Key Market Information Discrepancy on November 3rd - A Must-Read! | Alpha Morning Report

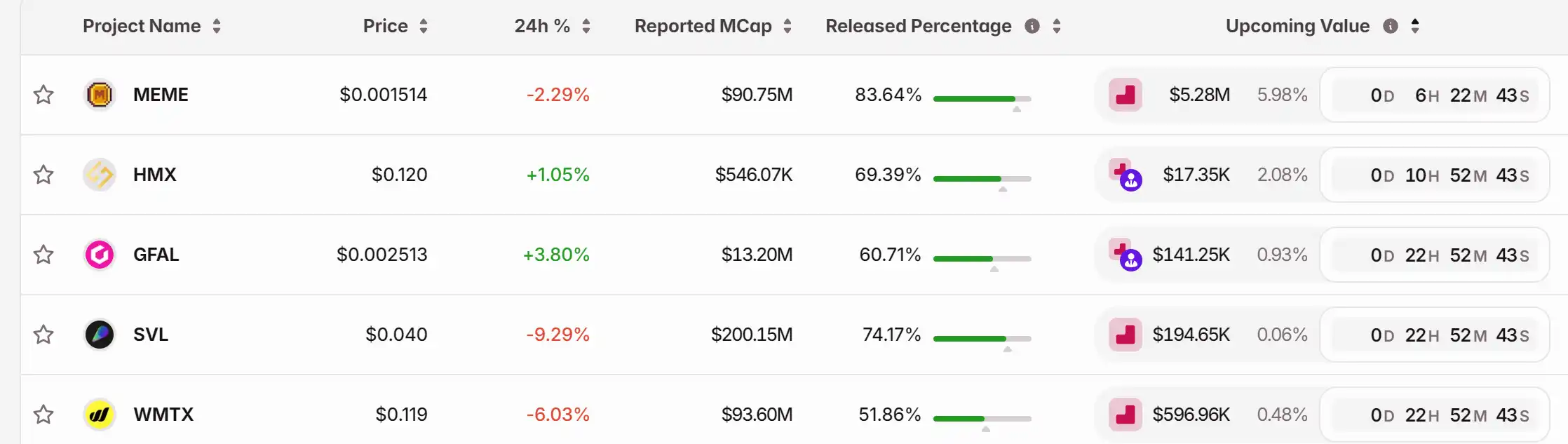

1. Top News: Less than 24 Hours Left Until Monad Airdrop Claim Period Ends 2. Token Unlock: $MEME, $HMX, $GFAL, $SVL, $WMTX

Featured News

1. Less Than 24 Hours Left Until the End of the Monad Airdrop Claim Period

2. ASTER Surges Over 17% in a Short Period, CZ Previously Tweeted About Buying ASTER Today

3. Pump.fun Has Repurchased PUMP Tokens Worth Over $160 Million in Total

4. ZK Surges Above $0.075 Briefly Before Retracing, Up Over 94% in 24 Hours

5. Driven by ZKsync's Surge, Tokens in the ZK and L2 Sectors Show Significant 24-Hour Gains

Articles & Threads

1. "Q3 Earnings Report: While Crypto Prices Cooled Off, Coinbase's Money-Making Machine Heated Up"

On October 31, 2025, Coinbase released its Q3 earnings report, which came at just the right time, injecting a dose of optimism into the liquidity-starved crypto industry. Total revenue was $1.87 billion, up 55% year-over-year and 25% quarter-over-quarter. Net profit reached $433 million, compared to just $75.5 million in the same period last year. Earnings per share were $1.50, surpassing analyst expectations by 45%.

2. "Smart Payments: The Evolutionary Path of the Next-Generation Payment System"

We are standing at a new inflection point. Agentic Payments are reshaping the fundamental logic of transactions. From in-chat GPT settlements to micro-payments between agents, and onto a new order of the web where machines pay for content—the picture of the "Agent Economy" is gradually emerging. If you care about the convergence of AI and blockchain, the practical path of next-gen payment protocols, or are pondering the automation trends of future business, this article is worth your time to read.

Market Data

Daily Market Overall Funding Heatmap (reflected by funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Mutuum Finance's DeFi Strategy: Balancing Stability Against Shiba Inu's Fluctuations

- Mutuum Finance (MUTM) raises $18.27M in presale with 80% completion, targeting $0.06 launch price for 400% potential gains. - Project combines Solana's utility-driven growth with SHIB's viral appeal via dual-lending model and automated risk management protocols. - CertiK audit (90/100) and $50K bug bounty address DeFi security risks, while buy-and-distribute mechanism boosts token value retention. - Whale investments and structured tokenomics (45.5% presale allocation) signal institutional confidence ahe

Bitcoin News Update: Retail Investors Panic While Institutions Accumulate as Bitcoin Challenges $106K Support Level

- Bitcoin fell below $100,000 on October 30, 2025, its first drop in six months amid heightened volatility. - ETF outflows ($488M) and institutional buying (397 BTC at $114,771) highlight retail caution vs. institutional confidence. - Analysts warn of 65%-70% drawdown risks over two years, citing weak investor understanding and panic selling cycles. - Regulatory shifts (e.g., Wyoming stablecoin plans) offer partial support but fail to offset year-to-date price swings ($67k-$124k). - Market uncertainty pers

Ethereum News Update: BullZilla Soars by 2,381%, Outperforming ETH and PEPE Amid October Decline

- BullZilla ($BZIL) surged 2,381% in October 2025, defying market downturns with deflationary tokenomics and a 24-stage presale model. - Ethereum (ETH) and Pepe (PEPE) declined 2.45% and 5.92% respectively amid broader "October Clearance Sale" corrections. - BullZilla's structured approach, including staking rewards and token burns, attracted $1M in presale funds and 3,300+ holders. - Analysts highlight BullZilla's measurable performance and transparent design as key differentiators in the competitive meme

Genius Sports Sees Revenue Growth Despite Lower Profits; Analysts Maintain $15 Price Target

- Genius Sports (GENI) reports Q3 2025 earnings with $156.27M revenue but -$0.18 EPS, showing revenue growth vs. worsening losses. - Analysts maintain "Outperform" rating (avg. $15 target, 33% upside) despite GF Value model suggesting $10.45 fair value. - Stock faces pressure from profitability challenges, with June 2025 post-earnings drop highlighting revenue-profitability disconnect.