Why can't cryptocurrencies generate long-term value?

Transformation is no longer a strategy, but has become the business model itself.

Transformation is no longer a strategy, but has become the business model itself.

Written by: rosie

Translated by: Luffy, Foresight News

Most of the crypto founders I know have now gone through three transformations.

The group who built NFT platforms in 2021 shifted to DeFi yield projects in 2022, then jumped on the AI agent bandwagon from 2023 to 2024, and now they are busy chasing the current hot trend (maybe prediction markets?).

There’s nothing wrong with pivoting itself; in many ways, it’s a choice that follows the rules of the game. But the problem is, this set of rules structurally determines that any long-termist building is out of the question.

18-Month Product Cycles

Narrative emerges → capital flows in → everyone pivots → 6-9 months of development → narrative cools off → pivot again.

This cycle used to be 3-4 years, then shortened to 2 years, and now, if you’re lucky, it’s only 18 months.

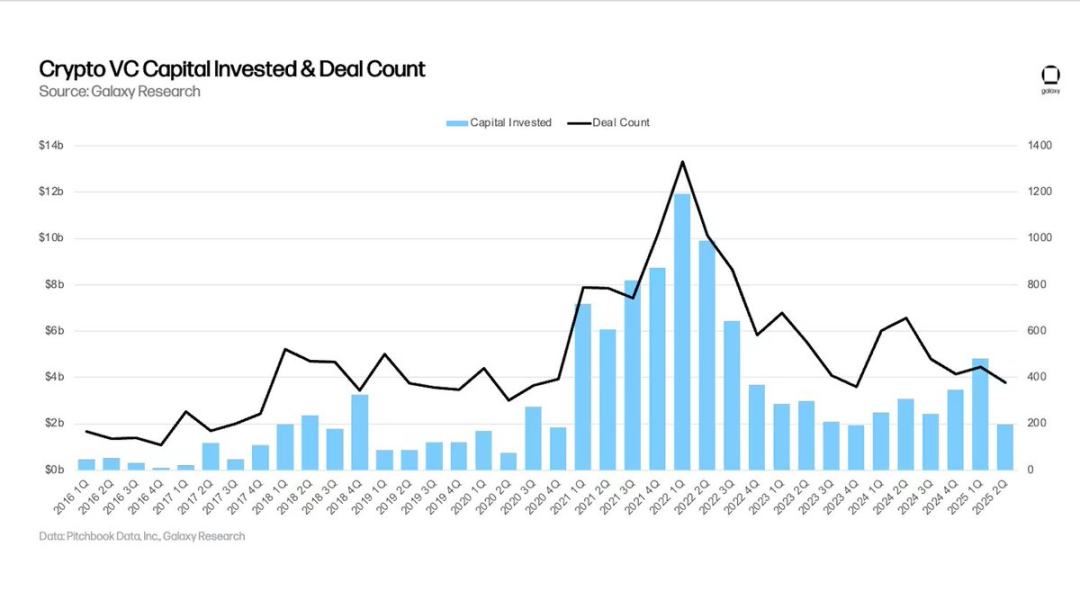

In Q2 2025, crypto venture capital plummeted nearly 60% in a single quarter, and founders have even less time and funding before the next trend forces them to pivot again.

The key issue is, 18 months is simply not enough to build anything meaningful. Real infrastructure takes at least 3-5 years to establish, and true product-market fit requires years of iterative optimization, not just a few quarters.

But if you’re still clinging to last year’s narrative, you become an “ineffective asset.” Investors avoid you, users leave, and some investors may even force you to chase the current hot trend. Meanwhile, your team members start interviewing with projects that have just raised funds on the latest narrative.

The Sunk Cost Fallacy as a Survival Mechanism

Traditional business advice is: don’t fall into the sunk cost fallacy—if something isn’t working, pivot in time.

The crypto industry takes this to the extreme, turning it into “maximizing sunk costs.” No one sticks with anything long enough to see if it’s truly viable.

Pivot at the first sign of resistance, pivot when user growth slows, pivot when fundraising stalls.

Every founder faces this trade-off:

- Continue developing the current product, which may take 2-3 years to see results, and if lucky, maybe raise another round;

- Pivot to a hot narrative, immediately secure funding, show paper gains, and exit before anyone realizes the project doesn’t work.

Most of the time, the latter is the better choice.

The Dilemma of Incompletion

Very few crypto projects actually complete their set development goals. Most projects are always “almost done,” always just one feature away from product-market fit.

But they never truly finish, because halfway through development, the narrative changes. Suddenly, the DeFi protocol you’re wrapping up becomes meaningless because everyone is talking about AI agents.

The market punishes “completion”: finished products have clear limitations, while unfinished products have infinite room for imagination.

Capital Chases Attention, Not Results

The actual fundraising situation is clear:

- Brand new narrative + no product: raises $50 million;

- Mature product with established narrative: struggles to raise $5 million;

- Old narrative + product + real users: can’t raise any funds at all.

Venture capital doesn’t invest in products, but in attention. And attention always flows to new narratives, not completed old projects. Today, most teams are “maximizing narrative value,” optimizing purely for a fundable story, with no regard for what they’re actually building. Completion means self-limitation, while incompletion preserves all possibilities.

The Team Retention Problem

Your best developer gets an offer with double the salary from a hot narrative project; your head of marketing is poached by a project that just raised $100 million.

You simply can’t compete, because six months ago you decided to stick with your current project and gave up on the then-hot narrative.

No one wants to work on a boring, stable project—they prefer those that are chaotic, overfunded, could collapse at any moment but might also deliver 10x returns.

User Attention Is Scarce

Crypto users only use your product because it’s new, everyone is talking about it, or there’s a chance for an airdrop.

Once the narrative shifts, they leave immediately, regardless of whether your product has improved or you’ve added the features they requested.

You can’t build a sustainable product for “unsustainable users.”

I know some founders who have pivoted so many times, they’ve long forgotten what they originally set out to build.

Decentralized social network → NFT platform → DeFi aggregator → gaming infrastructure → AI agent → prediction market. Transformation is no longer a strategy, but has become the business model itself.

The Infrastructure Paradox

The things in crypto that truly last mostly originated in times when no one was paying attention to crypto.

When Bitcoin was born, no one cared—there was no venture capital, no token issuance; Ethereum was created before the hype, when no one knew smart contracts would become what they are today.

Most things born during hype cycles eventually die with the cycle; those built in the gaps between cycles have a higher survival rate.

But no one builds during the gaps, because there’s no funding, no attention, and no exit liquidity.

Why Is the Status Quo Hard to Change?

Token-based incentive mechanisms provide flexible exit channels. As long as founders and investors can exit before the product matures, they will.

The speed of information dissemination far exceeds the speed of product building. By the time you finish development, everyone already knows whether it works. The core value proposition of crypto is “move fast”; asking it to slow down and build is asking it to go against its very nature.

This means if you spend 3 years building a product, someone else can copy your idea, launch a cruder but better-marketed version in 3 months, and beat you.

So, Where Do We Go From Here?

The crypto industry struggles to create long-term value because it is structurally at odds with long-termist thinking.

You can be a principled founder: refuse to pivot, stick to your original vision, and spend years rather than months refining your product. But you’ll likely run out of money, be forgotten, and be replaced by those who pivoted three times while you were still working on your first release.

The market doesn’t reward “completion,” only “creation”—creation again and again. Perhaps the real innovation in crypto isn’t the technology itself; maybe its true innovation is finding the way to extract the most value with the lowest level of completion. Or perhaps, transformation itself is its product.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Consolidates Above $177 Support as Market Watches $200 Breakout Level

BTC Dominance Faces 60% Barrier Before Next Halving Cycle

PEPE Consolidates Near $0.0566 With Market Watching Key Support and Resistance Levels

Shiba Inu Holds $5.7B Market Cap as Price Stabilizes Near Key Support