$33,000,000,000 in 6 Hours Gained by Crypto Market in Massive Reversal

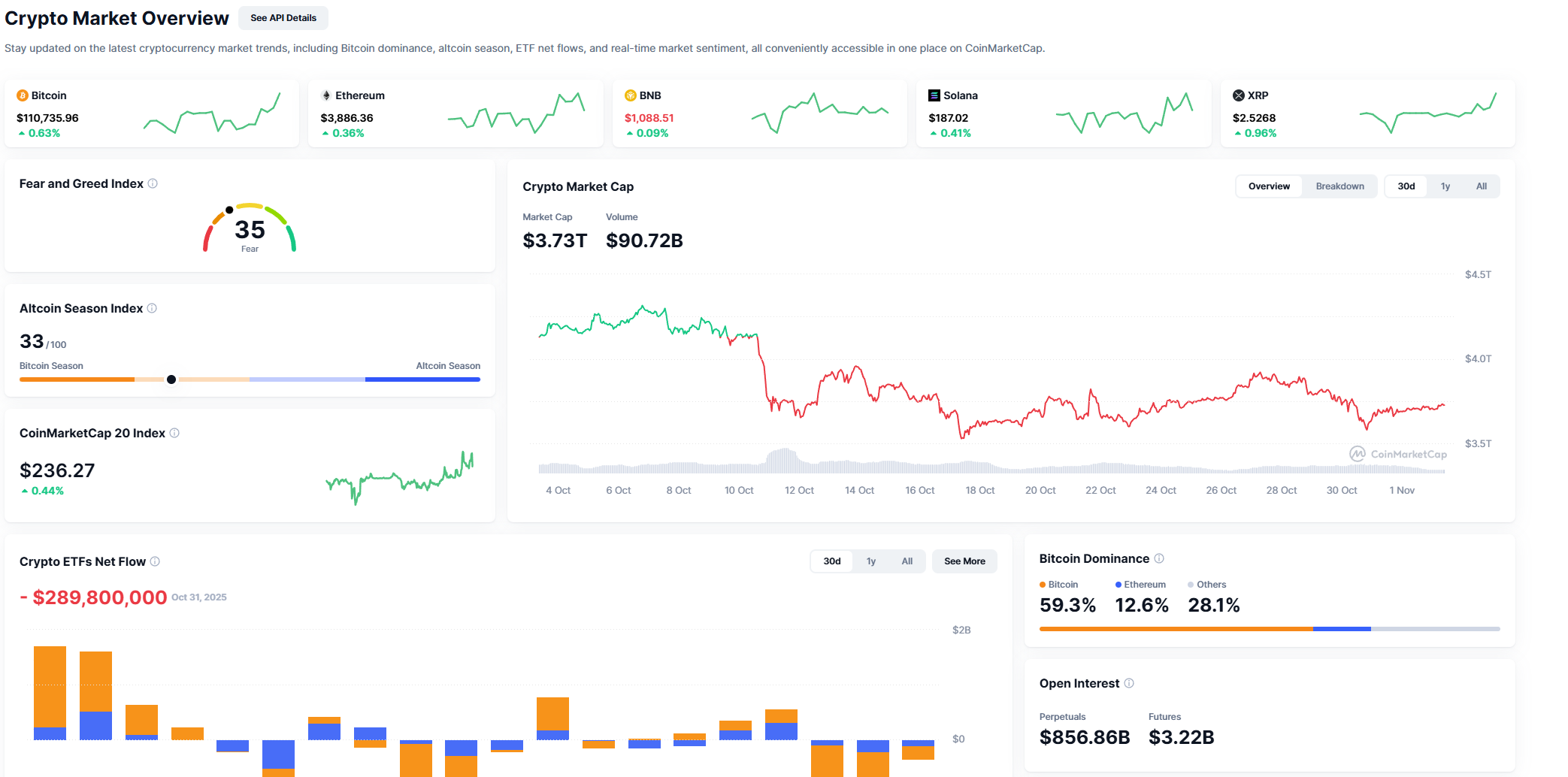

The cryptocurrency market experienced an abrupt surge of bullish momentum, adding over $33 billion in total capitalization in just six hours, indicating a short-term shift in traders’ risk-on stance. Bitcoin, Ethereum and XRP led the charge as the rally propelled almost all significant assets into the green.

Massive market growth

Bitcoin increased 0.67% to approximately $110,700, while Ethereum (ETH) increased 1.22% to regain the $3,850 mark, according to market data. Following closely behind, XRP saw a daily gain of 11%, which was sufficient to overtake BNB and reclaim the fourth-largest cryptocurrency position by market capitalization.

At $152.2 billion, XRP’s total market capitalization is now ahead of BNB’s $150.4 billion, a slight but significant lead that indicates a resurgence of investor interest. Solana (+1.04%), Cardano (+0.62%) and Dogecoin (+0.61%) are all included in the sea of green that is the overall market heat map.

Staying positive

As Bitcoin’s stable position above its 200-day moving average restored some confidence, buying pressure briefly increased even for smaller-cap assets. The technical setup for Bitcoin is still cautiously optimistic, it is still above the crucial $108,000 support zone, and the next resistance cluster is forming close to $113,800-$114,000, which is in line with the 100-day moving average.

Ahead of significant macro data releases, the timing of the rally points to aggressive short liquidations and updated institutional positioning. Although most large caps’ RSI levels are still neutral, this move might be more of a relief rally than the beginning of a full-scale bull run.

Right now, all eyes are on XRP, whose return to the fourth spot may spark new conversations about its long-term potential in payments and remittances. The general lesson, however, is obvious: traders are back in action, liquidity is returning, and the cryptocurrency market has just served as a reminder to everyone of how quickly momentum can change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fortress Ruble: Russia Closes Crypto Access to Bolster Digital Independence

- Russia's central bank bans domestic crypto payments, prioritizing its digital ruble CBDC launch by 2026 to reinforce financial sovereignty. - Stablecoins are allowed for international trade but prohibited domestically, balancing innovation with central bank control over monetary policy. - The policy aims to prevent crypto-driven financial instability, restrict domestic crypto use to speculation, and align with China's state-controlled CBDC model. - Critics argue the ban stifles innovation, while proponen

Bitcoin News Today: The Cryptocurrency Market Weighs AI Advancements and Trading Optimism Amid Regulatory and Global Political Challenges

- Blazpay (BLAZ) raised $1M in its presale, selling 87% of 157M tokens via audited AI-driven smart contracts and gamified rewards. - Corporate Bitcoin holdings grew: Coinbase added 2,772 BTC ($320M), while MicroStrategy's stash now controls 3% of total supply with $12.9B gains. - U.S.-China trade deal reduced crypto hardware costs by 20%, potentially boosting market growth by 15% in 2026 but triggering $471M ETF outflows post-announcement. - Regulatory scrutiny intensified as Singapore froze $150M in crypt

Trump’s Crypto Clemency: A Bold Move for Progress or a Moral Dilemma?

- Trump's 2025 pardon of Binance CEO CZ sparked debate over crypto ethics and U.S. regulatory leadership amid global competition. - The move faced criticism for alleged conflicts, including CZ's $2B investment in Trump-linked crypto ventures and prior regulatory violations. - Critics called it "pay for play," while supporters argued it boosted crypto innovation, citing a 15% post-pardon investment surge in U.S. firms. - Democrats demanded investigations as political tensions rose, with Trump framing the pa

SUI News Today: Investors Consider Blazpay's Presale Pressure Versus Sui's Volatile Surge

- Blazpay's AI-powered Layer 1 token presale nears 94% completion, raising $1M with 25% price hike imminent. - Sui (SUI) shows bullish technical indicators, targeting $3.00 as it stabilizes above $2.28 amid growing DeFi adoption. - Both projects position as high-growth AI-integrated blockchain alternatives to legacy platforms like Tron and Solana. - Blazpay's $0.0075 presale offers asymmetric upside potential, with $3K investment projecting $80K gains if reaching $0.20 post-listing. - Sui faces $653M token