Altcoins Collapse: Less Than 5% Beat Bitcoin as BTC Dominance Hits 60%+

Bitcoin is reclaiming control of the crypto market as altcoins “bleed,” with dominance soaring above 60% for the first time in years. Analysts warn that 2025 may favor Bitcoin and high-quality sectors like DeFi and RWA, leaving speculative altcoins behind.

After more than two months of weakness, Bitcoin is reasserting its dominance. The Bitcoin Dominance Index surpasses the 60% mark, the highest level since mid-2021.

Meanwhile, most altcoins have plunged, with fewer than 5% of the top 55 tokens outperforming BTC. As institutional inflows continue to favor Bitcoin, a clear “risk-off” sentiment is spreading across the market, firmly placing crypto in a new “Bitcoin Season.”

Bitcoin Consolidates Power as Altcoins Lose Ground

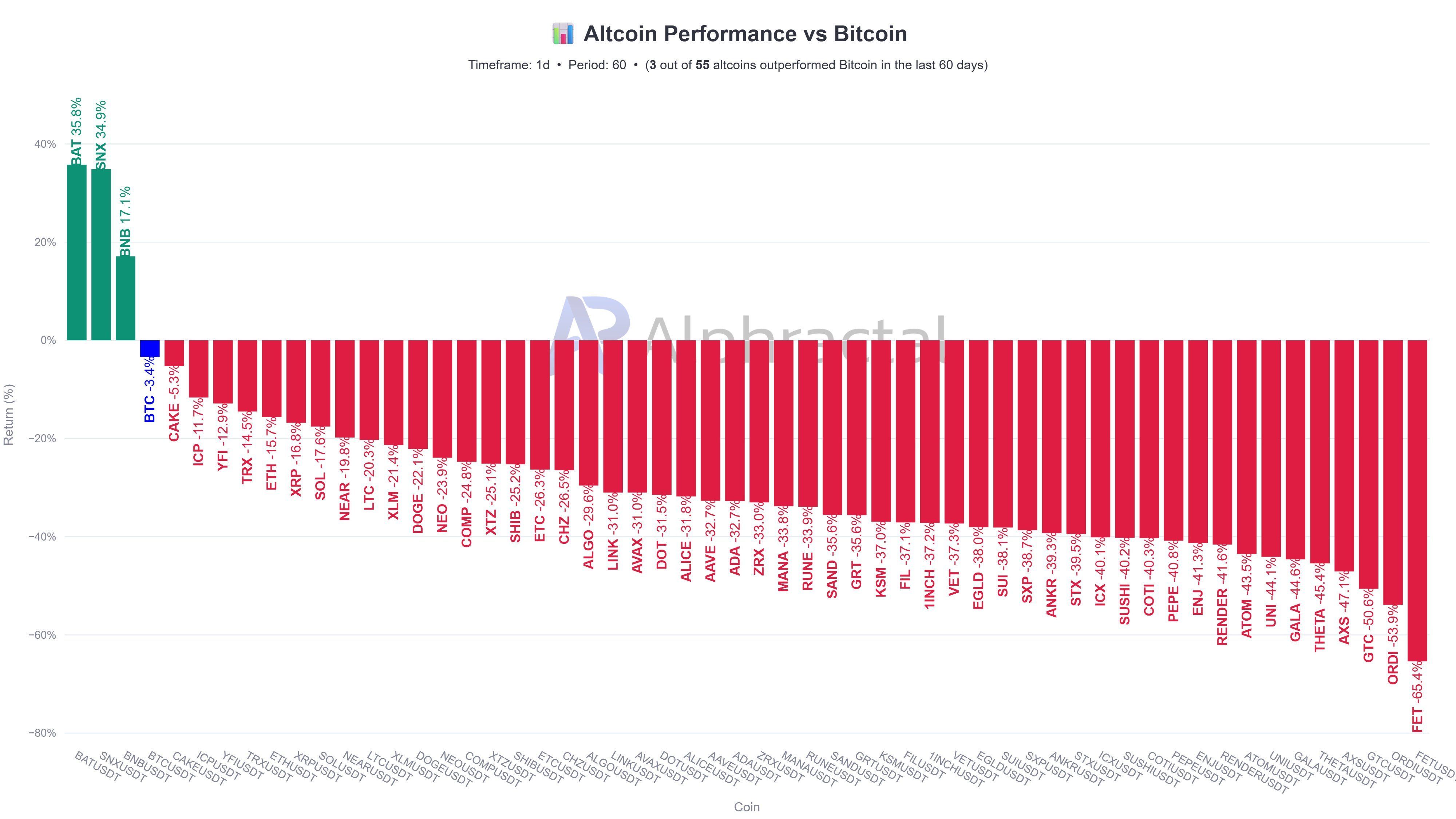

According to data from Alphractal, only 3 out of 55 major altcoins have outperformed Bitcoin (BTC) over the past 60 days, while the rest have lost between 20% and 80% of their value. The broader altcoin market remains deeply in the red, as reflected in the Altcoin Season Index, which currently hovers around 25-29, indicating that the market is in a Bitcoin Season.

Altcoin performance vs Bitcoin. Source:

Alphractal

Altcoin performance vs Bitcoin. Source:

Alphractal

On the Bitcoin Dominance (BTC.D) chart, the index reached 60.74%, up from 59% at the end of September, marking the highest level over two years. This signals that capital rotates out of riskier assets and back into Bitcoin. Analysts, such as Benjamin, forecast that altcoins could drop another 30% against Bitcoin in the coming weeks if Bitcoin’s uptrend continues.

BTC.D chart. Source:

TradingView

BTC.D chart. Source:

TradingView

Selling pressure across the altcoin market has intensified after several analysts noted that the structure established following the October crash is now breaking down. If this selling momentum persists, altcoins could enter a deeper downside phase.

Still, some traders remain optimistic about the broader market structure over the next three to six months. Bitcoin continues to hold above its 50-week EMA, with liquidity rising and expectations growing for a potential Fed rate cut in December. According to one trader, altcoins will eventually follow as long as BTC maintains its trend.

“Ignore fear, follow structure,” the user emphasized.

At this stage, we may witness a familiar liquidity rotation, capital flowing out of altcoins to reinforce Bitcoin’s dominance. As long as BTC remains strong on the weekly timeframe and institutional capital continues to enter the market, altcoins are unlikely to break out independently. This environment favors a defensive strategy, prioritizing BTC and stablecoins over speculative assets.

Recovery Signs May Emerge, but Not for All

Despite the short-term bearish outlook for altcoin performance vs Bitcoin, several analysts highlight the possibility of a technical bounce soon. According to another X user, the “Others vs BTC” chart just closed its monthly candle with a long wick to the downside, a pattern that has historically preceded short-term rebounds as markets “fill gap” in subsequent sessions.

Others/BTC chart. Source:

Bitcoinsensus

Others/BTC chart. Source:

Bitcoinsensus

While Bitcoin holds the upper hand, any pause or pullback in BTC’s momentum could allow altcoins to stage a selective recovery. This would enable speculative capital to flow back into smaller-cap tokens.

In summary, while a short-term recovery is possible, only a few market segments are likely to benefit, particularly projects with strong fundamentals and tangible applications, such as RWA, DeFi, or AI-linked tokens. The market is becoming increasingly selective, leaving little room for narrative-driven altcoins with weak fundamentals. Therefore, late 2025 may not bring a broad-based “altseason,” but rather a selective mini-altseason defined by quality over hype.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: The Crypto Landscape Shifts as Influencers Depart and Major Institutions Enter

- BSC meme coin KOLs are liquidating holdings amid volatility, triggering market consolidation. - GIGGLE and "Binance Life" saw short-term rebounds, but most tokens face ongoing sell-offs. - Analysts link exits to macroeconomic pressures and institutional entry reshaping crypto ownership. - Bitcoin/ETH ETF outflows ($327M) and rising sell-pressure age (100 days) highlight broader risk-off sentiment.

Ethereum News Update: Transforming Blockchain Privacy: Zama and Kakarot Unite to Achieve Over 10,000 Private TPS

- Zama acquires KKRT Labs to merge FHE and ZK technologies, targeting 10,000+ confidential TPS on Ethereum and Solana . - KKRT, backed by Buterin and StarkWare, brings ZK rollup expertise to enhance blockchain scalability and privacy infrastructure. - The $1.2B-valued Zama aims to expand research teams and integrate modular systems for high-throughput confidential finance. - Industry leaders praise the merger as pivotal for advancing privacy-preserving DeFi and overcoming blockchain adoption barriers.

Ethereum News Update: Bearish Whale’s $24 Million ETH Short Confronts Bullish Divergence

- Ethereum whale increases ETH short position 25x to $24M, signaling heightened bearish sentiment amid market recalibration. - Holder Accumulation Ratio (HAR) drops to 30.45%, reflecting reduced long-term holder buying pressure and aggressive short-term whale positioning. - Technical analysis reveals hidden bullish divergence with ETH near $3,860, but key resistance at $4,240 remains critical for trend validation. - Market uncertainty persists as whale positioning clashes with staking yield-driven accumula

DeFi Faces Instability: Yei's Suspension Highlights Underlying Systemic Threats

- Yei Finance paused its Sei-based protocol after a fastUSD market anomaly, citing "unusual conditions" and pledging 24-hour updates. - Stream Finance's $93M loss from XUSD depeg and Yei's fastUSD issues highlight systemic risks in leveraged DeFi models. - DeFi's decentralized governance gaps exposed by rehypothecation risks and opaque fund management, prompting calls for stricter oversight. - Market turbulence underscores need for transparent audits and contingency plans to prevent cascading failures in v