4E: The "Bitcoin price will inevitably fall after halving" rule may no longer hold true; the EU plans to expand cryptocurrency regulation.

On November 3rd, according to 4E observation, the traditional volatility pattern of Bitcoin after halving may be failing. Data shows that the current Bitcoin volatility is below 2%, hitting a historical low, while during the third halving period in 2020, the volatility once exceeded 5%. Keiji Maeda, a senior executive at the Japanese crypto company BACKSEAT, pointed out that with increased market liquidity and institutional participation, the impact of individual investors' short-term behavior on prices is weakening, and the so-called "post-halving correction" empirical rule may no longer apply.

In the EU, the European Commission is planning to expand central supervision of stock and cryptocurrency exchanges. The new proposal will give more power to the European Securities and Markets Authority, covering "the most important cross-border entities," to promote the construction of a "capital market union" and reduce regulatory fragmentation. The related proposal is expected to be officially presented in December.

On the other hand, Michael Saylor, Chairman of Strategy, stated that the company currently has no plans to acquire other Bitcoin asset reserve companies, citing the high uncertainty and long cycle involved in such mergers.

Regarding investment institutions, the latest top 15 holdings of ARKK ETF under Cathie Wood show that companies related to cryptocurrencies such as Coinbase (5.8%) and Circle (2.55%) have significant weight, indicating their continued bet in the new round of technology and digital asset cycle.

4E comment: Bitcoin entering a historical low volatility range may indicate that the market structure has shifted from speculation-driven to fund stability. If EU regulatory integration and institutional allocation trends advance simultaneously, cryptocurrency assets may gradually enter a "low volatility stable bull" phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US-China Trade Deal’s Impact on Crypto Markets

Borrowing the Fake to Achieve the Real: A Web3 Builder's Self-Reflection

Honeypot Finance’s AMM Perp DEX addresses the pain points of traditional AMMs through structural upgrades, including issues such as zero-sum games, arbitrage loopholes, and capital mixing problems. These upgrades achieve a sustainable structure, layered risk control, and a fair liquidation process.

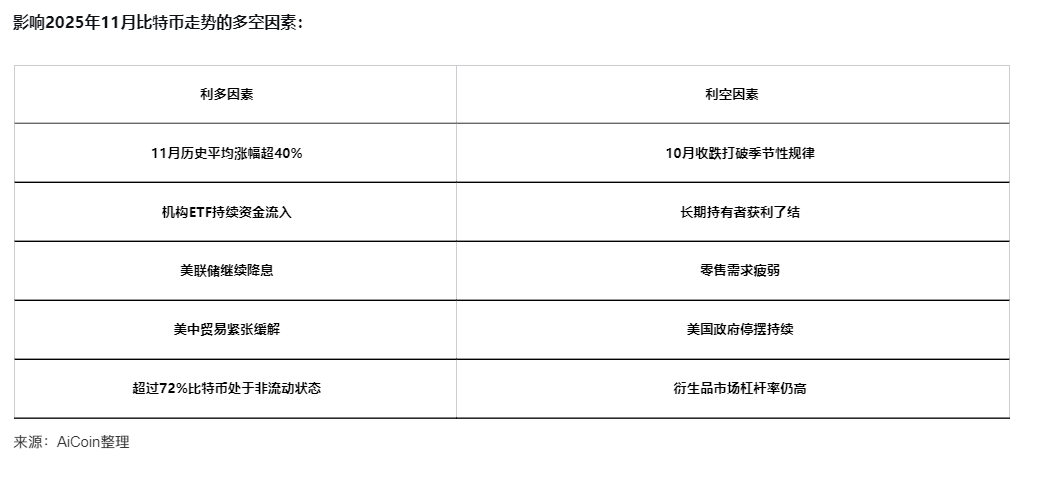

Bitcoin closed lower in October—can November bring a turnaround?

Trump’s Crypto Magic: From “Don’t Know” to a $2 Billion Pardon Spectacle