Bernstein Hikes Bitcoin Miner Targets as AI Infrastructure Play Continues to Gain Momentum

Bitcoin BTC$107,661.53 miners are now an integral part of the artificial intelligence (AI) value chain, Wall Street broker Bernstein said in a note Monday updating its model for the sector.

The broker argued that miners’ large-scale power infrastructure and facilities have become critical to AI data centers, now seen as the biggest execution bottleneck for the fast-growing industry.

Every U.S.-listed bitcoin miner the broker covers has pivoted toward maximizing the value of its power assets rather than betting on bitcoin price upside, analysts led by Gautam Chhugani wrote.

The firm's analysts abandoned their discounted cash flow (DCF) methodology in favor of a sum-of-parts valuation, combining miners’ bitcoin holdings, mining EBITDA, AI co-location and cloud revenues, and the potential value of power sites earmarked for AI data centers—using a conservative $3 million per megawatt (MW) multiple.

Bernstein lifted its price target for Core Scientific (CORZ) to $24 from $17, citing the company’s pivot toward high-performance computing (HPC) colocation and its plan to deliver about 590 megawatts of IT load by early 2027.

The report noted that shareholders’ rejection of the CoreWeave deal gives management more room to optimize value and hinted at a new partnership expected in the fourth quarter.

Riot Platforms (RIOT) also saw its target raised to $25 from $19, reflecting the AI potential of its 1-gigawatt Corsicana site. while CleanSpark (CLSK) was lifted to $24 from $20 as it moves toward a hybrid bitcoin-AI model through new hires and partnerships.

Bernstein rates IREN, CORZ, RIOT, and CLSK outperform, the broker said bitcoin miners with active or potential AI contracts are being re-rated by the market as key enablers of the next generation of computing infrastructure.

Mining stocks were flying in premarket trading following news of IREN's AI cloud deal with Microsoft.

IREN was 21% higher in early trade, around $60.75. Core Scientific shares were 6.8% higher at $23. Riot stock was 3% higher at $20.38. CleanSpark rose 3.6% to $18.44.

Read more: Bitcoin Network Hashrate Hit Record High in October, JPMorgan Says

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cryptocurrencies continue to "crash" on Monday, with some tokens falling back to the flash crash lows of October

Institutional demand for Bitcoin has fallen below the rate of new coin mining for the first time in seven months, suggesting that major buyers may be pulling back.

Crypto Market Crash: Henrik Zeberg Says Capitulation Is Setting Stage for a Massive Bull Run

Ripple Unlocks 1 Billion XRP Amid Market Weakness What It Means for Investors

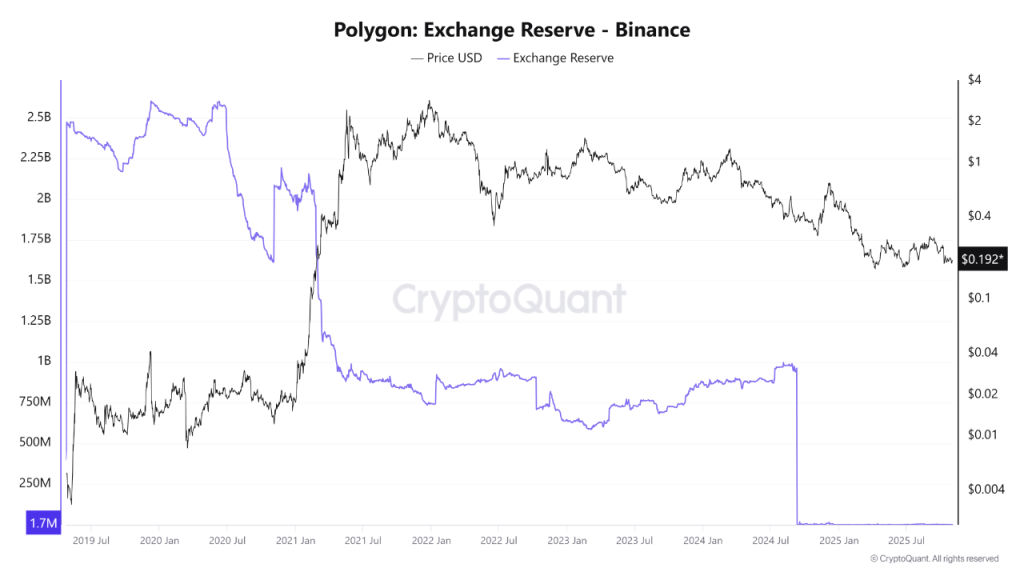

Can Polygon Rise 500%? A Look at Polygon Price Prediction 2025