- Toshi is the leading Base meme coin with Coinbase listing and strong community-driven growth.

- OriginTrail builds decentralized AI infrastructure ensuring trust and transparency in data sharing.

- Bitcoin Hyper is a Bitcoin Layer 2 using ZK-rollups for secure, fast transactions and BTC liquidity flow.

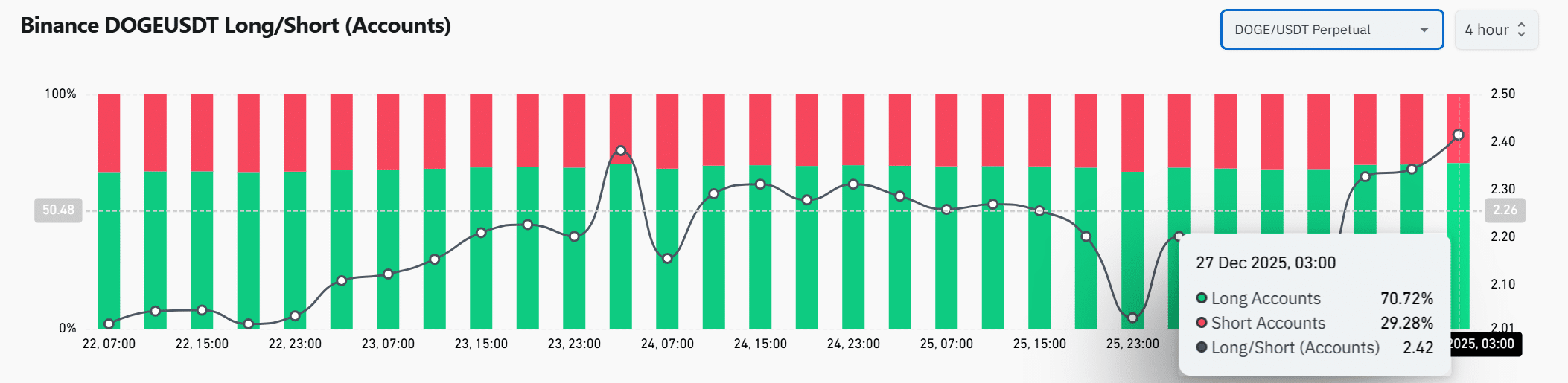

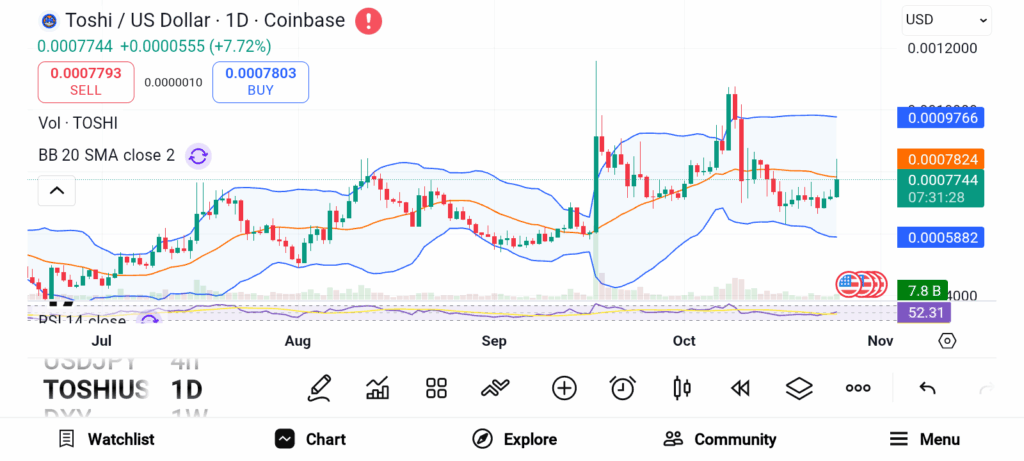

JPMorgan’s forecast of the Base token reaching a $34 billion valuation has fired up the crypto community. Many expect a potential airdrop that could create new wealth for early network users. If this happens, a “Base Season” might emerge as investors rotate their earnings into smaller Base projects. This shift could boost token prices, attract new liquidity, and spotlight several altcoins ready to benefit from the excitement.

Toshi (TOSHI)

Source: Trading View

Source: Trading View

Toshi has become the breakout meme coin on the Base network, recently surpassing Brett in market dominance. The token enjoys a unique advantage — it’s listed on Coinbase, which increases accessibility and visibility. Toshi calls itself “the face of Base,” presenting a fun, cat-themed identity that resonates with meme culture.

Beyond the memes, Toshi features NFTs, community art, and official merchandise. These additions create a lively, creative ecosystem that keeps users engaged. The coin gained around 5% today, signaling growing community confidence and strong buying activity. If a Base airdrop happens, many investors could channel their profits into Toshi, seeking quick upside potential.

OriginTrail (TRC)

Source: Trading View

Source: Trading View

OriginTrail brings a serious dose of innovation to the Base ecosystem. The project builds decentralized AI infrastructure designed to create trust in data. In an era where AI grows smarter every year, data reliability has become a real concern. OriginTrail addresses that by using decentralized knowledge graphs (DKGs) to verify and organize information.

These DKGs form a transparent trust layer, allowing data to be traced and validated across networks. This feature matters because AI models often struggle to confirm the truthfulness of their sources. OriginTrail solves that challenge by making information verifiable and tamper-proof.

Bitcoin Hyper (HYPER)

Source: Trading View

Source: Trading View

Bitcoin Hyper stands out as the first Bitcoin Layer 2 blockchain powered by ZK-rollups and built on the Solana Virtual Machine (SVM). This setup means transactions remain fast and low-cost while maintaining Bitcoin-level security. The ZK-rollup design bundles multiple transactions and reports them back to Bitcoin’s main chain, preserving transparency and trust.

A major highlight is the Trustless canonical bridge, which allows users to move BTC seamlessly between Bitcoin and the Layer 2 network. That bridge opens the door for Bitcoin liquidity to flow into the ecosystem, driving potential growth and broader adoption. Bitcoin Hyper merges Bitcoin’s strength with Solana’s speed, giving users the best of both worlds.

JPMorgan’s $34 billion Base token forecast signals growing confidence in the network’s future. Toshi captures the spirit of the Base community with creativity and culture. OriginTrail advances trust in AI data, offering real innovation. Bitcoin Hyper bridges Bitcoin and scalability for next-generation adoption.