Fake News Floods Pi Network Community as Exchange Supply Hits a New High

Pi Network faces a surge of misinformation about an alleged Global Consensus Value launch and ISO 20022 ties. While the Pi Core Team continues fighting fake news, rising exchange supply signals growing investor unease.

In November 2025, the Pi Network community has been buzzing with exciting and promising updates about the project’s development. However, behind the enthusiasm lies a wave of fake news circulating on X, aimed at manipulating sentiment and Pi’s perceived value.

The Pi Core Team (PCT) has not confirmed or officially announced these reports. Instead, influential Pioneers with large followings mainly spread them, fueled by investors’ tendency to believe what they want to hear.

What Fake Stories Are Circulating in the Pi Network Community This November?

In early November, Pioneers began spreading news that the Global Consensus Value (GCV) would officially launch on November 22, 2025, with participation from major financial institutions. This rumor quickly captured attention.

🌍🔥 THE PI REVOLUTION HAS BEGUN – GCV GOES LIVE ON NOVEMBER 22, 2025!November 22, 2025 marks a historic milestone as GCV officially goes live and the ISO 20022 standard switches on, launching a new era where Pi Network connects directly with major global banking…

— Learn everything (@dannamviet) November 2, 2025

As GCV supporters claim that each PI token should be valued at $314,159. The mathematical constant π inspires this number. However, the project’s core team has never mentioned or acknowledged the existence of GCV.

The rumor originated from earlier speculation that Pi Network was moving closer to ISO 20022 compliance, and might connect with Stellar (XLM) and Ripple (XRP) to bridge crypto with traditional finance.

Based on this narrative, some Pioneers interpreted that a middleware system would soon allow Pi to connect with traditional institutions, making Pi transactions interoperable with banks.

However, the account Pi Network argued that such claims are unreliable, explaining:

- The Pi Core Team has neither announced nor recognized GCV nor confirmed an official launch date of November 22.

- Assigning a specific date is a hallmark of fake news, used to plant hope in investors and manipulate price expectations.

- The story about Pi’s alignment with ISO 20022 did not originate directly from the PCT; most community discussions are interpretations that are favorable to Pi Network.

- The idea of a simple middleware connecting Pi and banks is oversimplified. Research from Stellar shows that such integration is highly complex and typically requires a stablecoin bridge.

“For reference, November 22nd is the date when the SWIFT network stops routing old-style MT messages. This only applies to members of the SWIFT network, which is a private cooperative. SWIFT is a messaging network, while Pi is a blockchain — blockchains transmit value, not messages,” X Account Pi Network said.

In August, the Pi Core Team launched a campaign encouraging the community to report misinformation.

However, many investors still choose to believe information that benefits their portfolios, even when it lacks verification or credible sources.

“Remember: Only what Pi Core Team says is real,” Pi Network added.

Meanwhile, Pi Supply on Exchanges Hits a Record High

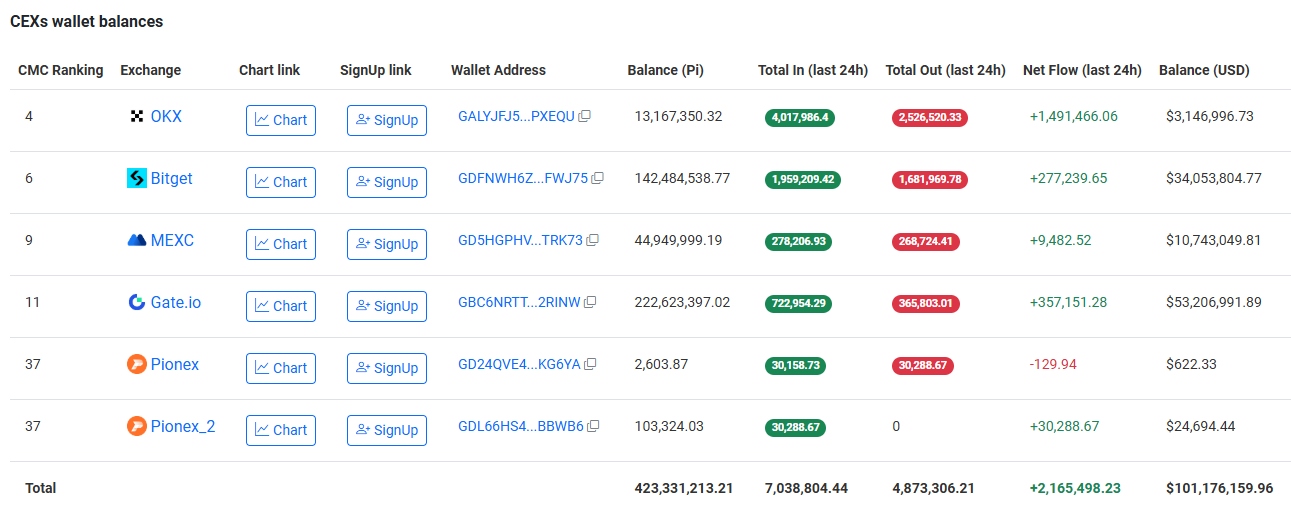

In the first week of November, the Pi exchange balance reached a new all-time high of over 423 million PI, increasing by more than 13 million PI compared to previous reports. In the past 24 hours alone, more than 2 million PI tokens have been transferred to exchanges.

Despite some positive developments — such as the AI-based KYC system upgrade and Pi Network Ventures’ first investment in OpenMind — many holders continue to sell. The overall market sentiment remains dominated by fear.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Ripple Establishes Wall Street Connection for Digital Assets as RLUSD Exceeds $1 Billion

- Ripple Labs launched Ripple Prime, a Wall Street-style OTC brokerage for institutional crypto trading, alongside RLUSD's $1B market cap milestone. - The platform enables cross-margining between XRP/RLUSD and traditional assets, addressing liquidity gaps via Ripple's custody and payments infrastructure. - XRP now serves as a core institutional asset for hedging and financing, bridging traditional portfolios with digital markets through compliance-focused infrastructure. - This hybrid model aims to reshape

Crypto’s Regulatory Balancing Act: How the US and Nigeria Weigh Innovation Against Combating Fraud

- U.S. regulators face controversy over Trump's pardon of Binance founder CZ, raising concerns about regulatory consistency and crypto-business ties. - Nigeria's SEC reports $218M in crypto Ponzi scheme losses, pushing for stricter oversight to combat fraud exploiting investor greed. - U.S. Congress debates crypto regulatory framework amid bipartisan divides, seeking clarity for an evolving digital asset landscape. - Global crypto markets grapple with balancing innovation incentives against fraud preventio

Bitcoin News Update: Investors Move Toward Mining and Infrastructure as Bitcoin Holdings Decline During Market Fluctuations

- Bitcoin exchange holdings fell 209,000 BTC in six months as institutions shift toward mining infrastructure and structured products amid volatility and regulatory uncertainty. - U.S. Bitcoin ETFs lost $946M last week, driven by Fed Chair Powell's hawkish stance and government shutdown-induced economic data gaps, while European/Asian funds saw inflows. - MicroStrategy's $45B Bitcoin reserve grew to 612,000 BTC through Saylor's accumulation strategy, while Matador aims to add 1,000 BTC by 2026 via $100M co

States and Judges Stand Up for SNAP Amid Congressional Stalemate

- U.S. government shutdown enters 31st day as bipartisan leaders seek resolution while states and judges act to protect SNAP benefits. - Oklahoma allocates $1M/week from emergency funds to support food banks, targeting 680,000 residents as federal aid dwindles. - Federal judges mandate $5B contingency fund use for SNAP, rejecting administration claims of legal barriers to sustain benefits. - Political blame shifts between parties, with Republicans citing Democratic filibuster delays and Democrats accusing