Date: Mon, Nov 03, 2025 | 06:40 AM GMT

The cryptocurrency market is shading its weekend upside momentum as both Bitcoin (BTC) and Ethereum (ETH) trade in red, sliding by about 2% and 4% respectively. The renewed weakness across the majors is adding pressure on several altcoins — including Near Protocol (NEAR).

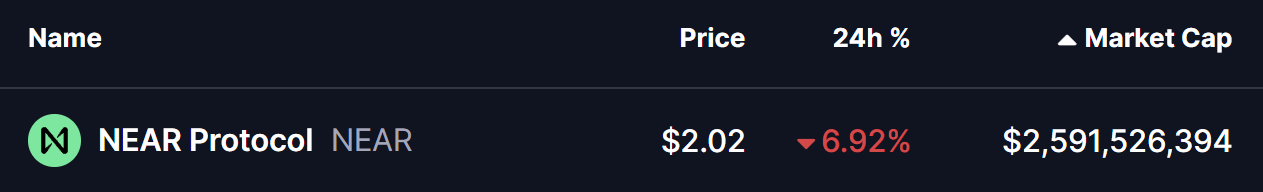

NEAR has dropped around 7% today, but more importantly, it is hovering near a crucial support level that could determine whether the token sees a short-term rebound or slips further into correction territory.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge Pattern in Play

On the 4-hour chart, NEAR appears to be forming a falling wedge pattern — a well-known bullish reversal formation that often signals exhaustion of a downtrend and potential for a rebound.

The recent correction has brought NEAR down to the lower boundary of the wedge, a level that has acted as strong support over the past few weeks. At the time of writing, the token trades around $2.02, with buyers once again stepping in to defend this zone.

Near Protocol (NEAR) 4H Chart/Coinsprobe (Source: Tradingview)

Near Protocol (NEAR) 4H Chart/Coinsprobe (Source: Tradingview)

The pattern shows that each dip toward this boundary has been met with quick buying reactions, suggesting strong accumulation interest near current levels.

What’s Next for NEAR?

If NEAR manages to hold above the wedge’s lower support and builds upward momentum, the first key upside target lies around $2.13, which aligns with the upper trendline of the wedge. A decisive breakout above $2.13–$2.15 could trigger a bullish reversal, potentially propelling NEAR toward the $2.40–$2.50 region in the coming sessions.

However, failure to defend the $2.00 support could put the bullish structure at risk. A breakdown below this level would likely extend the current downtrend and invite further selling pressure before a base forms again.