The Fog After the Plunge: Macro Liquidity Bottoms Out vs. Market Sentiment Reversal

Overall, the current market is in a volatile phase in the late stage of the bull cycle, with sentiment leaning pessimistic but liquidity not yet exhausted. If macro liquidity improves, the crypto market may continue its upward cycle; if liquidity remains constrained, it could accelerate the transition into the early stage of a bear market.

Author: Proton Capital Research Team

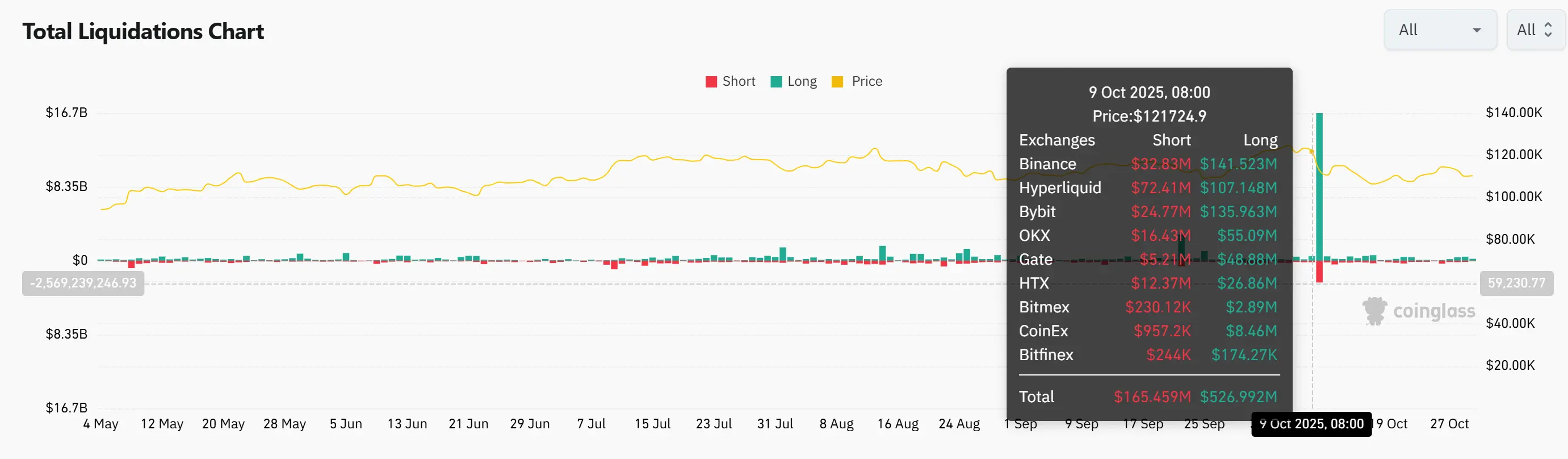

Since the liquidation event on October 11, sentiment in the crypto market has noticeably weakened. Large-scale contract liquidations and liquidity withdrawals triggered a chain reaction, and the market generally believes that we may now be in the late stage of the bull market. The "four-year cycle" concept, which was rarely mentioned in this round of the uptrend, has once again become the mainstream narrative, reflecting investors' heightened sensitivity to cycle tops and concerns about a potential bear market.

On the macro level, the Federal Reserve's ongoing balance sheet reduction and the TGA account's liquidity withdrawal have tightened global liquidity, serving as an important backdrop for the recent broad decline in crypto assets. However, from a trend perspective, liquidity tightening has reached a stage bottom, and with the Fed slowing its balance sheet reduction and the US government resuming spending, marginal liquidity is expected to improve going forward.

From a market structure perspective, although spot ETFs have seen net outflows, the scale is manageable, and stablecoin supply continues to grow, indicating that on-chain funds have not exited systemically and that market fundamentals remain resilient. Bitcoin has shown relative resistance to declines after the 1011 event, while volatility in the altcoin sector has increased significantly, showing that funds are gravitating toward core assets.

Overall, the current market is in a volatile stage in the late bull market, with sentiment leaning pessimistic but liquidity not yet exhausted. If macro liquidity warms up, the crypto market may continue its upward cycle; if liquidity remains constrained, it may accelerate into the early stage of a bear market.

October Review: Frequent Risk Events

Overall, after BTC briefly hit a new stage high in October, the crypto market suffered a panic drop due to the 10·11 liquidation event, and market sentiment turned sharply downward. The much-anticipated "Uptober" quickly turned into a highly volatile "Voltober." The rekindling of the US-China trade war, the massive 1011 liquidation event, USDE depegging, rumors of market maker blowups, and US regional bank lending risks all broke out at once, coupled with liquidity drying up, making mid-October the most panic-stricken period of the year.

1. The 10·11 Liquidation Event

The 10·11 liquidation event became the largest liquidation in crypto history. On that day, about $19 billion in notional value was liquidated, with over 1.6 million accounts forcibly closed. The trigger was Trump's announcement on October 10 to impose a 100% tariff on Chinese imports, sparking global panic. The crypto market crashed in a short time under amplified fear, with BTC dropping nearly 13% in 30 minutes, triggering a chain of liquidations. Most market makers withdrew liquidity to control risk, causing a brief "liquidity vacuum" in the market. Altcoins plummeted, with some dropping over 99%, and stablecoin USDe briefly depegged. The automatic deleveraging mechanism (ADL) was then activated, but some exchanges experienced priority confusion and lack of transparency, causing some positions to be forcibly closed at irrational prices.

Unlike single-point events such as the LUNA crash or FTX bankruptcy, this round of decline stemmed from systemic fragility in the contract trading system. In extreme market conditions, the limitations of market makers, liquidation mechanisms, and liquidity models were fully exposed. The scale of this liquidation far exceeded the second-largest historical event, severely damaging market confidence, with altcoins bearing the brunt. In the short term, funds may further flow back to mainstream assets like Bitcoin and Ethereum, while the altcoin market remains sluggish.

2. Rumors of Market Maker Blowups

After the 10·11 liquidation event, rumors circulated that several market makers suffered huge losses, with Wintermute drawing the most attention. Meanwhile, USDE briefly depegged on Binance, intensifying panic and evoking memories of the 2022 LUNA crash and the 3AC collapse. Wintermute's founder later stated that this round of market contagion was far less than in 2022, when institutional funds were highly intertwined, whereas current risk isolation is more robust and systemic risk has significantly decreased. This round of liquidations was mainly concentrated in high-leverage altcoin trading, with limited impact on mainstream coins, but small- and mid-cap assets and derivatives markets may remain highly volatile.

Although the liquidation scale reached five to ten times that of the LUNA crash, there have been no reports of market makers or lending institutions going bankrupt so far. Overall, core institutions remain stable, but investors should be wary of low liquidity and potential extreme volatility in the altcoin market.

3. USDE Depegging

During the market turmoil on October 11, stablecoin USDe briefly fell to about $0.65 on some exchanges (especially Binance), well below its $1 peg, sparking panic. Issuer Ethena later clarified that minting and redemption mechanisms were always functioning, the protocol's collateralization ratio was safe, and there was no risk of insolvency.

This depegging was different from the 2022 UST collapse; USDe's volatility mainly stemmed from liquidity mismatches on exchanges, not mechanism failure. On DeFi platforms like Curve and Aave, its price remained close to par. Overall, this was more like a liquidity stress test. In the short term, investor confidence in new stablecoins may be affected, but as long as Ethena maintains transparency and sufficient collateral, market trust is expected to gradually recover.

4. Bank Lending Risk Issues

Recently, Zions Bancorp and Western Alliance have successively exposed loan and credit risk issues, raising concerns about the asset quality of US regional banks. Zions set aside about $50 million in impairment for two allegedly fraudulent loans and an additional $10 million in provisions; Western Alliance disclosed about $198 million in bad loans related to Cantor Group V, with $30 million already provisioned. The borrowers involved were accused of hiding collateral and structuring linked sub-loans, among other fraudulent practices.

Although the news caused market volatility, the overall scale and risk exposure of this event are far less than the 2023 Silicon Valley Bank crisis. The current problem loan scale at Zions and Western Alliance is relatively limited—less than 1% of their total loans and even below the average bad debt rate in the US banking sector. This means the event is more of an isolated risk exposure rather than a systemic liquidity crisis.

The risk events of the past week are reminiscent of the last bear market, but a closer look reveals fundamental differences from the 2022 LUNA collapse and the Silicon Valley Bank crisis. USDe depegging and regional bank bad debts mainly reflect liquidity mismatches at the exchange level and individual credit fraud, rather than a complete failure of protocols or the banking system. The 10·11 liquidation did cause a huge shock, but core market makers and basic financial structures remain stable, and the follow-up impact still needs observation. Overall, this round of panic is more like a concentrated exposure of market leverage and liquidity fragility, rather than a systemic collapse.

Next, we will look at which stage of the cycle we are in from three main lines: liquidity, market sentiment, and macro events.

Macro Liquidity: Signs of a Bottom

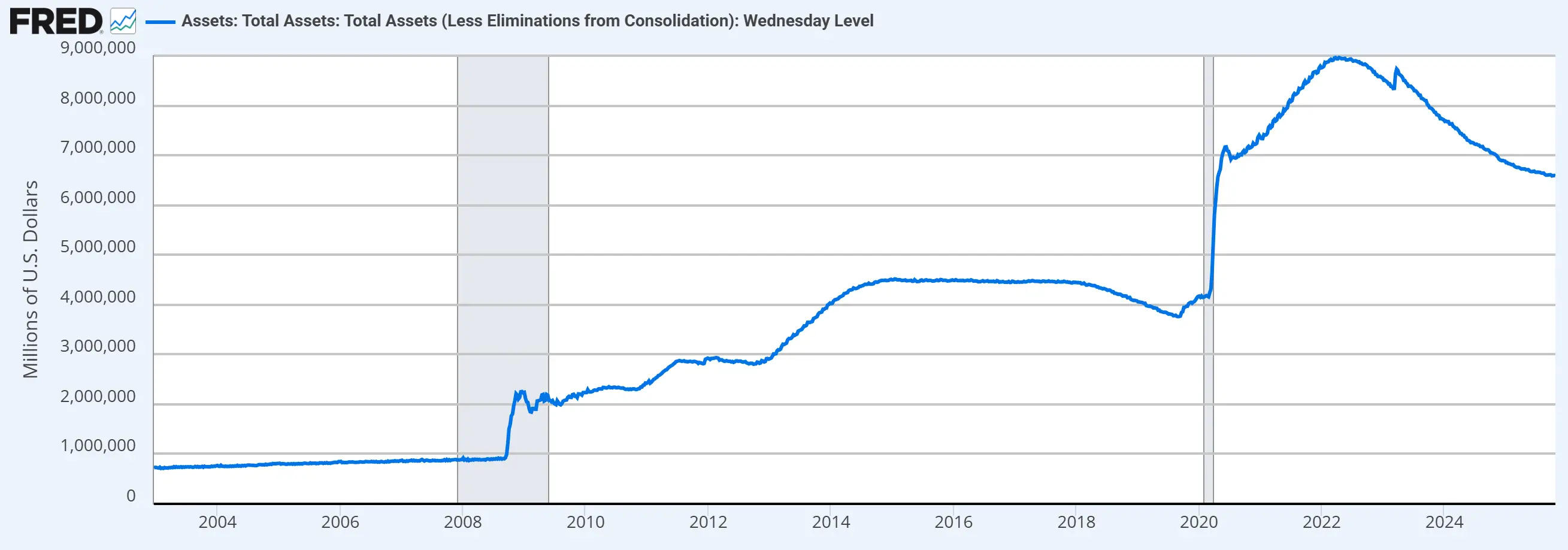

Currently, the Federal Reserve is still in the process of balance sheet reduction, but the pace has clearly slowed. Since April this year, the Fed has lowered the monthly Treasury redemption cap from $25 billion to $5 billion, while the MBS redemption cap remains at $35 billion. On October 14, Powell stated in a speech in Philadelphia that since 2022, the balance sheet has been reduced by about $2.2 trillion and hinted that "the point of possibly stopping balance sheet reduction may be near in the coming months," or that a stable phase may arrive earlier than expected.

In addition, strategists from JPMorgan and Bank of America recently predicted that, given the recent tightening of funding conditions, the Fed is likely to announce at the October FOMC meeting that it will stop reducing its balance sheet, which is about $6.6 trillion, ending the process of withdrawing liquidity from financial markets. This is much earlier than the previously expected timeline of December or early next year.

The Fed's balance sheet has now dropped by $2.38 trillion from its peak. The New York Fed, which operates the Fed's balance sheet policy, previously estimated that during the reduction process, bank reserves would fall from about $3.6 trillion to $2.5 trillion or $3 trillion, and the balance sheet would shrink to about $6 trillion or $6.5 trillion. Currently, bank reserves have dropped to $2.93 trillion, and the Fed's balance sheet is at the edge of this range.

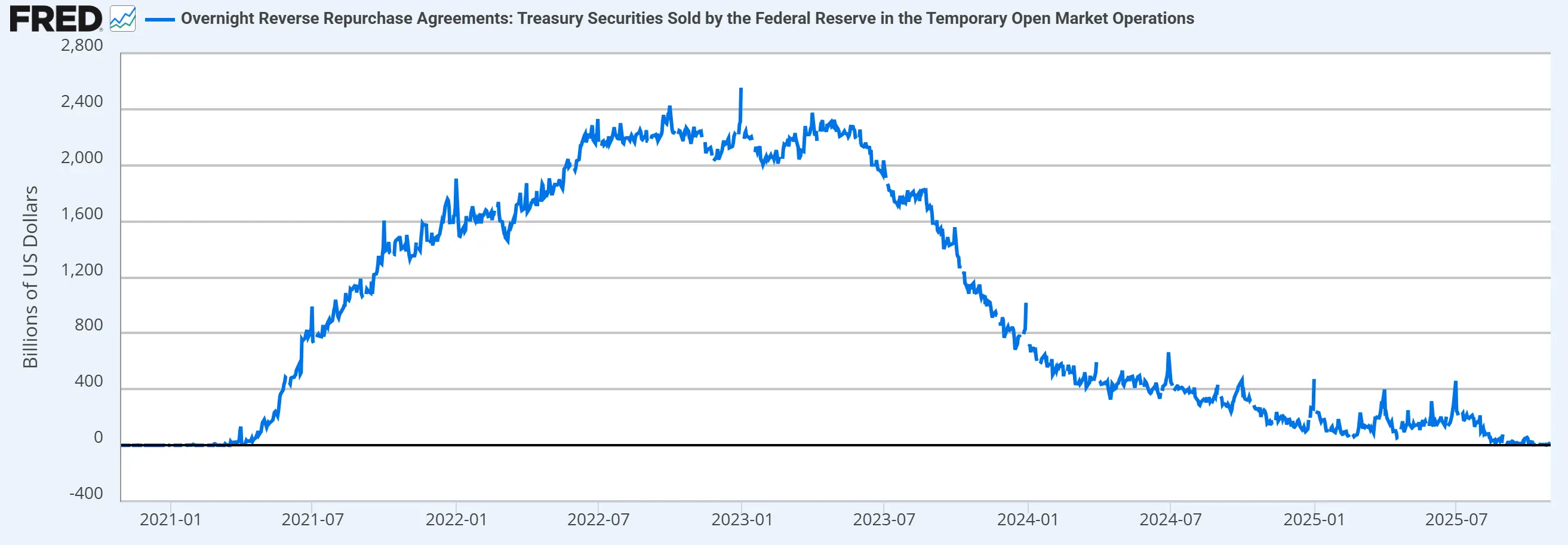

The overnight reverse repo tool is a means for the Fed to withdraw liquidity from the market, managing bank reserve levels in coordination with balance sheet reduction. According to the data, since August this year, the reverse repo tool has been drained and can no longer release liquidity.

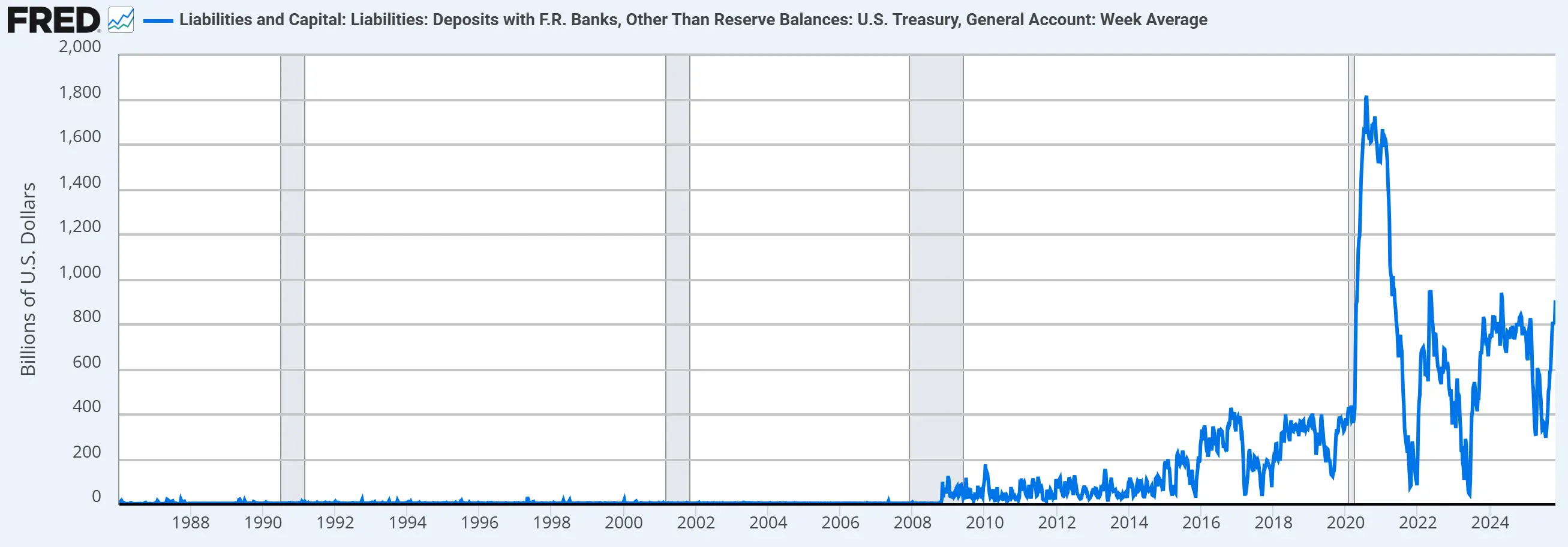

The TGA account is the US Treasury's "checking account" at the Fed, used to manage the federal government's daily revenues and expenditures. By adjusting the TGA balance, the Treasury can influence US dollar liquidity in financial markets. Although the TGA currently has a large balance (after the "Big and Beautiful" Act raised the debt ceiling, the Treasury increased its cash reserves, which can also be understood as liquidity being withdrawn from the market), the US government shutdown has affected the Treasury's process of releasing liquidity.

Overall, the macro environment is at a liquidity bottom: balance sheet reduction continues, reverse repo is exhausted, and the fiscal side is constrained by the government shutdown. This is an important backdrop for the recent crypto market correction. However, as balance sheet reduction ends and the government resumes operations, overall liquidity is expected to recover. Whether this will drive a crypto market rebound still depends on whether funds can flow back into the crypto ecosystem.

Crypto Market Liquidity: No Major Withdrawals Yet

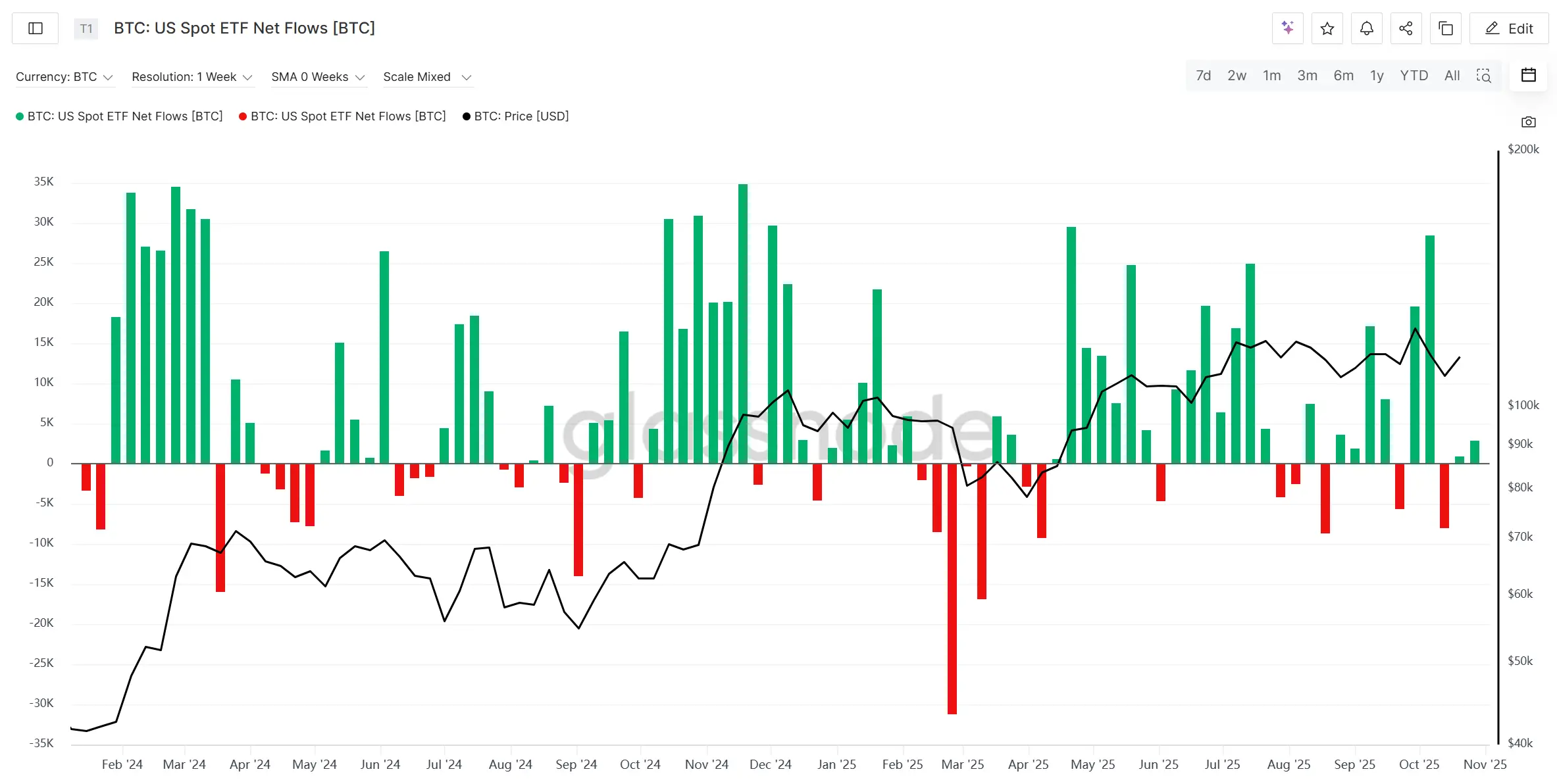

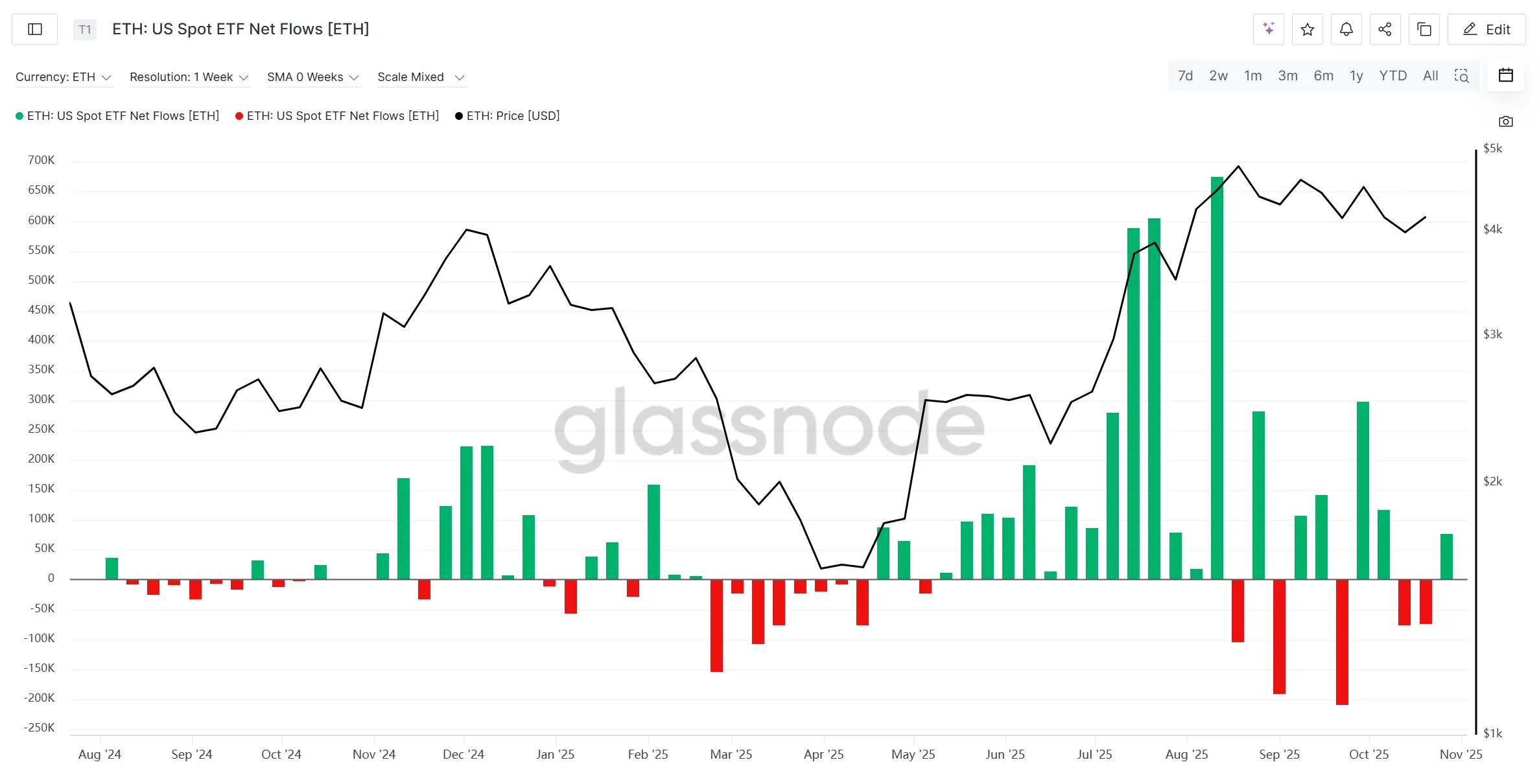

First, let's look at BTC and ETH spot ETF inflows and outflows. In this bull market, their flows can to some extent reflect liquidity entering and exiting the crypto market. In terms of capital flows, BTC and ETH spot ETFs recorded net outflows for two consecutive weeks after the "1011 liquidation event," but the scale was limited and still manageable, showing no signs of systemic withdrawal.

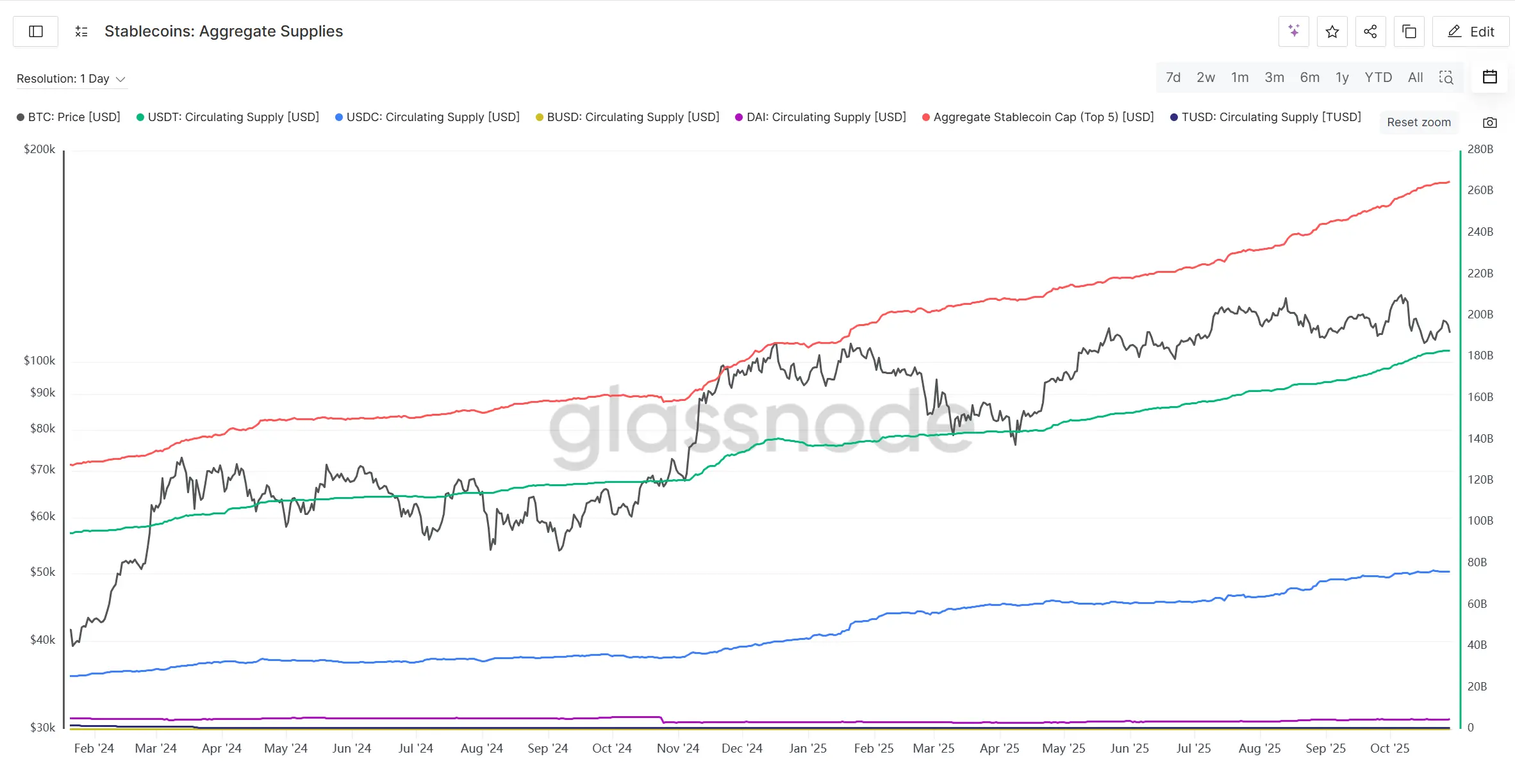

Meanwhile, the supply of major stablecoins continues to rise, even accelerating slightly during the market correction, indicating that on-chain funds are still growing and potential liquidity remains.

Overall, the recent crypto market decline is more due to macro liquidity tightening rather than internal market liquidity exhaustion. Spot ETF outflows are manageable, and stablecoin supply is stable, indicating that funds have not panicked and exited. The current adjustment looks more like a short-term disturbance rather than a trend reversal. If macro liquidity marginally improves, the crypto market still has the potential to recover and move upward.

Market Sentiment: Pessimistic Narratives and the Return of "Cycle Theory"

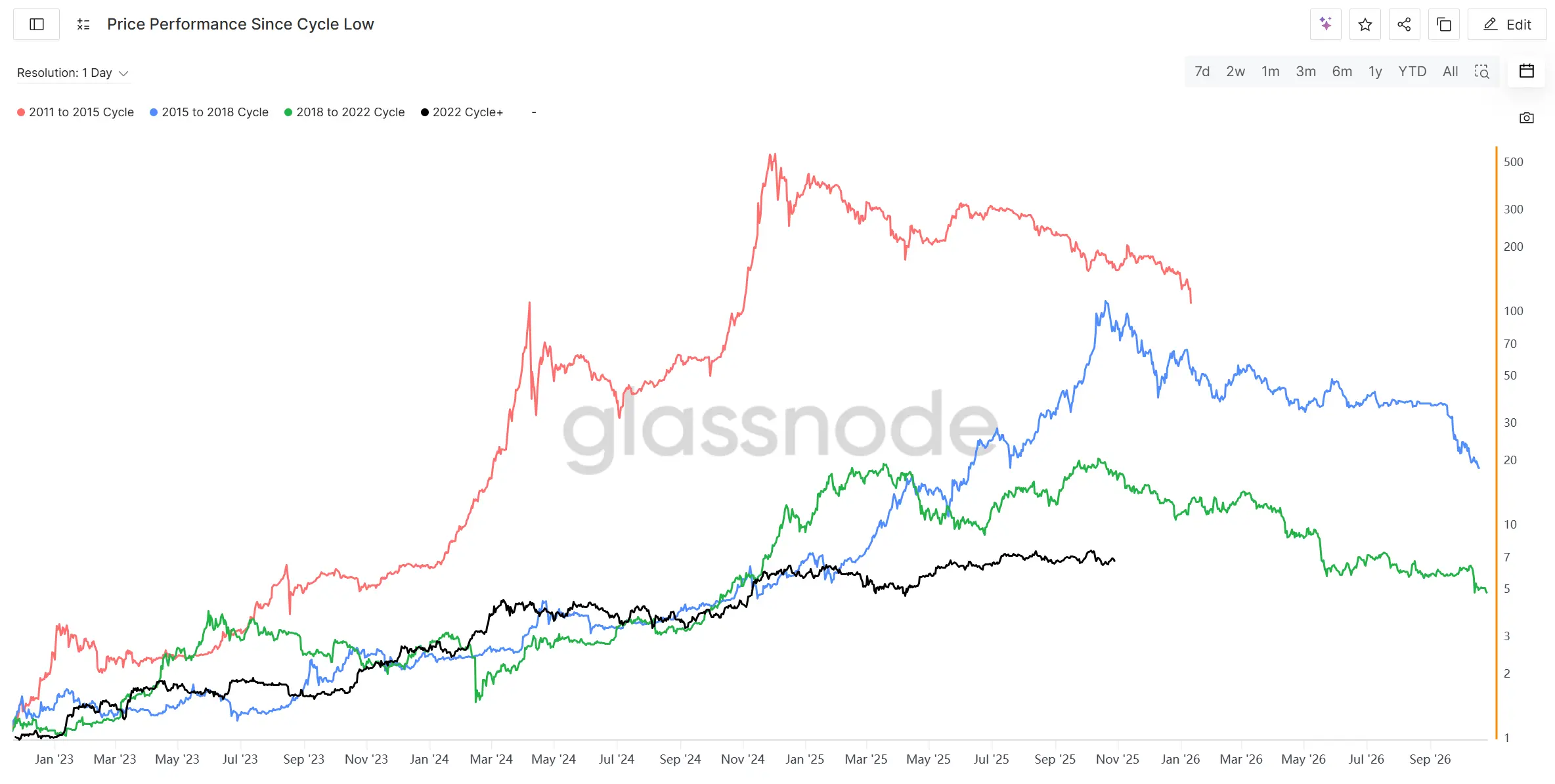

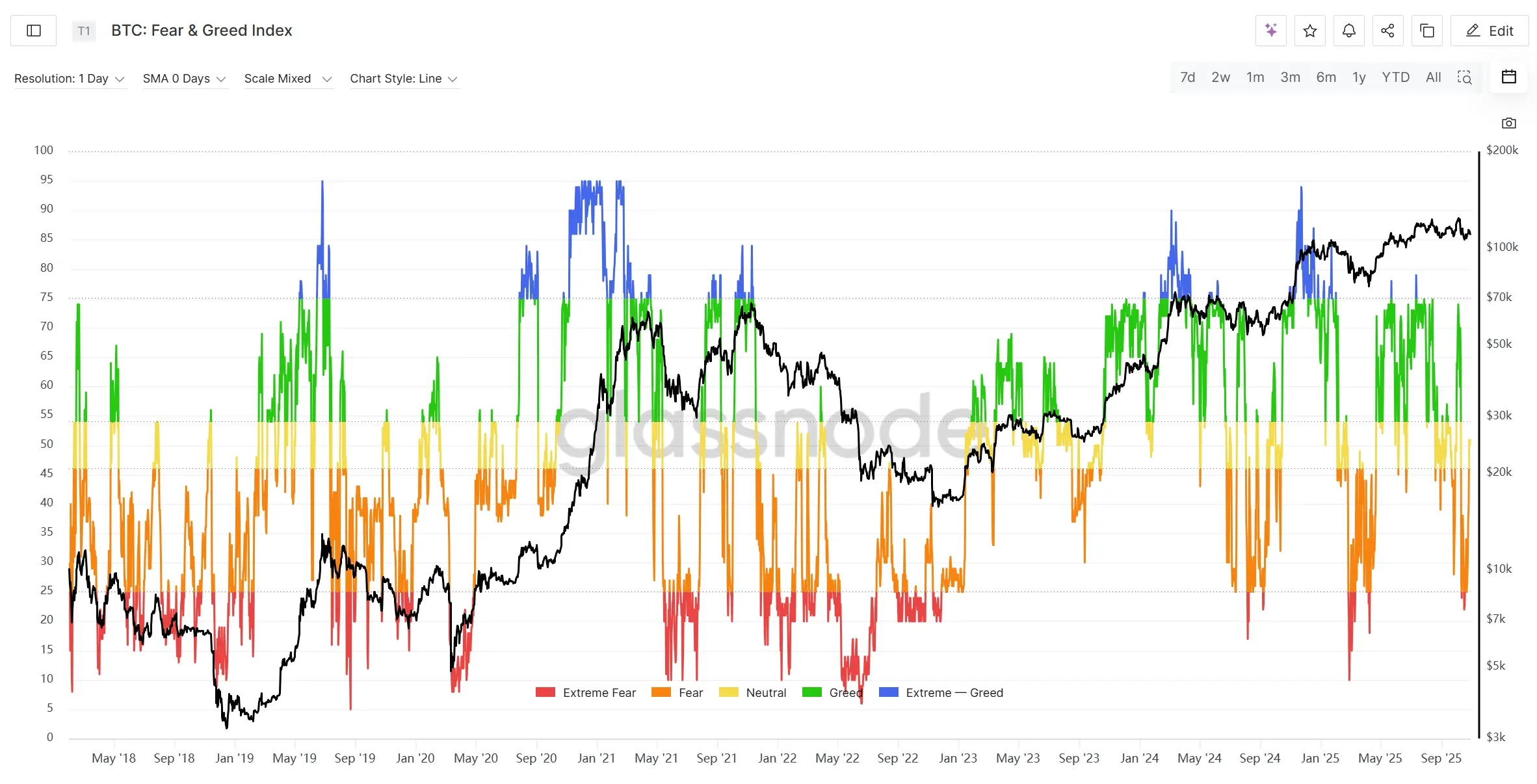

Since the October 11 liquidation event, crypto market sentiment has clearly turned pessimistic, and the four-year cycle—a concept rarely mentioned in this bull market—has once again spread throughout the crypto market. Looking at the operation of the last four bear market lows, the current position is at the high point of the "2015 to 2018" cycle and the last high before entering the bear market in the "2018 to 2022" cycle. From a historical cycle perspective, it seems that the countdown to the bear market has begun, and combined with the 1011 liquidation event, the fear of a bear market is spreading rapidly throughout the crypto market.

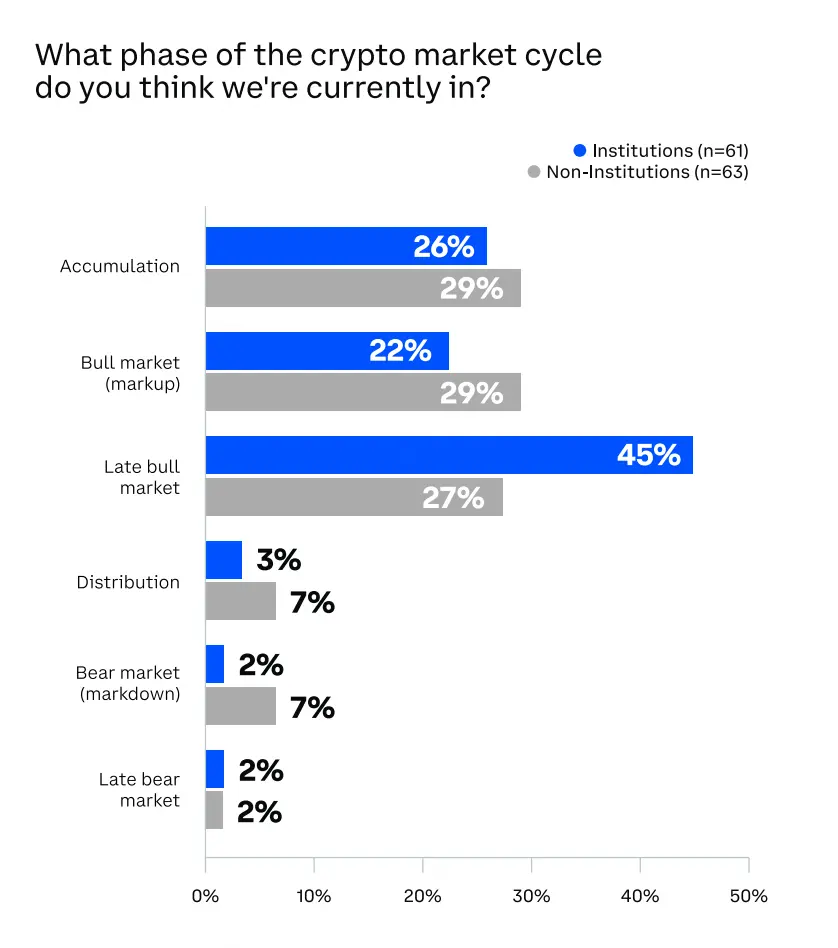

A Coinbase survey of over 120 institutional and retail investors at the end of September showed that, regarding the stage of the crypto market, as many as 45% of institutional investors believed the market was already in the late bull market, while 27% of non-institutional investors chose the same. After the 1011 liquidation event, the proportion choosing late bull market and distribution phase is likely even higher.

In addition, over $20 billion in notional value of long positions in the contract market were wiped out, with a large number of leveraged longs forcibly closed, making it difficult for the market to gather enough momentum for an uptrend in the short term. Secondly, the Crypto Fear & Greed Index quickly fell to around 20 after the 1011 event, a relative bottom range. Although BTC prices have stabilized, the overall index remains at the bottom, indicating that market sentiment is extremely cautious or even fearful, but it also means that a potential rebound will take time to digest risk.

In summary, overall market sentiment is gradually leaning toward the end of the bull market, and the 1011 liquidation event briefly plunged the market into extreme panic. Judging by sentiment alone, the market may continue to fluctuate and decline in the short term, and the recovery of liquidity and investor confidence will take time. If the market cannot reach new highs or the uptrend quickly stalls, a bear market is indeed possible. However, if the "bull market extension" or structure differs from previous cycles, the start of the bear market may also be slower or milder than in history.

Macro Black Swan Events: Rising Uncertainty Again

1. US Government Shutdown

Since October 1, 2025, the US federal government has been shut down due to a budget impasse, becoming the second-longest shutdown in history. Congress failed to pass a temporary funding resolution before the new fiscal year, and the Senate repeatedly failed to reach the 60-vote threshold for Republican proposals, with budget negotiations deadlocked. If Congress and the White House cannot compromise, the shutdown may last until mid-November, with subsequent negotiations focusing on medical subsidies, the debt ceiling, and wage guarantees.

For the crypto market, a government shutdown means lower risk appetite in the short term, and volatility in traditional markets may prompt some funds to seek safety or speculation in crypto assets. However, given the high leverage and volatility in the crypto market, if risk assets are sold off overall, crypto assets will not be spared.

Due to the government shutdown, the release of several economic and employment data has been delayed, which may cause the Fed to maintain its current pace of rate cuts. FedWatch has fully priced in a 50 basis point rate cut on October 29. Combined with the Fed's dovish turn and weak employment, expectations for two 50 basis point rate cuts this year have strengthened, providing underlying support for risk assets, including cryptocurrencies.

2. US-China Trade War

Since October 2025, US-China trade relations have once again become tense, with tariffs and technology export restrictions in focus. The event was triggered by China announcing expanded export restrictions on rare earths and key minerals, prompting a strong US response. Trump then announced that starting in November, the US would impose tariffs of up to 100% on Chinese goods and restrict Chinese companies from accessing key components and software in the US industrial chain, marking an escalation of the trade war from goods to high-tech and strategic resources. Global markets are once again worried about supply chain restructuring and rising inflation. Recently, both sides have shown a slightly softer stance. Trump and his Treasury Secretary have repeatedly stated that high tariffs are unsustainable, US-China relations still have room for cooperation, and they do not want economic decoupling. It is reported that representatives from both sides have begun economic and trade consultations in Malaysia. November 1 is a key date, as tariffs take effect and the two leaders may meet during the APEC summit, which could bring a turning point.

Overall, the US-China tariff conflict remains the biggest uncertainty for global financial and crypto markets and was the direct trigger for the 10·11 crash. Subsequent developments need to be closely watched.

Summary

Overall, October was the most volatile and emotionally pivotal month in this bull market cycle.

On the macro level, the Fed's ongoing balance sheet reduction and TGA account liquidity withdrawal have put global markets at a liquidity bottom. However, with the Fed slowing its reduction and the government reopening, marginal liquidity improvement is expected, and the long-term trend still leans toward easing.

From the internal crypto market perspective, although ETFs have seen net outflows, the scale is limited, and stablecoin supply continues to increase, indicating that on-chain funds are still accumulating. Bitcoin's drop in the largest liquidation event in history was only about 17%, showing its resilience as a core asset. In contrast, the altcoin sector is fragile and highly volatile, and extreme market moves may occur frequently in the future.

On the sentiment side, discussions about the "end of the bull market" have heated up rapidly, and the four-year cycle logic is being widely mentioned again. If liquidity cannot effectively return, the crypto market may gradually revert to the traditional cycle rhythm, entering a high-level consolidation or even the early stage of a bear market. However, if the Fed ends balance sheet reduction early and liquidity is injected again, the crypto market could still extend the bull cycle.

Overall judgment: The current market is in a volatile adjustment phase in the late bull market. Macro liquidity has bottomed but has not yet recovered; systemic risk has not been eliminated, but Bitcoin shows strong resilience. The future trend will depend on the speed of liquidity recovery and market confidence rebuilding. Strategically, a high allocation to mainstream assets (BTC, ETH) should be maintained, altcoin risk exposure should be controlled, and attention should be paid to macro turning signals and the evolution of potential systemic risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Central Bank of Malaysia releases three-year roadmap to pilot asset tokenization projects.

Top 5 Cryptocurrency Predictions for 2026: Crossing Cycles and Breaking Boundaries

The End of the Four-Year Cycle: Five Major Disruptive Trends in Cryptocurrency by 2026.

Top 3 Cryptos Poised for a Strong Comeback After Recent Market Dip