The Chainlink price prediction 2025 is making the spotlight because the $100 mark per LINK is currently a topic of discussion on social media, and many are understandably curious about the factors driving such predictions.

Chainlink’s transition from an oracle pioneer to a key player in institutional fintech reflects its solid business model and commitment to meaningful innovation. Although its current price may appear modest, despite various strong fundamental metrics and factors, that too along with global capital-market integrations and a decreasing supply on exchanges. This clearly suggests the potential for future growth. It seems Chainlink price USD may be approaching a key moment.

Originally it was just built to serve defi, but it has come a long way. By evolving into a modular backbone of services that powers institutional-grade data, interoperability, and seamless connectivity with legacy systems. For instance, Chainlink’s DataLink platform enables firms to deliver regulated market data across 40+ blockchains .

Furthermore, according to Sergey Nazarov, Chainlink crypto’s ongoing evolution and vision for interoperability demonstrate it as a key bridge. This connects traditional institutions and decentralized systems through secure and verified data exchange.

More precisely, they aim to establish standardized frameworks that seamlessly integrate blockchains with existing financial infrastructures.

The increasing number of integrations is also a key element that is helping Chainlink’s evolution. Also, in the Recent week, it has showcased that it is accelerating growth . Between October 27th and November 2nd alone, there were 62 integrations of the Chainlink standard across 24 blockchains. This cross-chain adoption continues to reinforce Chainlink’s position as the industry’s leading oracle solution.

Similarly, today it hit a jackpot as one of the most significant updates came with FTSE Russell’s collaboration with Chainlink, enabling the publication of major global indices on-chain via DataLink. These include the Russell 1000, 2000, and 3000 indices, the FTSE 100, WMR FX benchmarks, and FTSE DAR digital asset prices. The integration connects over $18 trillion in benchmarked assets with on-chain infrastructure through Chainlink’s secure data delivery system.

This sets the stage for a unified data framework that strengthens the Chainlink price forecast and underscores its rising importance across capital markets.

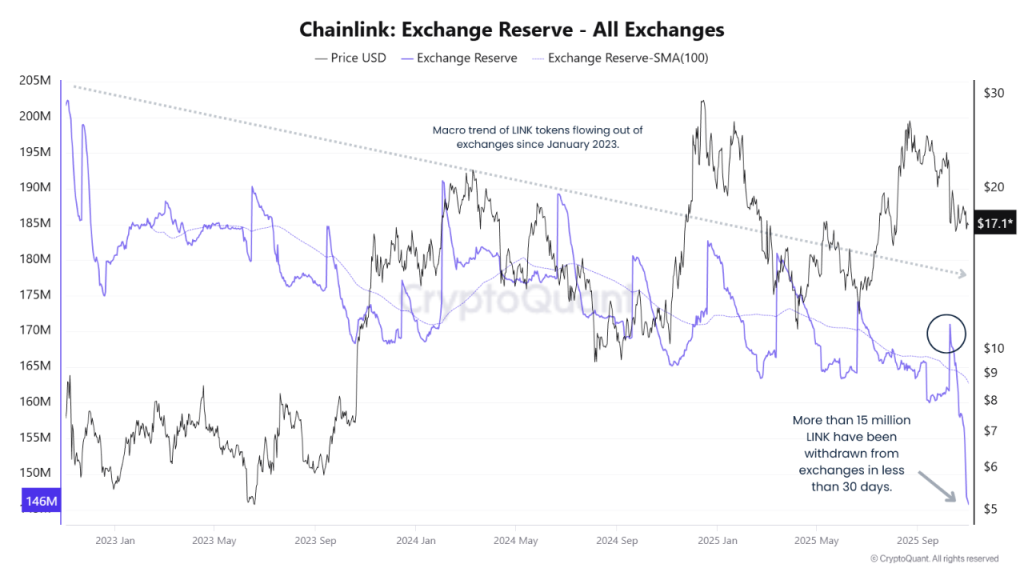

In addition, the on-chain data signals increasing confidence among investors. More than 15 million LINK have been withdrawn from exchanges in less than 30 days. This reduced total reserves from 180 million to 146 million LINK. This reflect long-term holding behavior.

This pattern hints for an upcoming supply squeezes as bullish accumulation is high. While Chainlink price today may still face volatility, the declining supply suggests strong conviction among holders.

Technically, the Chainlink price chart displays a symmetrical triangle formation, with projections indicating a possible dip to $15. But, this is considered as a key accumulation zone for a rally toward the $100 level.

Such a setup supports a long-term bullish setup that exceeds Chainlink price prediction November 2025 short-term targets.