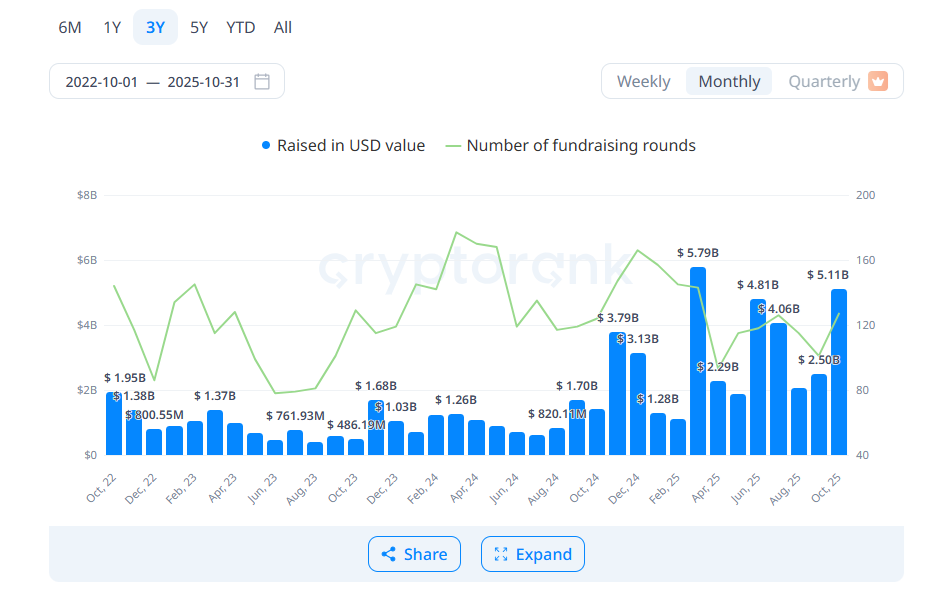

Crypto Venture Funding Rebounds: Surges to $5.11B in October

Crypto venture capital activity continued its steady recovery in October, closing the month with $5.11 billion in reported deals. Investor confidence strengthened after a slower summer, and funding levels nearly matched the March 2025 peak of $5.79 billion. Early data suggests that October’s final total could rise further once all undisclosed rounds are reported.

In brief

- October crypto VC deals hit $5.11B, the second-highest since 2022, signaling renewed investor confidence.

- The U.S. led with $2.26B in funding, while international projects added $1.63B in undisclosed deals.

- 127 rounds closed, led by Coinbase Ventures; Echo and Kalshi headline large late-stage raises.

- AI-linked crypto projects captured 32% of funding as NFT and gaming investments continued to fade.

US Leads Crypto VC Revival as October Funding Hits $5.11B

Venture activity gained momentum across late-stage projects, indicating that investors favored established ventures over early experimental platforms. The United States maintained its dominant position, securing $2.26 billion in deals.

Meanwhile, international projects with undisclosed deal details contributed another $1.63 billion. Overall, October ranked as the second-strongest month for crypto VC activity since 2022.

Over the past year, funding patterns have undergone notable shifts. Investors are focusing more on projects with proven business models and less on speculative tokens with limited liquidity. This change reflects lessons learned from the 2021–2022 cycle, during which many low-float assets struggled in secondary markets.

VC Market Recovers with 127 Deals and Late-Stage Focus

A total of 127 funding rounds closed in October, marking a return to typical investment activity levels. Coinbase Ventures once again led the space, participating in 10 rounds, followed by Yzi Labs with five deals.

Echo’s $375 million raise, led by Coinbase Ventures, was one of the month’s largest announcements. Founded by well-known crypto personality Jordan Fish (also known as Cobie), Echo attracted significant institutional attention. Prediction market platform Kalshi also raised $300 million, reinforcing the trend toward larger, late-stage investments.

Average deal sizes ranged between $3 million and $10 million, although major rounds such as Kalshi and Tempo helped lift overall totals. Larger fund allocations have become increasingly common as mature projects seek growth capital.

Investment activity was concentrated in several key sectors:

- AI-linked crypto projects accounted for 32% of all funding activity.

- Binance Alpha initiatives made up more than 15% of total deals.

- Real-world assets (RWA) and payment solutions remained steady investment targets.

- Developer tools continued attracting mid-sized rounds.

- NFT and gaming projects saw limited funding, reflecting a shift away from 2021’s dominant categories.

Coinbase Ventures also participated in several smaller rounds between $5 million and $20 million, expanding its footprint across early infrastructure and application layers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Eric Trump Set to Address Political Challenges in Bitcoin Talk at Florida Event

- Eric Trump will keynote Florida's Blockchain Futurist Conference 2025, spotlighting American Bitcoin's $445M BTC holdings and 6.23% stock surge. - The Trump-linked firm, formed by merging American Data Centers and Hut 8 , now holds 80% stake and plans $2.1B expansion to boost Bitcoin exposure. - Political scrutiny grows as Rep. Ro Khanna pushes to ban foreign crypto funding for Trump allies, following Trump's pardon of Binance founder Zhao. - American Bitcoin's vertically integrated model reduced costs b

Noomez Faces Transparent Roadmap Hurdles Amid Meme Coin Turmoil

- Solana's meme coin market sees extreme volatility, with Trump Coin ($TRUMP) surging to $1.59B market cap driven by political hype. - Noomez ($NNZ) counters chaos with deflationary mechanics, burning unsold tokens and offering transparent on-chain metrics via its 28-stage presale. - By locking liquidity and vesting team tokens, Noomez aims to prevent rug pulls while contrasting with short-term-focused models like SafeMoon. - The project's structured roadmap and fixed supply create predictable deflation, a

DoorDash's Financial Results to Gauge Market Resilience Amid Sharp Declines in Crypto and Stocks

- Cryptocurrency markets plummet as Bitcoin and Ethereum hit multi-month lows amid macroeconomic fears and regulatory uncertainty. - Altcoins lose over 30% in a week, reigniting debates about crypto's viability as FTX and Binance inject liquidity to stabilize prices. - DoorDash faces 14.5% YTD stock decline despite 24.1% revenue growth, with investors scrutinizing margins amid rising costs and social initiatives. - Collaborations with Waymo on autonomous delivery and McDonald's 20-minute delivery model hig

Michael Saylor restarts the Strategy machine with 397 new BTC