Analyst: Stream Finance's $93 million loss could lead to over $285 million in risk exposure

On November 4, according to The Block, independent DeFi analyst YieldsAndMore mapped out the risk exposure network related to Stream Finance's $93 million loss. In lending markets, stablecoins, and liquidity pool networks, hundreds of millions of dollars in loans and collateral positions may be indirectly affected. YieldsAndMore stated that Stream's debt spans at least seven networks, involving numerous counterparties such as Elixir, MEV Capital, Varlamore, TelosC, and Re7 Labs. Assets related to Stream's xUSD, xBTC, and xETH tokens have been repeatedly collateralized in protocols such as Euler, Silo, Morpho, and Sonic, amplifying the potential risk contagion in the DeFi sector. It is estimated that the total debt related to Stream (excluding indirect exposure between derivative stablecoins) is about $285 million. Among them, TelosC ($123.6 million), Elixir ($68 million), and MEV Capital ($25.4 million) have the largest associations. The team stated that the losses are significant, the resolution method is unclear, and more stablecoins and liquidity pools may be affected. Research results show that the largest single risk exposure belongs to Elixir's deUSD, which lent $68 million USDC to Stream, accounting for about 65% of deUSD's total reserves. Elixir stated that its positions enjoy "full redemption rights per dollar," but according to YieldsAndMore's post on X, the Stream team has informed creditors that repayments will be suspended until legal review is completed. Other indirect risk exposures may include Treeve's scUSD, which has fallen into multi-layered lending loops through Mithras, Silo, and Euler. In addition, Varlamore and MEV Capital also hold smaller but noteworthy positions. YieldsAndMore wrote in a post about the Stream incident: "This risk map is still incomplete. We expect that as positions are closed and lending contracts are audited, more affected liquidity pools will come to light."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation sets strict 128-bit encryption rules for 2026

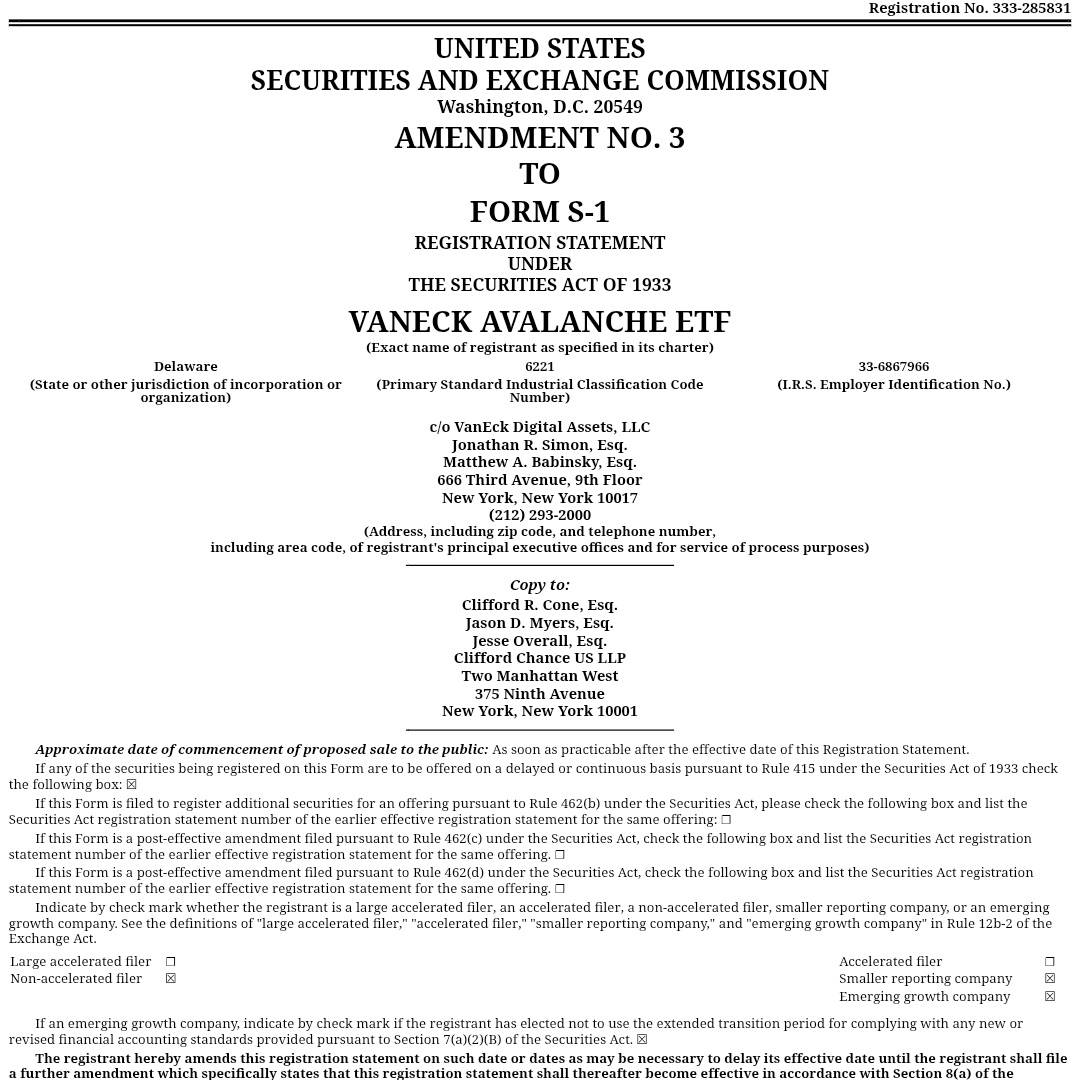

VanEck updates Avalanche ETF application to include staking rewards

VanEck submits spot AVAX ETF application to US SEC

Pi Network updates DEX and AMM features and launches holiday event