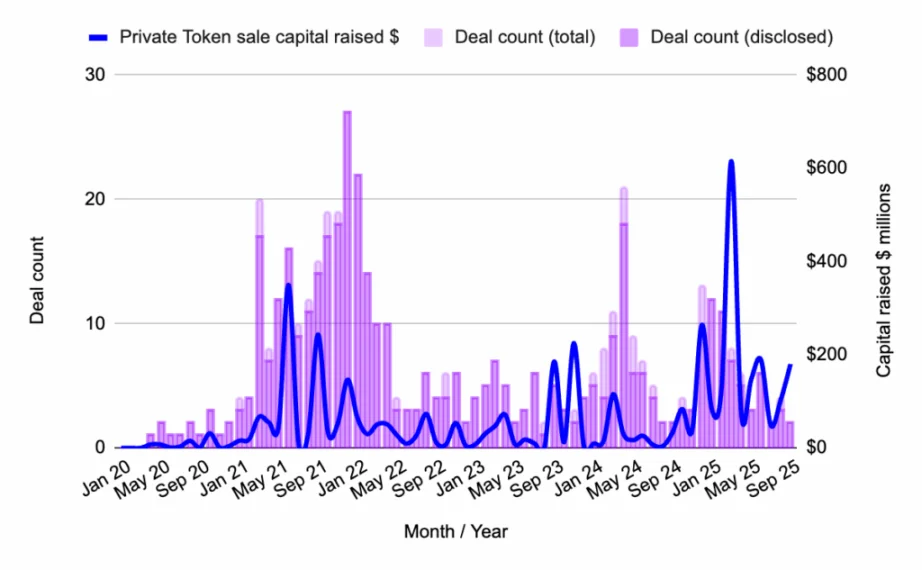

Private Token Sales: Huge Capital, Big Names Involved

Figure 6: Private token sale capital deployment and deal count, January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $180 millions

-

Disclosed deals: 2

Private token activity remains concentrated, with a single large raise doing all the work. The recent pattern continues: fewer token rounds, bigger checks, and exchange-driven plays absorbing liquidity.

Highlight: Crypto.com ($178 millions)

Crypto.com raised a massive $178 millions, reportedly in partnership with Trump Media. The exchange continues to push its global accessibility and mass-market crypto payment tools.

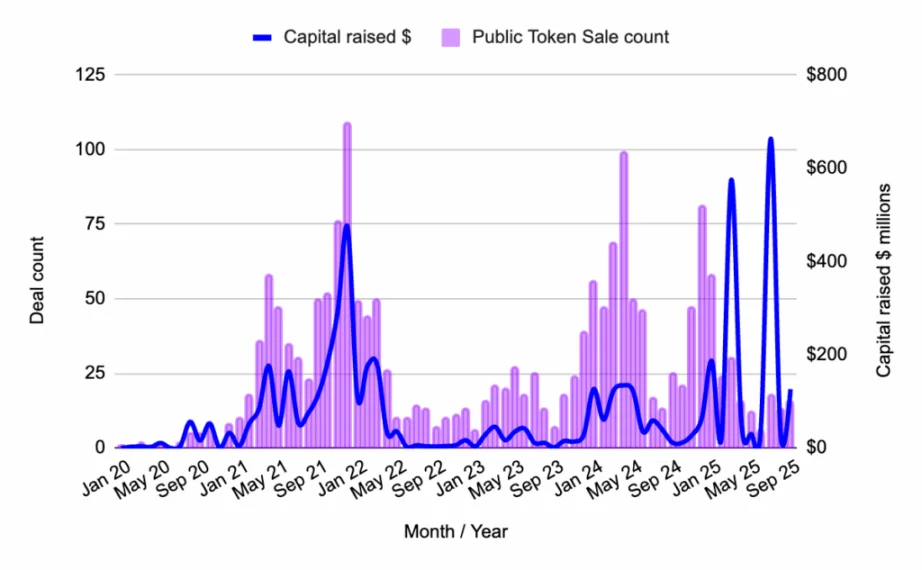

Public Token Sales: Bitcoin’s Yield Moment

Figure 7: Public token sale capital deployment and deal count, January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $126.2 millions

-

Disclosed deals: 16

Public token sales remain active, driven by two attractive narratives: Bitcoin yield (BTCFi) and AI agents. This is a reminder that public markets are still chasing narratives.

Highlight: Lombard ($94.7 millions)

Lombard is bringing Bitcoin into DeFi, launching LBTC, a yield-bearing, cross-chain, liquid BTC asset designed to unify Bitcoin liquidity across ecosystems. This is part of the growing "BTCFi" trend, earning DeFi yields with BTC.