Altcoin Berachain’s network was temporarily halted following a security breach linked to Balancer V2, aimed at safeguarding user assets. The Berachain Foundation announced that validators deliberately coordinated the network’s pause and that the system would resume once the recovery of funds is complete. Approximately $12 million is estimated to be at risk as developers initiated an urgent hard fork process to isolate and protect affected contracts and recover stolen assets.

Impact of Balancer Vulnerability on Blockchain

Berachain’s decentralized exchange, BEX, held over $50 million in assets as of Monday. The hack originated from an access control flaw in Balancer V2. This vulnerability similarly resulted in millions of dollars in liquidity being drained from the Ethereum $3,615 -based DeFi protocol Balancer.

The developer team emphasized that the decision to pause the network was crucial for the security of user funds, explaining that the hard fork required a more complex fix than simply reversing a few blocks. The goal post-fork is to recover the affected assets and fully isolate the security weaknesses.

“We Must Take Action”

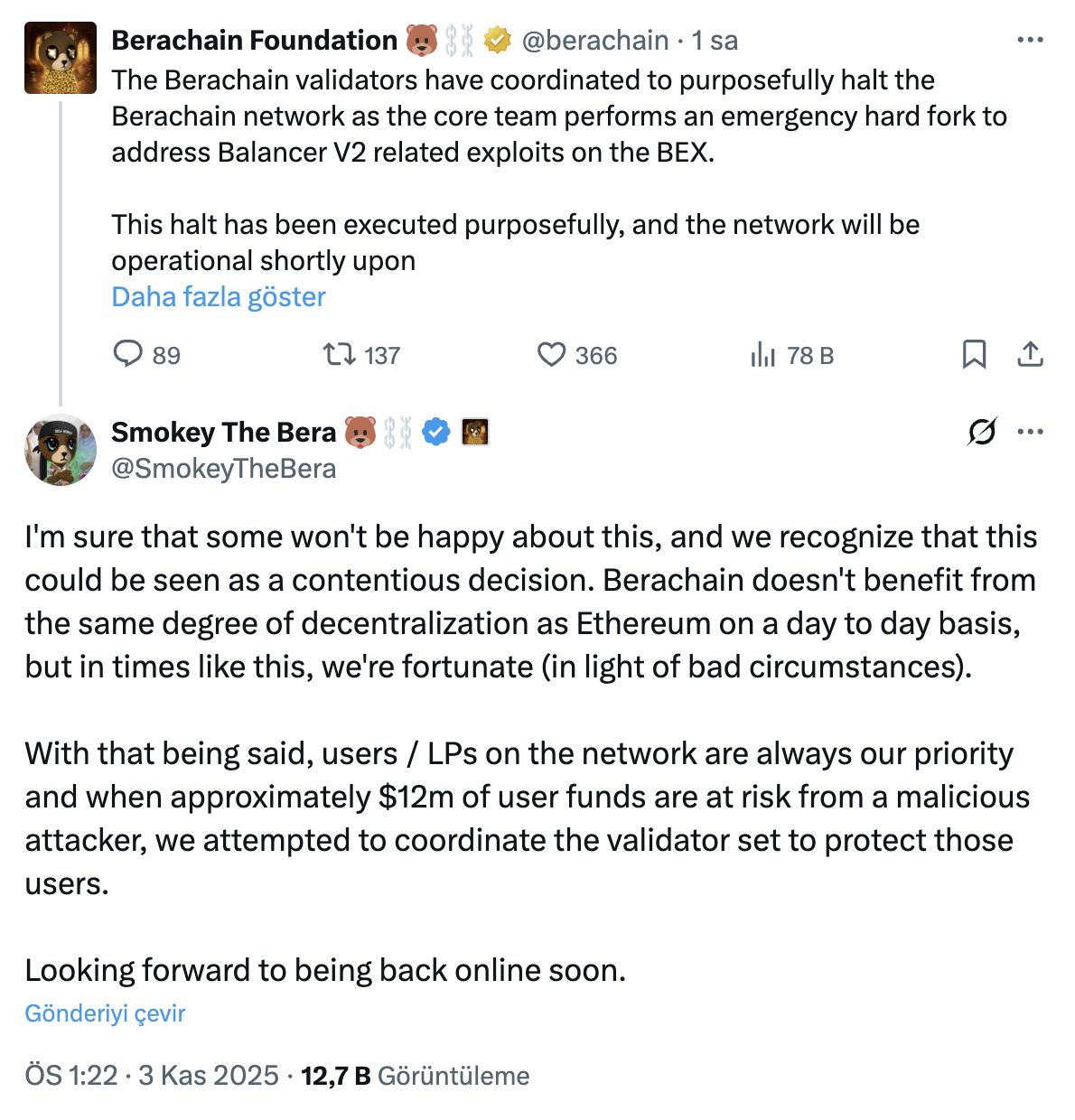

Altcoin Berachain co-founder Smokey The Bera highlighted on his X account the rapid and collective response by validators to protect user funds. Acknowledging that the decision might be seen as controversial by some, Smokey stated, “We are not at Ethereum’s level of decentralization, but if user funds are threatened, we must take action.”

Smokey The Bera’s statement

Smokey The Bera’s statement

Following these events, the mainnet asset BERA coin experienced a 6% loss in value, while Balancer’s BAL coin depreciated by 8%. Other Balancer derivatives impacted by the same hack, particularly Beets Finance, reported similar security breaches.