The much-watched Pi Network (PI) is showing notable momentum in recent weeks. Beginning October at approximately $0.172, its token surged to $0.29 before settling at around $0.25 by the month’s close. This upward move follows sustained corrections, propelled by ecosystem updates, new features, and AI applications.

New Developments and Key Factors

Two core factors driving this rise are the revitalized community engagement—especially around AI and application pilot programs—and increased volumes in over-the-counter (OTC) transactions. According to AI-supported analyses, these dynamics seem to have been principal drivers behind PI’s 50% increase. On the technical analysis side, closing above the 50-day moving average at about $0.2618 potentially signals continuation of this upward trend.

Points of Caution

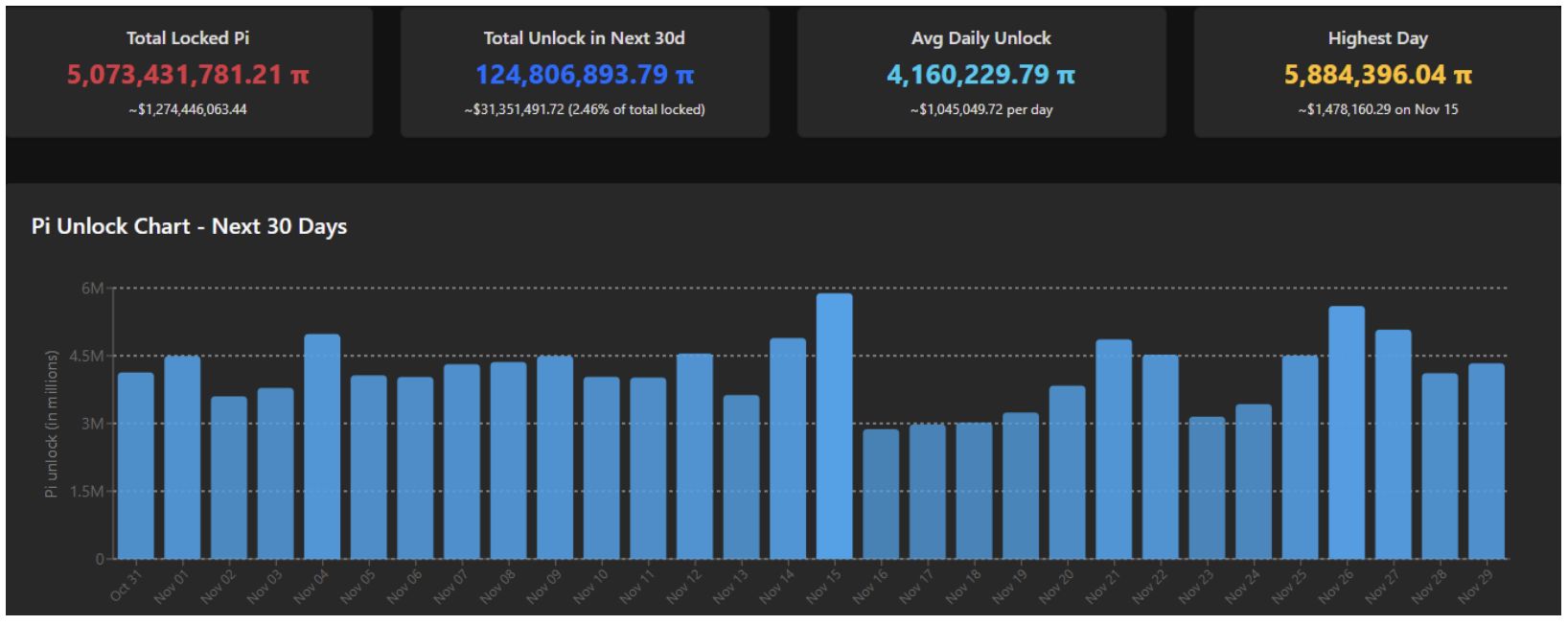

However, not everything is rosy. Liquidity remains comparatively weak and is largely dependent on OTC transactions. Listing the token on larger exchanges or expanding its liquidity base could be strong catalysts for further upward movement. Moreover, future token unlocks, with approximately 120 million PI expected to be released in November, could exert pressure on prices due to supply-side risks. Additionally, the general crypto market sentiment, particularly recovery trends in Bitcoin $0.004861 and altcoins, could be decisive for the direction of PI.

Meanwhile, signals from other projects parallel to PI Network emerge. For instance, other altcoin projects and payment-focused crypto solutions garnering investor attention have outpaced PI in momentum. Analysts argue that PI still falls short of meeting expectations regarding real-world use cases and extensive licensing/service integrations. This reality may lead investors to pivot toward “application-focused” projects instead of PI.

In summary, Pi Network is currently sending mixed signals: community engagement is rising, and technical indicators are hinting at recovery. Nevertheless, sustainable growth demands concrete achievements such as liquidity increases, exchange listings, and a balanced token release schedule. Therefore, rather than acting on a “rise” expectation, adopting a cautious approach by closely monitoring developments could be more prudent at this stage.