The Daily: Standard Chartered sees major RWA growth on Ethereum, CZ challenges Sen. Warren, and more

Quick Take Standard Chartered’s head of digital assets research predicts the market cap for onchain real-world assets could increase roughly 5,600% to $2 trillion by 2028. The lawyer for Changpeng Zhao is demanding that Sen. Elizabeth Warren retract “defamatory statements” she made about the former Binance CEO following his pardon by President Donald Trump.

The following article is adapted from The Block’s newsletter, The Daily , which comes out on weekday afternoons.

Happy Halloween, on this Friday, Oct. 31!

Bitcoin rebounded near $110,000 after a thaw in U.S.–China relations, despite continuing ETF outflows.

In today's newsletter, Standard Chartered says tokenized RWAs can reach $2 trillion by 2028, Ex-Binance CEO Changpeng Zhao's lawyer demands an "immediate retraction" from Sen. Warren of previous claims, Ether.fi DAO proposes a $50 million token buyback plan, and more.

Meanwhile, Coinbase and Strategy posted Q3 earnings on Thursday — analysts remain bullish on both companies.

Let's get started!

P.S. CryptoIQ is now available to everyone. Take the test for a chance to win $20,000!

Standard Chartered sees tokenized real-world assets reaching $2 trillion by 2028 — 'vast majority' on Ethereum

- Standard Chartered predicts the market cap for onchain real-world assets could increase roughly 5,600% by 2028 to $2 trillion, up from about $35 billion today, according to an analyst note. Moreover, the majority of those assets will be tokenized on Ethereum.

- Geoffrey Kendrick, Standard Chartered’s head of digital assets research, said tokenized money market funds and listed equities alone could each grow to $750 billion markets, with onchain private equity, commodities, and corporate debt also growing in size.

- "Stablecoins have created several necessary pre-conditions for a broader expansion of DeFi via the three pillars of increased public awareness, onchain liquidity, and onchain lending/borrowing activity in fiat-pegged product," Kendrick said.

- The main risk, Kendrick cautioned, would be if regulatory clarity in the U.S. fails to materialize — a possibility if the administration cannot push through changes before the November 2026 midterm elections — "but not our base case."

- While other chains will also likely see growth, Kendrick predicts most real-world assets will find a home on Ethereum due to the network's historical reliability and network effects.

Ex-Binance CEO Changpeng Zhao's lawyer demands 'immediate retraction' from Sen. Warren over post-pardon remarks

- The lawyer for Changpeng Zhao is demanding that Sen. Elizabeth Warren retract "defamatory statements" she made about the former Binance CEO following his pardon by President Donald Trump.

- Last week, Warren criticized the president's move, saying on X that Zhao pleaded guilty to a criminal money laundering charge, and circulated a resolution urging Congress to block "this blatant corruption."

- Zhao's lawyer, Teresa Goody Guillén, sent a letter to the top Democrat on the Senate Banking Committee this week, requesting an apology over her statements related to CZ's 2023 guilty plea for failing to maintain adequate money-laundering controls and subsequent pardon.

- Earlier this week, Fox News' Charles Gasparino reported that Zhao is weighing whether to bring a libel suit against Warren.

- Although Zhao has denied lobbying the Trump administration for a pardon, ties between the Trump-backed DeFi project World Liberty Financial and Binance have raised questions among several observers.

Canaan’s Japan deal marks first state-linked bitcoin mining project in the country

- Canaan is reportedly supplying bitcoin mining rigs to a major Japanese utility for a grid-stability research project, marking the country’s first publicly disclosed state-linked mining initiative.

- While Canaan did not identify the partner, the move follows earlier reports that a subsidiary of Japan’s largest utility, Tokyo Electric Power Company (TEPCO), had studied using surplus energy generated by solar and wind to mine bitcoin.

- Canaan said in its Thursday release that its hydro-cooled Avalon A1566HA servers will be used to “stabilize regional power-grid load through controlled overclocking and underclocking,” dynamically adjusting hashrate and voltage to balance energy use in real time.

Ether.fi DAO proposes $50 million ETHFI buyback as DeFi’s repurchase wave tops $1.4 billion

- Ether.fi DAO has introduced a proposal to allocate up to $50 million from its treasury on token buybacks, which, if approved, would enable the Ether.fi Foundation to execute open-market purchases of ETHFI if the token dips below $3.

- With ETHFI down over 89% from its 2024 high to trade around $0.93 on Oct. 31, the program would activate immediately upon approval.

- Ether.fi is not the first to execute token buybacks, which have reached $1.4 billion alone this year, led by projects such as Hyperliquid and Pump.fun, Aave, and Uniswap.

Ethereum devs officially target Dec. 3 for Fusaka upgrade

- In an All Core Devs call on Thursday, Ethereum researchers officially selected Dec. 3 as the date to push out the mainnet activation of the much-anticipated Fusaka upgrade.

- Fusaka went live on the Hoodi testnet on Tuesday in its final step towards mainnet activation following successful deployments on the Holesky and Sepolia testnets earlier this month.

- The backward-compatible Fusaka hard fork will implement about a dozen Ethereum Improvement Proposals to improve the sustainability, security, and scalability of the basechain and surrounding Layer 2 ecosystem, including the introduction of the PeerDAS streamlined data sampling technique.

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing the Fake to Achieve the Real: A Web3 Builder's Self-Reflection

Honeypot Finance’s AMM Perp DEX addresses the pain points of traditional AMMs through structural upgrades, including issues such as zero-sum games, arbitrage loopholes, and capital mixing problems. These upgrades achieve a sustainable structure, layered risk control, and a fair liquidation process.

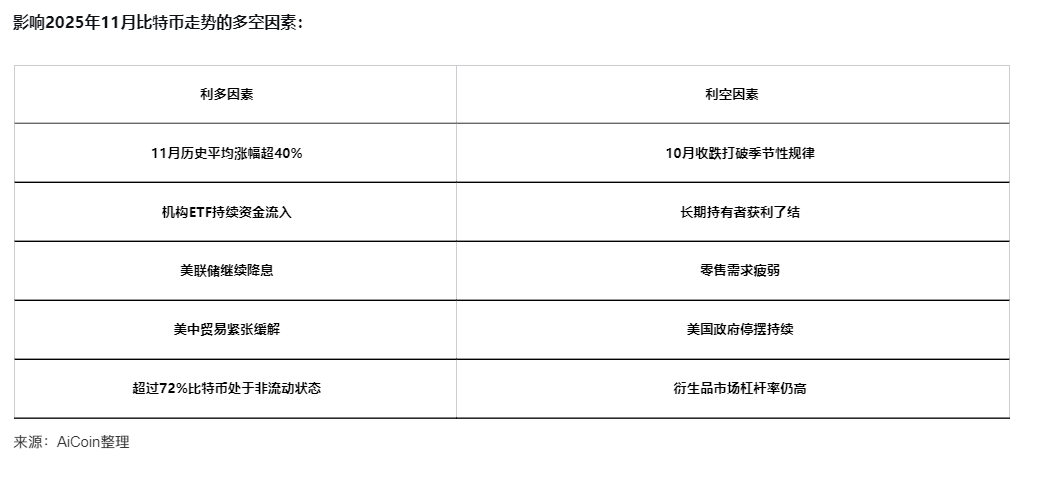

Bitcoin closed lower in October—can November bring a turnaround?

Trump’s Crypto Magic: From “Don’t Know” to a $2 Billion Pardon Spectacle